Question: Hello could you please help me with calculating the basis for the common stock and preferred stock? Problem 6-52 (LO. 3) Ramon and Sophie are

Hello could you please help me with calculating the basis for the common stock and preferred stock?

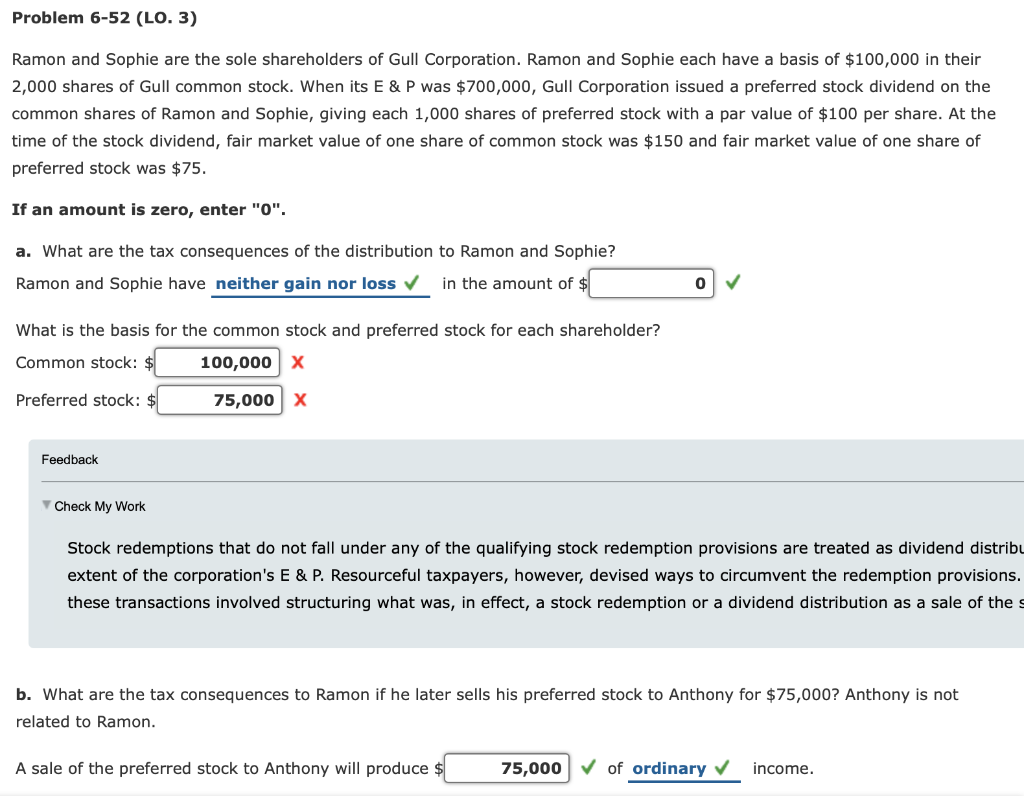

Problem 6-52 (LO. 3) Ramon and Sophie are the sole shareholders of Gull Corporation. Ramon and Sophie each have a basis of $100,000 in their 2,000 shares of Gull common stock. When its E&P was $700,000, Gull Corporation issued a preferred stock dividend on the common shares of Ramon and Sophie, giving each 1,000 shares of preferred stock with a par value of $100 per share. At the time of the stock dividend, fair market value of one share of common stock was $150 and fair market value of one share of preferred stock was $75. If an amount is zero, enter "O". a. What are the tax consequences of the distribution to Ramon and Sophie? Ramon and Sophie have neither gain nor loss in the amount of $ 0 What is the basis for the common stock and preferred stock for each shareholder? Common stock: $ 100,000 x Preferred stock: $ 75,000 X Feedback Check My Work Stock redemptions that do not fall under any of the qualifying stock redemption provisions are treated as dividend distribu extent of the corporation's E & P. Resourceful taxpayers, however, devised ways to circumvent the redemption provisions. these transactions involved structuring what was, in effect, a stock redemption or a dividend distribution as a sale of the b. What are the tax consequences to Ramon if he later sells his preferred stock to Anthony for $75,000? Anthony is not related to Ramon. A sale of the preferred stock to Anthony will produce $ 75,000 of ordinary income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts