Question: Hello! could you help to find the question number answer? Thank you. Central Manufacturing Entrepreneur Beverly Brown began personally designing and manufacturing fashion accessories in

Hello! could you help to find the question number answer? Thank you.

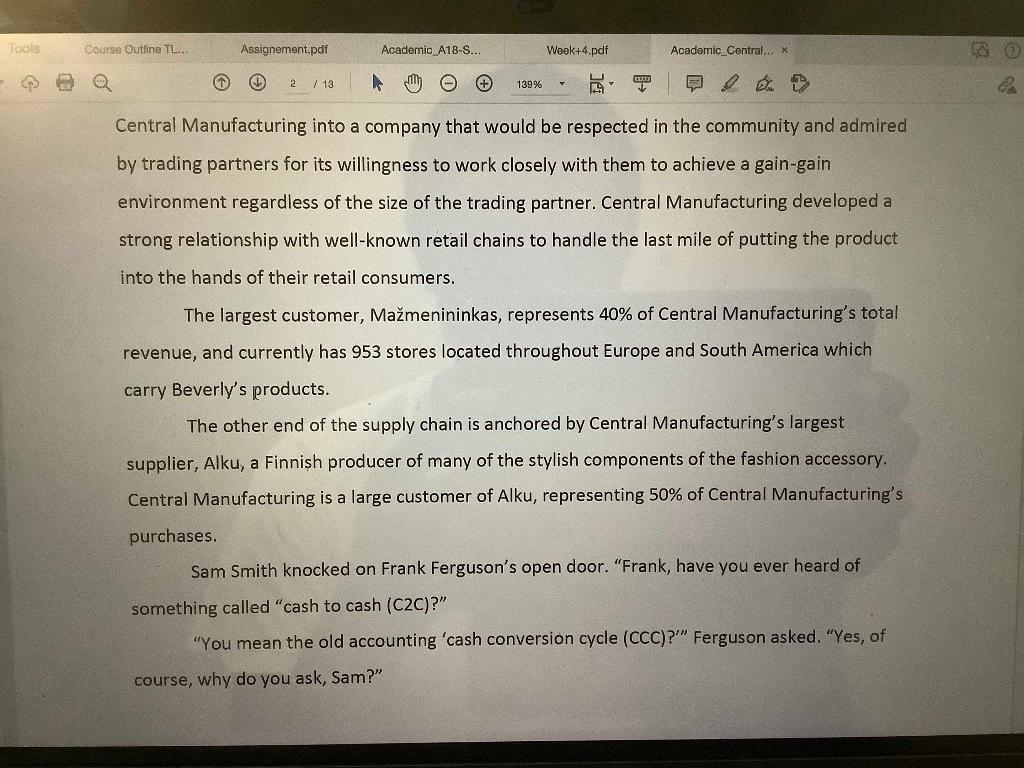

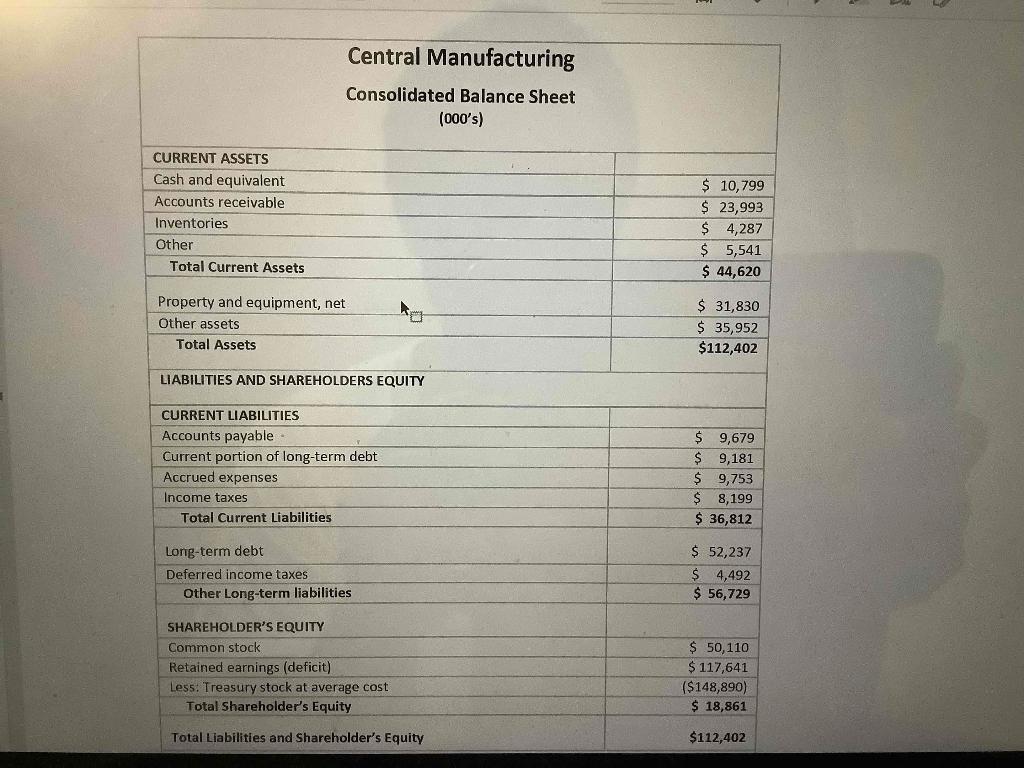

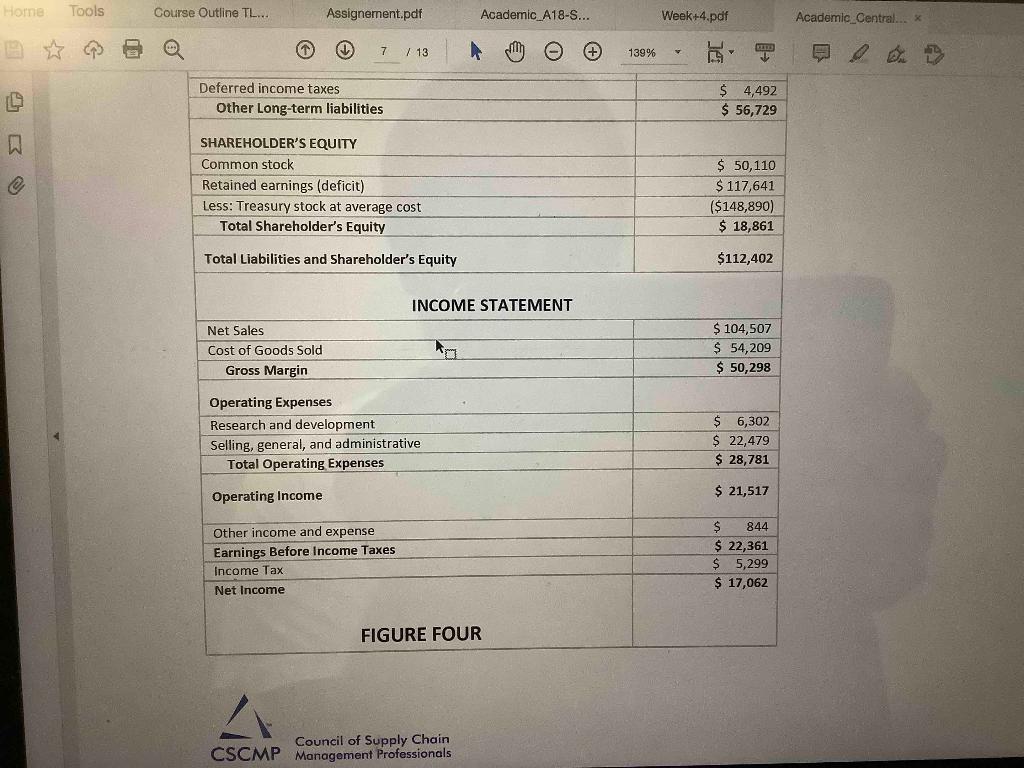

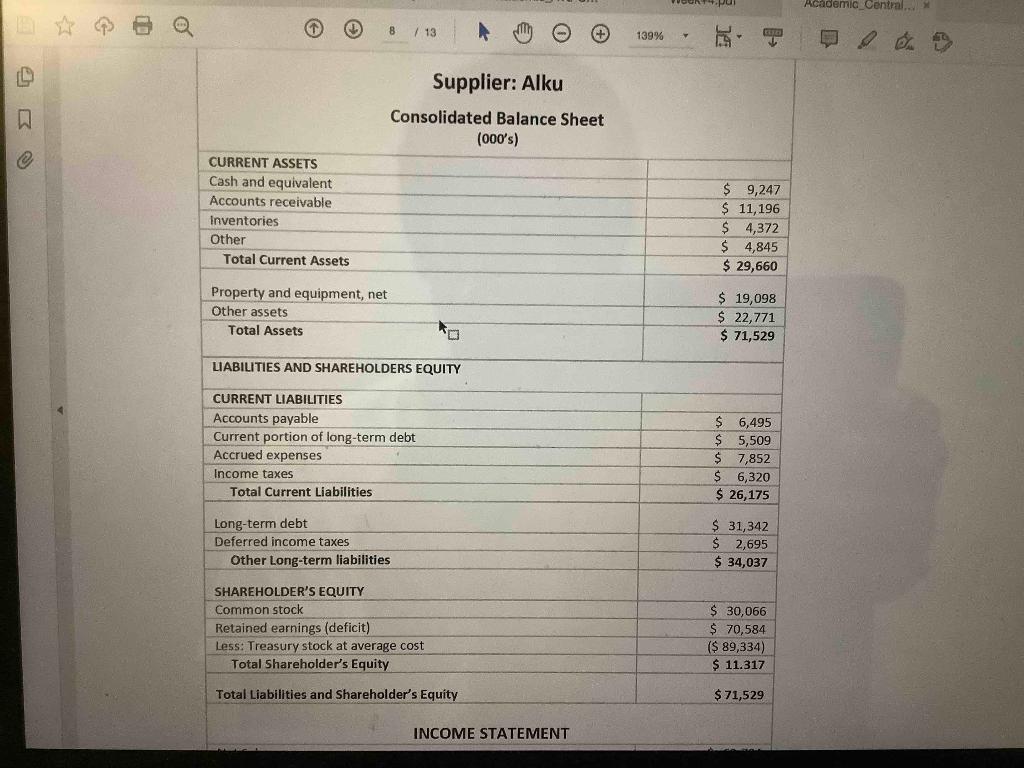

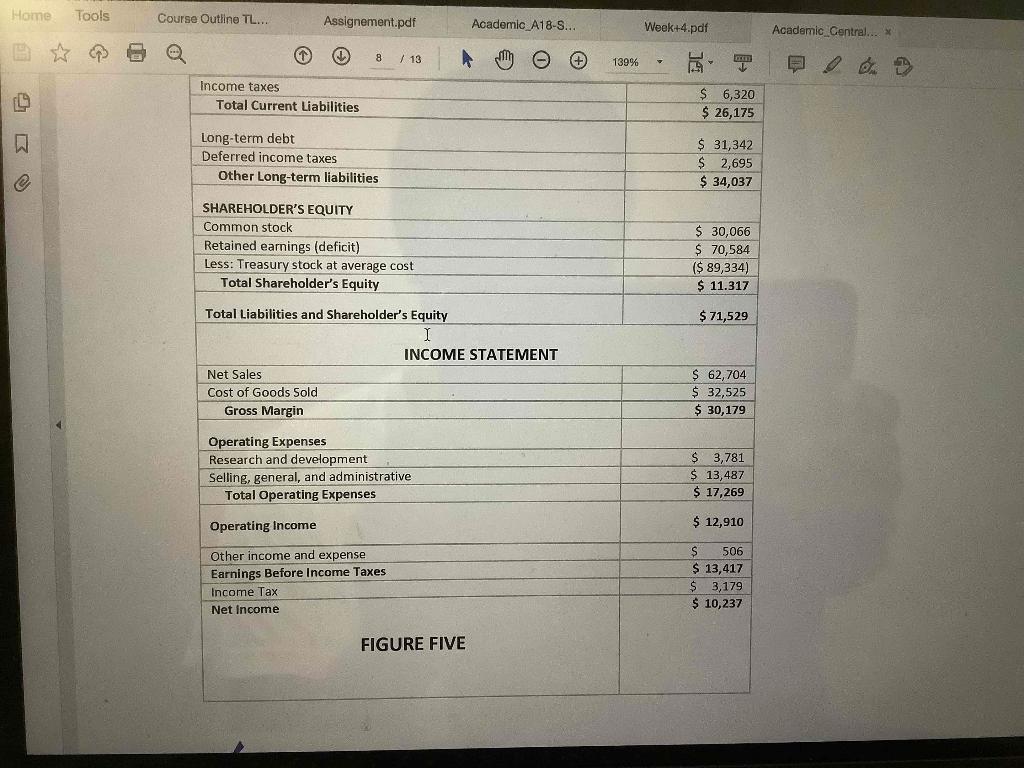

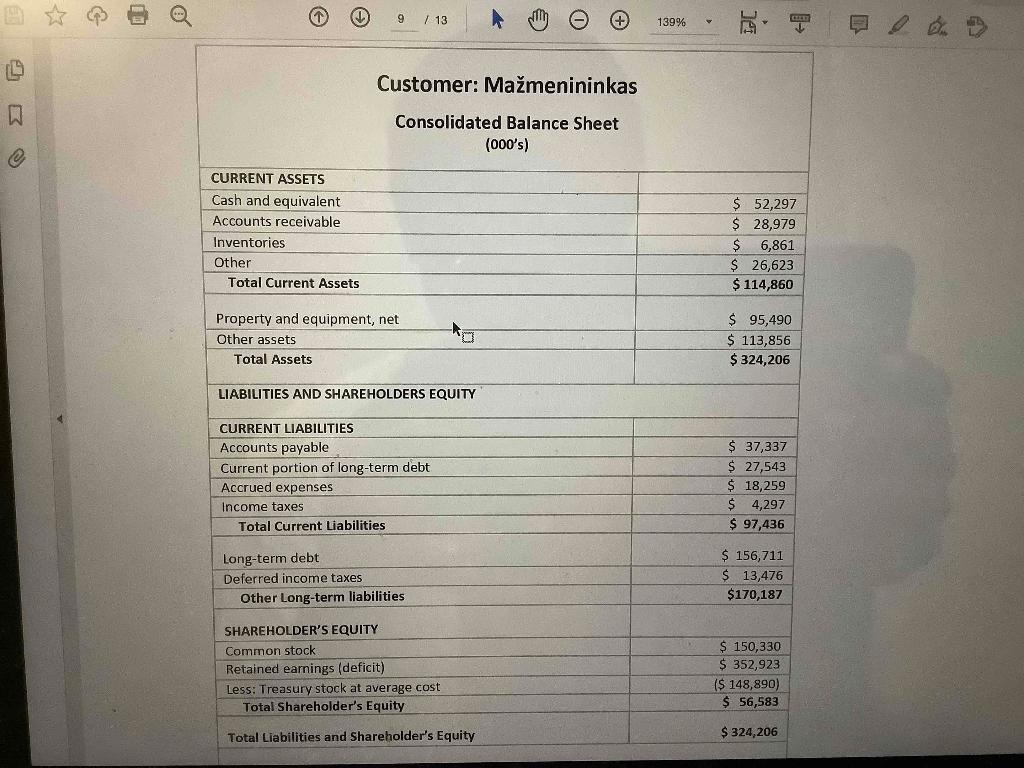

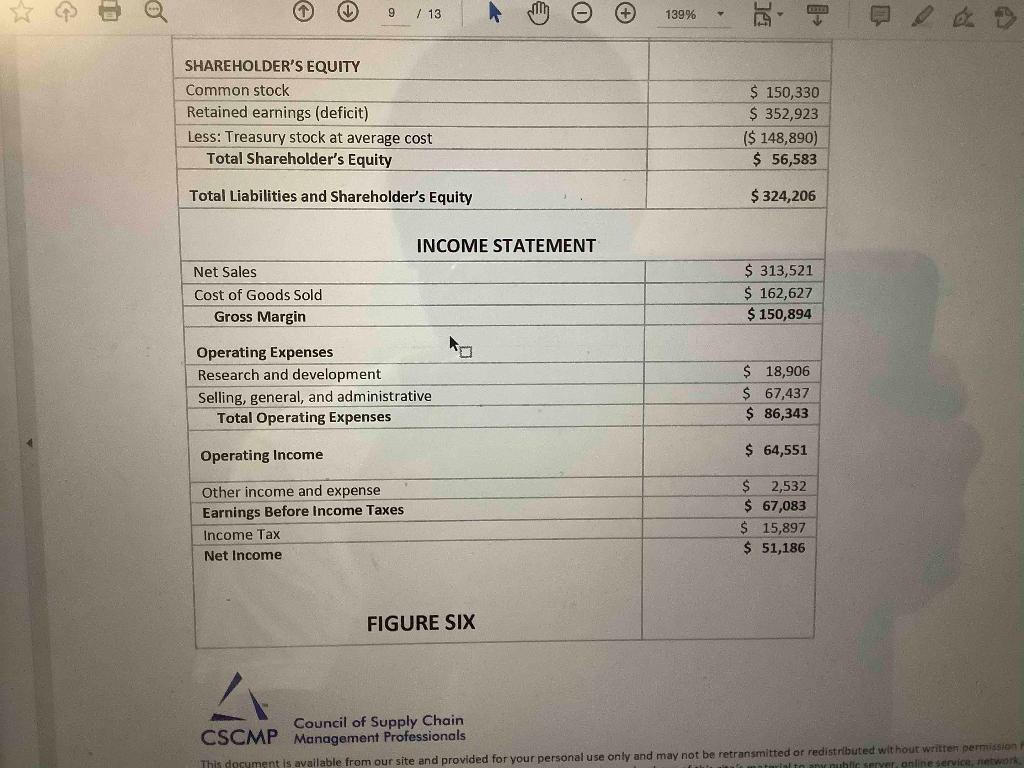

Central Manufacturing Entrepreneur Beverly Brown began personally designing and manufacturing fashion accessories in her garage during her spare time after work. Her products became the latest fashion rage and orders flooded in. Demand for products from her home-based business grew to the point where she set up operations in a local business park, added manufacturing employees, then added an office staff to support production, solicit sales with major retailers, and handle distribution. Central Manufacturing Company incorporated in 2010 and presently employs more than 100 employees. Her two most trusted employees, chief financial officer, Fred Ferguson, and chief operating officer, Sam Smith, work hard to maintain the principles that Beverly used to develop Central Manufacturing into a company that would be respected in the community and admired by trading partners for its willingness to work closely with them to achieve a gain-gain environment regardless of the size of the trading partner. Central Manufacturing developed a strong relationship with well-known retail chains to handle the last mile of putting the product into the hands of their retail consumers. The largest customer, Mamenininkas, represents 40% of Central Manufacturing's total Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X @ 2 / 13 139% Pe 17 Central Manufacturing into a company that would be respected in the community and admired by trading partners for its willingness to work closely with them to achieve a gain-gain environment regardless of the size of the trading partner. Central Manufacturing developed a strong relationship with well-known retail chains to handle the last mile of putting the product into the hands of their retail consumers. The largest customer, Mamenininkas, represents 40% of Central Manufacturing's total revenue, and currently has 953 stores located throughout Europe and South America which carry Beverly's products. The other end of the supply chain is anchored by Central Manufacturing's largest supplier, Alku, a Finnish producer of many of the stylish components of the fashion accessory. Central Manufacturing is a large customer of Alku, representing 50% of Central Manufacturing's purchases. Sam Smith knocked on Frank Ferguson's open door. "Frank, have you ever heard of something called "cash to cash (C2C)?" "You mean the old accounting 'cash conversion cycle (CCC)?'" Ferguson asked. "Yes, of course, why do you ask, Sam?" als Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central. 3 / 13 139% D Days of Payables = A/P x 365 COGS Days of Inventory = Inventory x 365 COGS Days of Receivables = A/R x 365 Sales Days of Cash to Cash = Inventory + Receivables - Payables FIGURE ONE "I stumbled across some academic papers, 12 which suggest using something called 'cash to cash' to help manage the supply chain," Smith responded. "What piqued my interest that this is the first time I have seen an easy-to-develop metric that looks across multiple trading partners. As you know, most company measures only look within its own four walls or with one trading partner, for example, sales with a customer or purchases with a supplier. A measure that considers a supply chain-supplier to manufacturer to customer-is as rare as a skinny pastry shop employee." ols Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 3 7.13 139% FIGURE ONE "I stumbled across some academic papers, 12 which suggest using something called 'cash to cash' to help manage the supply chain," Smith responded. "What piqued my interest is that this is the first time I have seen an easy-to-develop metric that looks across multiple trading partners. As you know, most company measures only look within its own four walls or with one trading partner, for example, sales with a customer or purchases with a supplier. A measure that considers a supply chain-supplier to manufacturer to customer-is as rare as a skinny pastry shop employee." "Most companies must pay their suppliers (cash out) before they get paid by their customers (cash in)," Ferguson pointed out. "It's easy to calculate using data that comes from the balance sheet and income statement. This information is available for all publically-traded companies, and, I believe any privately held companies interested in improving their supply chains would also be willing to provide this information. Total revenue and cost of goods sold "Supply Chain Cash-to-Cash: Strategy for the 21st Century." Strategic Finance 2009 nn 40-49 Tools Course Outlina TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 4 / 13 139% 7 from the income statement, and receivables, payables, and inventory from the balance sheet. Pretty general information and usually not proprietary so the data is easy to obtain." "Are the formulas complicated?" Smith asked. "You know how I like 'simple, especially w with the financial stuff." "Very simple," Ferguson said with a smile. "All you do is convert the receivables, payables, and inventory into 'days of.' Look at the formulas in Figure One." "They ARE simple!" Smith exclaimed. "So what does cash to cash mean?" "It measures the number of days a company waits to get paid," Ferguson replied. "Look at Figure Two. It shows an American retailer. On the day they receive a shipment, they take 44 days (accounts payables) to pay their supplier. Sixty days after receiving the shipment, they sell it to their customer. The payment from the customer is in their hands ten days later. Calculate cash to cash and you see they must pay out 26 days before the cash comes in. Cash to cash." "Is it always like that?" Smith asked. Accounts Payable (-44.0 Days) Inventory (+ 60.0 Days) DOS Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 4 / 13 1399 : w cash to casn ana you see they must pay out 26 days perore the casn comes in. Casn to cash. "Is it always like that?" Smith asked. Accounts Payable (- 44.0 Days) Inventory (+ 60.0 Days) Accounts Receivable (+ 10.0 Days) --- Cash-to-Cash Cycle (+ 26.0 Days) "No," said Ferguson. "Some companies actually get paid by their customers BEFORE they pay their suppliers. Dell is probably the best known company that achieves this (see Figure Three). They developed a quick manufacturing process and create finished product six days Council of Supply Chain CSCMP Management Professionals Tools Course Outline TL... Asalgnoment.pdf Academic A18-s... Week 4.pdf Academic Central 3 / 13 139% after receiving a shipment from their supplier. Their customers pay in 33 days, but Dell does not have to pay its supplier for 55 days. The company has cash coming in 16 days before it has to be paid out." ] Accounts Payable (-55.0 Days) Inventory (+ 6.0 Days) Accounts Receivable (+ 33.0 Days) Cash-to-Cash Cycle - 16.0 Days) FIGURE THREE "Brilliant!" Smith enthused. "So they do not have to borrow money and essentially profit off the "float.' We should look at this cash-to-cash thing for our company." "Right," said Ferguson. "Our company has grown to the point where this should be a consideration. The first question is whether Central has positive or negative cash to cash using Mercal Pro Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * 5 713 139% p. FIGURE THREE "Brilliant!" Smith enthused. "So they do not have to borrow money and essentially profit off the 'float.' We should look at this cash-to-cash thing for our company." "Right," said Ferguson. "Our company has grown to the point where this should be a consideration. The first question is whether Central has positive or negative cash to cash using our financial information (Figure Four). Then we should determine the cash to cash for our largest supplier, Alku, and our largest customer, Mamenininkas. Fortunately we already have I their financial information (Figure Five, Figure Six). "One of the articles pointed out that most companies will have differing cost of capital and inventory-carrying costs" Smith continued. "Strategic supply chain management can take advantage of the inherent benefits of each trading partner to help strengthen the supply chain and make it more profitable. We really ought to look at how we handle our financial transactions throughout our supply chain." "Well," said Ferguson, "We have a close enough working relationship with Alku to know that their weighted average cost of capital is 18.3%, not as good as the 17.7% that we have, and Council of Sunnly Chain sis Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 6 1 13 139% v ED certainly nowhere near the 15.8% that Mamenininkas has. They are so large and I believe the size of the company helps them get better interest rates than Central." "Ah, but Alku has a lower cost to carry inventory," Smith observed. "It only costs them 25.9% annually to hold inventory. Our cost is 29.7% and Mamenininkas keeps pointing out that their inventory carrying cost is 32.3%, which is why they want us to make more frequent, smaller shipments to them. This has actually helped Central as we scramble to have enough production to meet their orders. We could not send large shipments if we had to. "There is probably some opportunity to use these different costs to help strengthen the supply chain. For example, I wonder what would happen if Mamenininkas were to pay us faster, say ten days earlier. We would not have to borrow as much to pay our bills while we wait for payment from Mamenininkas. By tapping into their lower cost of capital we could share the savings with Mamenininkas and both companies would benefit. If we propose it to them AND they can lower costs, I think they would be interested." Central Manufacturing Consolidated Balance Sheet (000's) CURRENT ASSETS Cash and equivalent Accounts receivable Inventories Other Total Current Assets $ 10,799 $ 23,993 $ 4,287 $ 5,541 $ 44,620 Property and equipment, net Other assets Total Assets $ 31,830 $ 35,952 $112,402 LIABILITIES AND SHAREHOLDERS EQUITY CURRENT LIABILITIES Accounts payable Current portion of long-term debt Accrued expenses Income taxes Total Current Liabilities $ 9,679 $ 9,181 $ 9,753 $ 8,199 $ 36,812 Long-term debt Deferred income taxes Other Long-term liabilities $ 52,237 $ 4,492 $ 56,729 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 50,110 $ 117,641 ($148,890) $ 18,861 Total Liabilities and Shareholder's Equity $112,402 Horne Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * 27 cp 6 7 / 13 139% je Deferred income taxes Other Long-term liabilities $ 4,492 $ 56,729 @ SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 50,110 $ 117,641 ($148,890) $ 18,861 Total Liabilities and Shareholder's Equity $112,402 INCOME STATEMENT Net Sales Cost of Goods Sold Gross Margin $ 104,507 $ 54,209 $ 50,298 Operating Expenses Research and development Selling, general, and administrative Total Operating Expenses $ 6,302 $ 22,479 $ 28,781 $ 21,517 Operating Income Other income and expense Earnings Before Income Taxes Income Tax Net Income $ 844 $ 22,361 $ 5,299 $ 17,062 FIGURE FOUR Council of Supply Chain CSCMP Management Professionals . Academic Central @ 8 / 13 139% Supplier: Alku Consolidated Balance Sheet (000's) CURRENT ASSETS Cash and equivalent Accounts receivable Inventories Other Total Current Assets $ 9,247 $ 11,196 $ 4,372 $ 4,845 $ 29,660 Property and equipment, net Other assets Total Assets $ 19,098 $ 22,771 $ 71,529 LIABILITIES AND SHAREHOLDERS EQUITY CURRENT LIABILITIES Accounts payable Current portion of long-term debt Accrued expenses Income taxes Total Current Liabilities $ 6,495 $ 5,509 $ 7,852 $ 6,320 $ 26,175 Long-term debt Deferred income taxes Other Long-term liabilities $ 31,342 $ 2,695 $ 34,037 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 30,066 $ 70,584 ($ 89,334) $ 11.317 Total Liabilities and Shareholder's Equity $ 71,529 INCOME STATEMENT Home Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * 8 / 13 139% Income taxes Total Current Liabilities $ 6,320 $ 26,175 Long-term debt Deferred income taxes Other Long-term liabilities $ 31,342 $ 2,695 $ 34,037 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 30,066 $ 70,584 ($ 89,334) $ 11.317 $ 71,529 Total Liabilities and Shareholder's Equity I INCOME STATEMENT Net Sales Cost of Goods Sold Gross Margin $ 62,704 $ 32,525 $ 30,179 $ Operating Expenses Research and development Selling, general, and administrative Total Operating Expenses $ 3,781 $ 13,487 $ 17,269 Operating Income $ 12,910 Other income and expense Earnings Before Income Taxes Income Tax Net Income $ 506 $ 13,417 $ 3,179 $ 10,237 FIGURE FIVE 9 / 13 139% DC Customer: Mamenininkas Consolidated Balance Sheet (000's) CURRENT ASSETS Cash and equivalent Accounts receivable Inventories Other Total Current Assets $ 52,297 $ 28,979 $ 6,861 $ 26,623 $ 114,860 Property and equipment, net Other assets Total Assets $ 95,490 $ 113,856 $ 324,206 LIABILITIES AND SHAREHOLDERS EQUITY CURRENT LIABILITIES Accounts payable Current portion of long-term debt Accrued expenses Income taxes Total Current Liabilities $ 37,337 $ 27,543 $ 18,259 $ 4,297 $ 97,436 Long-term debt Deferred income taxes Other Long-term liabilities $ 156,711 $ 13,476 $170,187 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 150,330 $ 352,923 ($ 148,890) $ 56,583 Total Liabilities and Shareholder's Equity $ 324,206 9 / 13 e 139% 14 - SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 150,330 $ 352,923 ($ 148,890) $ 56,583 Total Liabilities and Shareholder's Equity $ 324,206 INCOME STATEMENT Net Sales Cost of Goods Sold Gross Margin $ 313,521 $ 162,627 $ 150,894 Operating Expenses Research and development Selling, general, and administrative Total Operating Expenses $ 18,906 $ 67,437 $ 86,343 Operating Income $ 64,551 Other income and expense Earnings Before Income Taxes Income Tax Net Income $ 2,532 $ 67,083 $ 15,897 $ 51,186 FIGURE SIX Council of Supply Chain CSCMP Management Professionals This document is available from our site and provided for your personal use only and may not be retransmitted or redistributed without written permission Server online service, netwo Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central 10 / 13 139% q "OK," said Ferguson. I will run the numbers and see what we get." "If we run this by Beverly, we should put the savings in terms of additional sales," Smith added. "She will understand that much better since she seems to focus more on sales than " operations." "Right," agreed Ferguson. "We will let her know what this means both in terms of cost savings, which goes directly to the bottom line, and equivalent to additional sales." "Hey! We can also look at how we are managing our inventory with Alku," Smith said. "They have a lower cost to hold inventory and we should be able to do a better job of working with them to have them hold our inventory until just before we need it. Something like a vendor-managed inventory (VMI) system where we do not have to hold the inventory until right when we need it. Dell has an interesting process where the suppliers deliver containers of inventory but Dell does not actually 'own' the inventory until they remove it from the container. The inventory is physically located at the Dell manufacturing location but not received until Dell needs it. Dell installed a barcode reader at each container door. When they go into the container to get something, they scan it and Dell 'buys' it from the supplier at that point. We could probably set up something like this with Alku. They could hold the inventory at their lower ICC and we would potentially reduce the amount of inventory that we hold by 21 days of supply. I assume we would have the same 50%-50% share agreement with Alku as we me Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * Lo * P 10 / 13 + 139% CA > received until Dell needs it. Dell installed a barcode reader at each container door. When they go into the container to get something, they scan it and Dell 'buys' it from the supplier at that point. We could probably set up something like this with Alku. They could hold the inventory at their lower ICC and we would potentially reduce the amount of inventory that we hold by 21 2 days of supply. I assume we would have the same 50%-50% share agreement with Alku as we do with Mamenininkas." "Certainly," agreed Ferguson. "As Beverly was developing what is now our supply chain, she made sure to include a clause in every contract that we equally share any savings with each trading partner." "But Alku would increase their costs. How do we handle that?" asked Smith. "We can determine what 21 days of carrying cost savings means to us, and what 21 days of additional carrying cost means to Alku," Ferguson said. "We would pay Alku's additional carrying cost plus half the savings. We can ledger it in the accounting books and recognize the savings. It is innovative supply chain finance." 21 Council of Supply Chain CSCMP Management Professionals This document is avallable from our site and provided for your personal use only and may not be retransmitted or redistributed without written permission from 10 Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central.. 11 / 13 139% "I suppose we will have to explain it to Beverly in both terms of cost savings and equivalent sales," Smith said. "Of course," replied Ferguson. I will look at that right after I consider the Mamenininkas opportunity. We can present both to Beverly at the same time. I think she will be pleased that we are doing some leading edge supply chain financing. That's why she keeps us around!" QUESTIONS: Question #1: Determine the number of days of payables, receivables, and inventory for Central Manufacturing. How many days of cash to cash do they have? Question #2: Determine the number of days of payables, receivables, and inventory for the supplier Alku. How many days of cash to cash do they have? Question #3: Determine the number of days of payables, receivables, and inventory for the customer Mamenininkas. How many days of cash to cash do they have? Course ne Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... x 2 1 11 / 13 + 13996 QUESTIONS: 2 Question #1: Determine the number of days of payables, receivables, and inventory for Central Manufacturing. How many days of cash to cash do they have? Question #2: Determine the number of days of payables, receivables, and inventory for the supplier Alku. How many days of cash to cash do they have? Question #3: Determine the number of days of payables, receivables, and inventory for the customer Mamenininkas. How many days of cash to cash do they have? Question #4: Determine the one-time and annual cost savings for Central Manufacturing if customer Mamenininkas agrees to pay ten days faster? Question #5: If we propose sharing the annual cost savings for Central Manufacturing with customer Mamenininkas 50%-50%, the savings will go to our bottom line. How much will this increase our earnings before income taxes (EBIT)? MacBook Pro Central Manufacturing Entrepreneur Beverly Brown began personally designing and manufacturing fashion accessories in her garage during her spare time after work. Her products became the latest fashion rage and orders flooded in. Demand for products from her home-based business grew to the point where she set up operations in a local business park, added manufacturing employees, then added an office staff to support production, solicit sales with major retailers, and handle distribution. Central Manufacturing Company incorporated in 2010 and presently employs more than 100 employees. Her two most trusted employees, chief financial officer, Fred Ferguson, and chief operating officer, Sam Smith, work hard to maintain the principles that Beverly used to develop Central Manufacturing into a company that would be respected in the community and admired by trading partners for its willingness to work closely with them to achieve a gain-gain environment regardless of the size of the trading partner. Central Manufacturing developed a strong relationship with well-known retail chains to handle the last mile of putting the product into the hands of their retail consumers. The largest customer, Mamenininkas, represents 40% of Central Manufacturing's total Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X @ 2 / 13 139% Pe 17 Central Manufacturing into a company that would be respected in the community and admired by trading partners for its willingness to work closely with them to achieve a gain-gain environment regardless of the size of the trading partner. Central Manufacturing developed a strong relationship with well-known retail chains to handle the last mile of putting the product into the hands of their retail consumers. The largest customer, Mamenininkas, represents 40% of Central Manufacturing's total revenue, and currently has 953 stores located throughout Europe and South America which carry Beverly's products. The other end of the supply chain is anchored by Central Manufacturing's largest supplier, Alku, a Finnish producer of many of the stylish components of the fashion accessory. Central Manufacturing is a large customer of Alku, representing 50% of Central Manufacturing's purchases. Sam Smith knocked on Frank Ferguson's open door. "Frank, have you ever heard of something called "cash to cash (C2C)?" "You mean the old accounting 'cash conversion cycle (CCC)?'" Ferguson asked. "Yes, of course, why do you ask, Sam?" als Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central. 3 / 13 139% D Days of Payables = A/P x 365 COGS Days of Inventory = Inventory x 365 COGS Days of Receivables = A/R x 365 Sales Days of Cash to Cash = Inventory + Receivables - Payables FIGURE ONE "I stumbled across some academic papers, 12 which suggest using something called 'cash to cash' to help manage the supply chain," Smith responded. "What piqued my interest that this is the first time I have seen an easy-to-develop metric that looks across multiple trading partners. As you know, most company measures only look within its own four walls or with one trading partner, for example, sales with a customer or purchases with a supplier. A measure that considers a supply chain-supplier to manufacturer to customer-is as rare as a skinny pastry shop employee." ols Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 3 7.13 139% FIGURE ONE "I stumbled across some academic papers, 12 which suggest using something called 'cash to cash' to help manage the supply chain," Smith responded. "What piqued my interest is that this is the first time I have seen an easy-to-develop metric that looks across multiple trading partners. As you know, most company measures only look within its own four walls or with one trading partner, for example, sales with a customer or purchases with a supplier. A measure that considers a supply chain-supplier to manufacturer to customer-is as rare as a skinny pastry shop employee." "Most companies must pay their suppliers (cash out) before they get paid by their customers (cash in)," Ferguson pointed out. "It's easy to calculate using data that comes from the balance sheet and income statement. This information is available for all publically-traded companies, and, I believe any privately held companies interested in improving their supply chains would also be willing to provide this information. Total revenue and cost of goods sold "Supply Chain Cash-to-Cash: Strategy for the 21st Century." Strategic Finance 2009 nn 40-49 Tools Course Outlina TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 4 / 13 139% 7 from the income statement, and receivables, payables, and inventory from the balance sheet. Pretty general information and usually not proprietary so the data is easy to obtain." "Are the formulas complicated?" Smith asked. "You know how I like 'simple, especially w with the financial stuff." "Very simple," Ferguson said with a smile. "All you do is convert the receivables, payables, and inventory into 'days of.' Look at the formulas in Figure One." "They ARE simple!" Smith exclaimed. "So what does cash to cash mean?" "It measures the number of days a company waits to get paid," Ferguson replied. "Look at Figure Two. It shows an American retailer. On the day they receive a shipment, they take 44 days (accounts payables) to pay their supplier. Sixty days after receiving the shipment, they sell it to their customer. The payment from the customer is in their hands ten days later. Calculate cash to cash and you see they must pay out 26 days before the cash comes in. Cash to cash." "Is it always like that?" Smith asked. Accounts Payable (-44.0 Days) Inventory (+ 60.0 Days) DOS Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 4 / 13 1399 : w cash to casn ana you see they must pay out 26 days perore the casn comes in. Casn to cash. "Is it always like that?" Smith asked. Accounts Payable (- 44.0 Days) Inventory (+ 60.0 Days) Accounts Receivable (+ 10.0 Days) --- Cash-to-Cash Cycle (+ 26.0 Days) "No," said Ferguson. "Some companies actually get paid by their customers BEFORE they pay their suppliers. Dell is probably the best known company that achieves this (see Figure Three). They developed a quick manufacturing process and create finished product six days Council of Supply Chain CSCMP Management Professionals Tools Course Outline TL... Asalgnoment.pdf Academic A18-s... Week 4.pdf Academic Central 3 / 13 139% after receiving a shipment from their supplier. Their customers pay in 33 days, but Dell does not have to pay its supplier for 55 days. The company has cash coming in 16 days before it has to be paid out." ] Accounts Payable (-55.0 Days) Inventory (+ 6.0 Days) Accounts Receivable (+ 33.0 Days) Cash-to-Cash Cycle - 16.0 Days) FIGURE THREE "Brilliant!" Smith enthused. "So they do not have to borrow money and essentially profit off the "float.' We should look at this cash-to-cash thing for our company." "Right," said Ferguson. "Our company has grown to the point where this should be a consideration. The first question is whether Central has positive or negative cash to cash using Mercal Pro Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * 5 713 139% p. FIGURE THREE "Brilliant!" Smith enthused. "So they do not have to borrow money and essentially profit off the 'float.' We should look at this cash-to-cash thing for our company." "Right," said Ferguson. "Our company has grown to the point where this should be a consideration. The first question is whether Central has positive or negative cash to cash using our financial information (Figure Four). Then we should determine the cash to cash for our largest supplier, Alku, and our largest customer, Mamenininkas. Fortunately we already have I their financial information (Figure Five, Figure Six). "One of the articles pointed out that most companies will have differing cost of capital and inventory-carrying costs" Smith continued. "Strategic supply chain management can take advantage of the inherent benefits of each trading partner to help strengthen the supply chain and make it more profitable. We really ought to look at how we handle our financial transactions throughout our supply chain." "Well," said Ferguson, "We have a close enough working relationship with Alku to know that their weighted average cost of capital is 18.3%, not as good as the 17.7% that we have, and Council of Sunnly Chain sis Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... X 6 1 13 139% v ED certainly nowhere near the 15.8% that Mamenininkas has. They are so large and I believe the size of the company helps them get better interest rates than Central." "Ah, but Alku has a lower cost to carry inventory," Smith observed. "It only costs them 25.9% annually to hold inventory. Our cost is 29.7% and Mamenininkas keeps pointing out that their inventory carrying cost is 32.3%, which is why they want us to make more frequent, smaller shipments to them. This has actually helped Central as we scramble to have enough production to meet their orders. We could not send large shipments if we had to. "There is probably some opportunity to use these different costs to help strengthen the supply chain. For example, I wonder what would happen if Mamenininkas were to pay us faster, say ten days earlier. We would not have to borrow as much to pay our bills while we wait for payment from Mamenininkas. By tapping into their lower cost of capital we could share the savings with Mamenininkas and both companies would benefit. If we propose it to them AND they can lower costs, I think they would be interested." Central Manufacturing Consolidated Balance Sheet (000's) CURRENT ASSETS Cash and equivalent Accounts receivable Inventories Other Total Current Assets $ 10,799 $ 23,993 $ 4,287 $ 5,541 $ 44,620 Property and equipment, net Other assets Total Assets $ 31,830 $ 35,952 $112,402 LIABILITIES AND SHAREHOLDERS EQUITY CURRENT LIABILITIES Accounts payable Current portion of long-term debt Accrued expenses Income taxes Total Current Liabilities $ 9,679 $ 9,181 $ 9,753 $ 8,199 $ 36,812 Long-term debt Deferred income taxes Other Long-term liabilities $ 52,237 $ 4,492 $ 56,729 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 50,110 $ 117,641 ($148,890) $ 18,861 Total Liabilities and Shareholder's Equity $112,402 Horne Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * 27 cp 6 7 / 13 139% je Deferred income taxes Other Long-term liabilities $ 4,492 $ 56,729 @ SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 50,110 $ 117,641 ($148,890) $ 18,861 Total Liabilities and Shareholder's Equity $112,402 INCOME STATEMENT Net Sales Cost of Goods Sold Gross Margin $ 104,507 $ 54,209 $ 50,298 Operating Expenses Research and development Selling, general, and administrative Total Operating Expenses $ 6,302 $ 22,479 $ 28,781 $ 21,517 Operating Income Other income and expense Earnings Before Income Taxes Income Tax Net Income $ 844 $ 22,361 $ 5,299 $ 17,062 FIGURE FOUR Council of Supply Chain CSCMP Management Professionals . Academic Central @ 8 / 13 139% Supplier: Alku Consolidated Balance Sheet (000's) CURRENT ASSETS Cash and equivalent Accounts receivable Inventories Other Total Current Assets $ 9,247 $ 11,196 $ 4,372 $ 4,845 $ 29,660 Property and equipment, net Other assets Total Assets $ 19,098 $ 22,771 $ 71,529 LIABILITIES AND SHAREHOLDERS EQUITY CURRENT LIABILITIES Accounts payable Current portion of long-term debt Accrued expenses Income taxes Total Current Liabilities $ 6,495 $ 5,509 $ 7,852 $ 6,320 $ 26,175 Long-term debt Deferred income taxes Other Long-term liabilities $ 31,342 $ 2,695 $ 34,037 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 30,066 $ 70,584 ($ 89,334) $ 11.317 Total Liabilities and Shareholder's Equity $ 71,529 INCOME STATEMENT Home Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * 8 / 13 139% Income taxes Total Current Liabilities $ 6,320 $ 26,175 Long-term debt Deferred income taxes Other Long-term liabilities $ 31,342 $ 2,695 $ 34,037 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 30,066 $ 70,584 ($ 89,334) $ 11.317 $ 71,529 Total Liabilities and Shareholder's Equity I INCOME STATEMENT Net Sales Cost of Goods Sold Gross Margin $ 62,704 $ 32,525 $ 30,179 $ Operating Expenses Research and development Selling, general, and administrative Total Operating Expenses $ 3,781 $ 13,487 $ 17,269 Operating Income $ 12,910 Other income and expense Earnings Before Income Taxes Income Tax Net Income $ 506 $ 13,417 $ 3,179 $ 10,237 FIGURE FIVE 9 / 13 139% DC Customer: Mamenininkas Consolidated Balance Sheet (000's) CURRENT ASSETS Cash and equivalent Accounts receivable Inventories Other Total Current Assets $ 52,297 $ 28,979 $ 6,861 $ 26,623 $ 114,860 Property and equipment, net Other assets Total Assets $ 95,490 $ 113,856 $ 324,206 LIABILITIES AND SHAREHOLDERS EQUITY CURRENT LIABILITIES Accounts payable Current portion of long-term debt Accrued expenses Income taxes Total Current Liabilities $ 37,337 $ 27,543 $ 18,259 $ 4,297 $ 97,436 Long-term debt Deferred income taxes Other Long-term liabilities $ 156,711 $ 13,476 $170,187 SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 150,330 $ 352,923 ($ 148,890) $ 56,583 Total Liabilities and Shareholder's Equity $ 324,206 9 / 13 e 139% 14 - SHAREHOLDER'S EQUITY Common stock Retained earnings (deficit) Less: Treasury stock at average cost Total Shareholder's Equity $ 150,330 $ 352,923 ($ 148,890) $ 56,583 Total Liabilities and Shareholder's Equity $ 324,206 INCOME STATEMENT Net Sales Cost of Goods Sold Gross Margin $ 313,521 $ 162,627 $ 150,894 Operating Expenses Research and development Selling, general, and administrative Total Operating Expenses $ 18,906 $ 67,437 $ 86,343 Operating Income $ 64,551 Other income and expense Earnings Before Income Taxes Income Tax Net Income $ 2,532 $ 67,083 $ 15,897 $ 51,186 FIGURE SIX Council of Supply Chain CSCMP Management Professionals This document is available from our site and provided for your personal use only and may not be retransmitted or redistributed without written permission Server online service, netwo Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central 10 / 13 139% q "OK," said Ferguson. I will run the numbers and see what we get." "If we run this by Beverly, we should put the savings in terms of additional sales," Smith added. "She will understand that much better since she seems to focus more on sales than " operations." "Right," agreed Ferguson. "We will let her know what this means both in terms of cost savings, which goes directly to the bottom line, and equivalent to additional sales." "Hey! We can also look at how we are managing our inventory with Alku," Smith said. "They have a lower cost to hold inventory and we should be able to do a better job of working with them to have them hold our inventory until just before we need it. Something like a vendor-managed inventory (VMI) system where we do not have to hold the inventory until right when we need it. Dell has an interesting process where the suppliers deliver containers of inventory but Dell does not actually 'own' the inventory until they remove it from the container. The inventory is physically located at the Dell manufacturing location but not received until Dell needs it. Dell installed a barcode reader at each container door. When they go into the container to get something, they scan it and Dell 'buys' it from the supplier at that point. We could probably set up something like this with Alku. They could hold the inventory at their lower ICC and we would potentially reduce the amount of inventory that we hold by 21 days of supply. I assume we would have the same 50%-50% share agreement with Alku as we me Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... * Lo * P 10 / 13 + 139% CA > received until Dell needs it. Dell installed a barcode reader at each container door. When they go into the container to get something, they scan it and Dell 'buys' it from the supplier at that point. We could probably set up something like this with Alku. They could hold the inventory at their lower ICC and we would potentially reduce the amount of inventory that we hold by 21 2 days of supply. I assume we would have the same 50%-50% share agreement with Alku as we do with Mamenininkas." "Certainly," agreed Ferguson. "As Beverly was developing what is now our supply chain, she made sure to include a clause in every contract that we equally share any savings with each trading partner." "But Alku would increase their costs. How do we handle that?" asked Smith. "We can determine what 21 days of carrying cost savings means to us, and what 21 days of additional carrying cost means to Alku," Ferguson said. "We would pay Alku's additional carrying cost plus half the savings. We can ledger it in the accounting books and recognize the savings. It is innovative supply chain finance." 21 Council of Supply Chain CSCMP Management Professionals This document is avallable from our site and provided for your personal use only and may not be retransmitted or redistributed without written permission from 10 Tools Course Outline TL... Assignement.pdf Academic A18-S... Week+4.pdf Academic Central.. 11 / 13 139% "I suppose we will have to explain it to Beverly in both terms of cost savings and equivalent sales," Smith said. "Of course," replied Ferguson. I will look at that right after I consider the Mamenininkas opportunity. We can present both to Beverly at the same time. I think she will be pleased that we are doing some leading edge supply chain financing. That's why she keeps us around!" QUESTIONS: Question #1: Determine the number of days of payables, receivables, and inventory for Central Manufacturing. How many days of cash to cash do they have? Question #2: Determine the number of days of payables, receivables, and inventory for the supplier Alku. How many days of cash to cash do they have? Question #3: Determine the number of days of payables, receivables, and inventory for the customer Mamenininkas. How many days of cash to cash do they have? Course ne Assignement.pdf Academic A18-S... Week+4.pdf Academic Central... x 2 1 11 / 13 + 13996 QUESTIONS: 2 Question #1: Determine the number of days of payables, receivables, and inventory for Central Manufacturing. How many days of cash to cash do they have? Question #2: Determine the number of days of payables, receivables, and inventory for the supplier Alku. How many days of cash to cash do they have? Question #3: Determine the number of days of payables, receivables, and inventory for the customer Mamenininkas. How many days of cash to cash do they have? Question #4: Determine the one-time and annual cost savings for Central Manufacturing if customer Mamenininkas agrees to pay ten days faster? Question #5: If we propose sharing the annual cost savings for Central Manufacturing with customer Mamenininkas 50%-50%, the savings will go to our bottom line. How much will this increase our earnings before income taxes (EBIT)? MacBook Pro

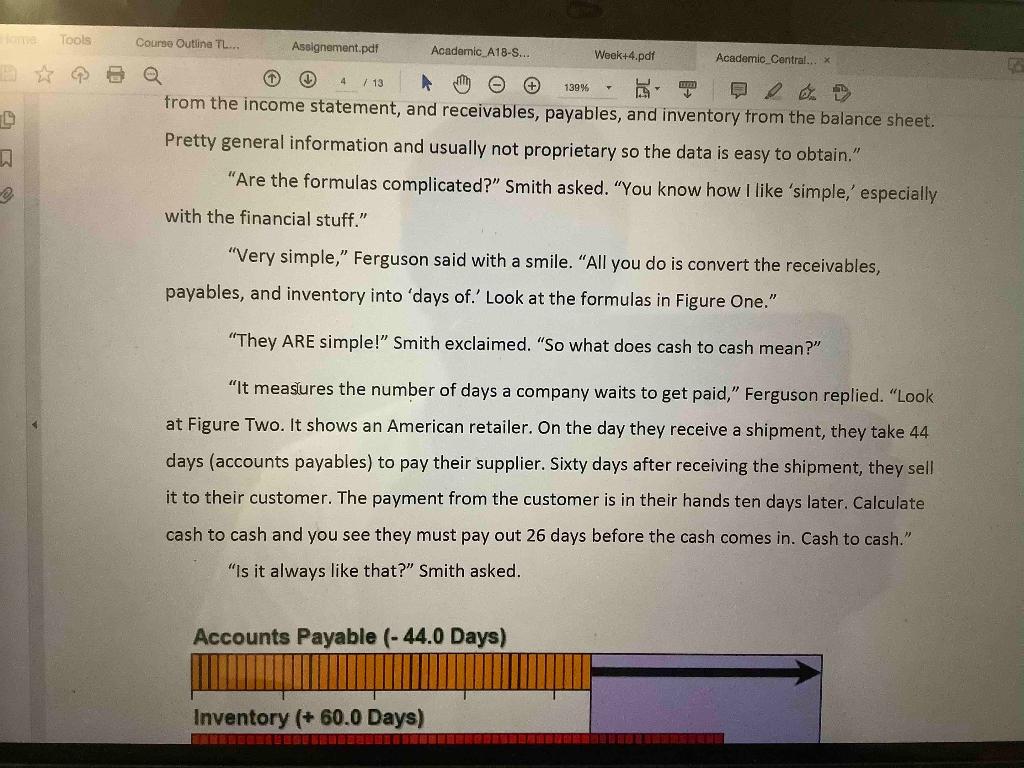

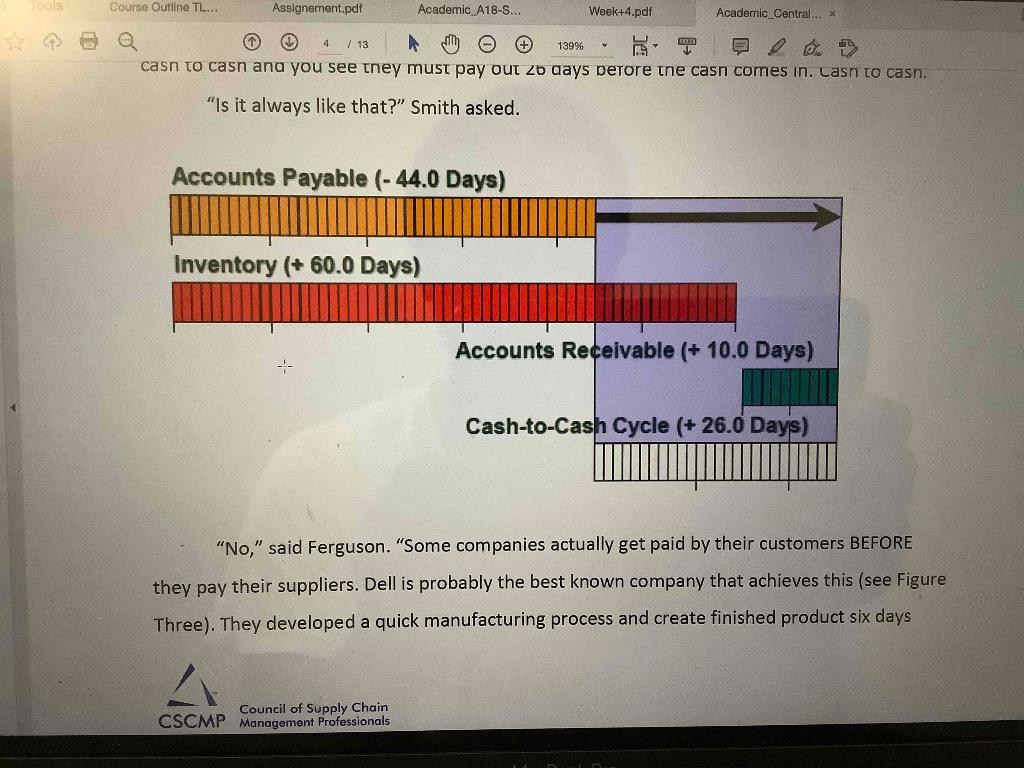

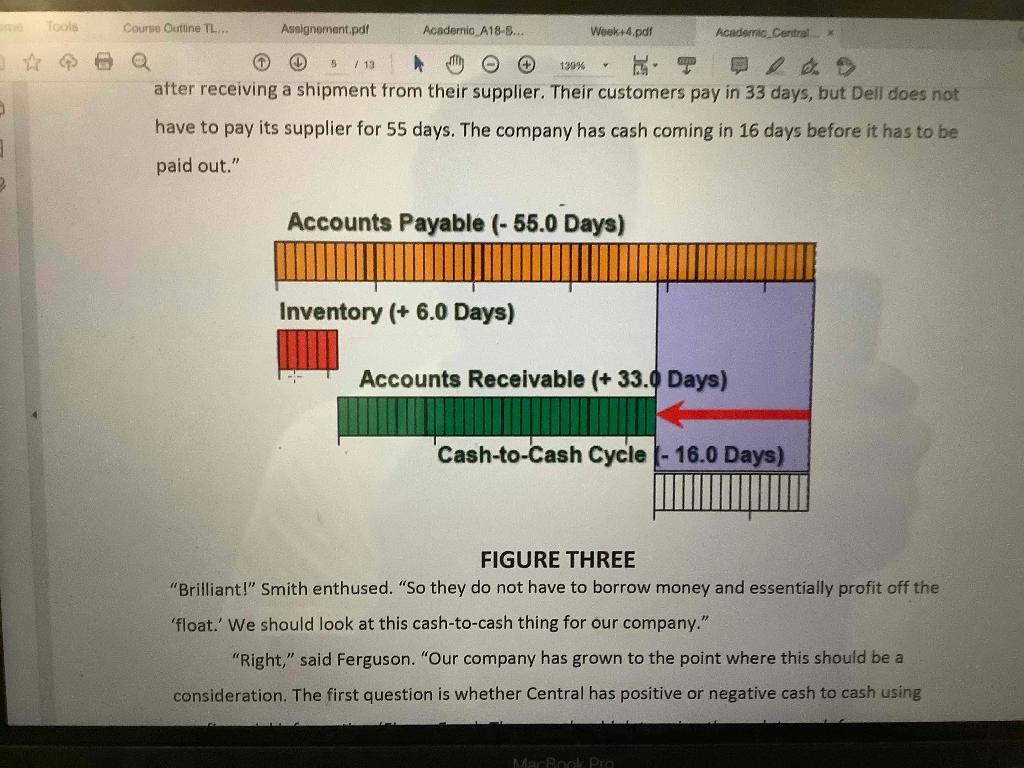

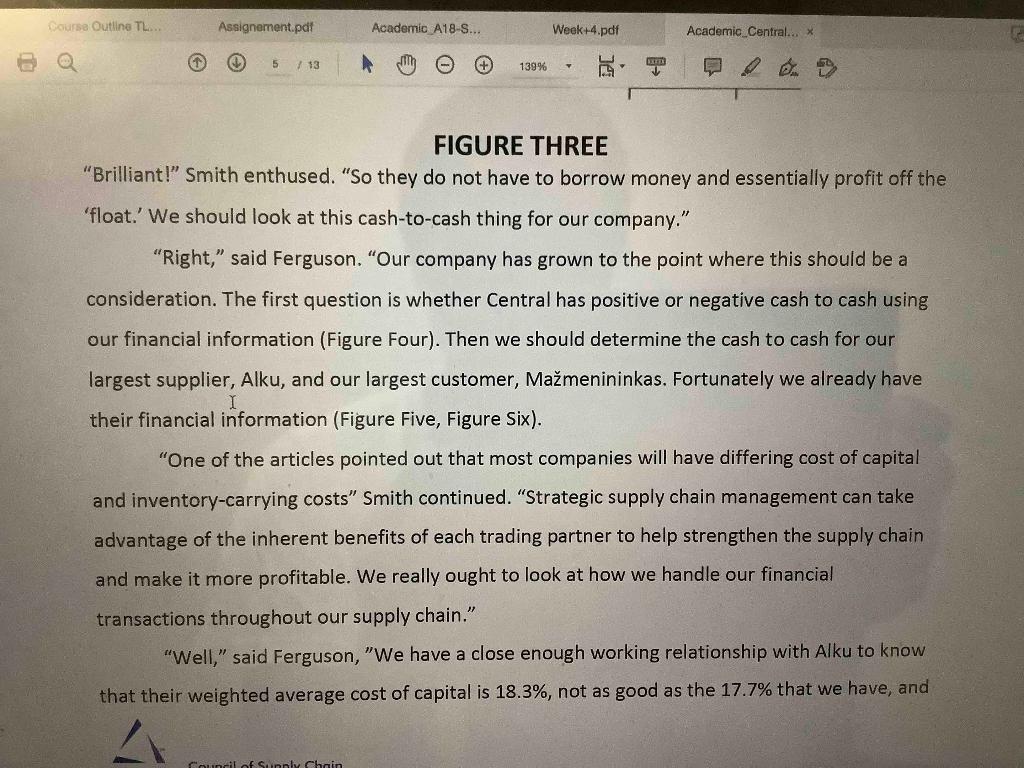

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts