Question: Hello coursehero team, can someone help me to construct the cash flow statement, balance sheet and income statement? Proprietor: Mr. Isell Holmes Name of the

Hello coursehero team, can someone help me to construct the cash flow statement, balance sheet and income statement?

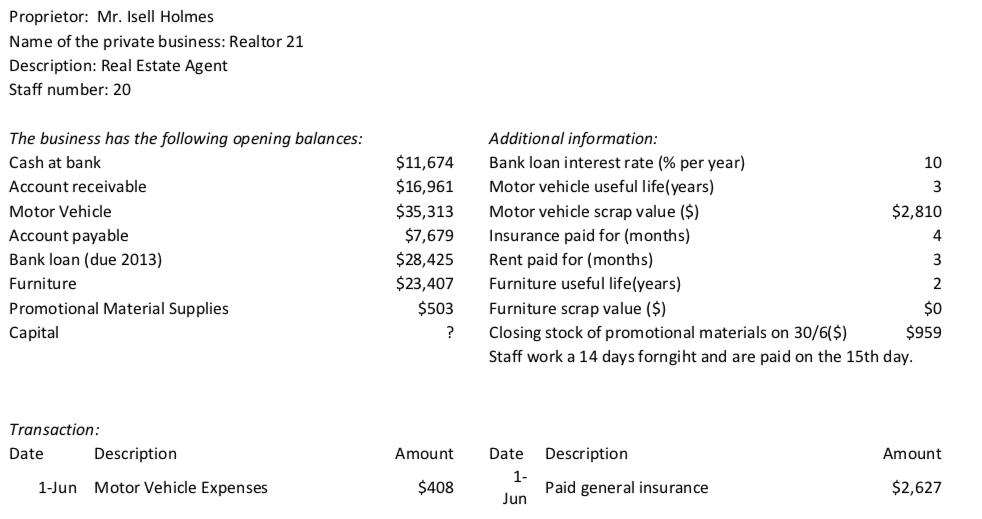

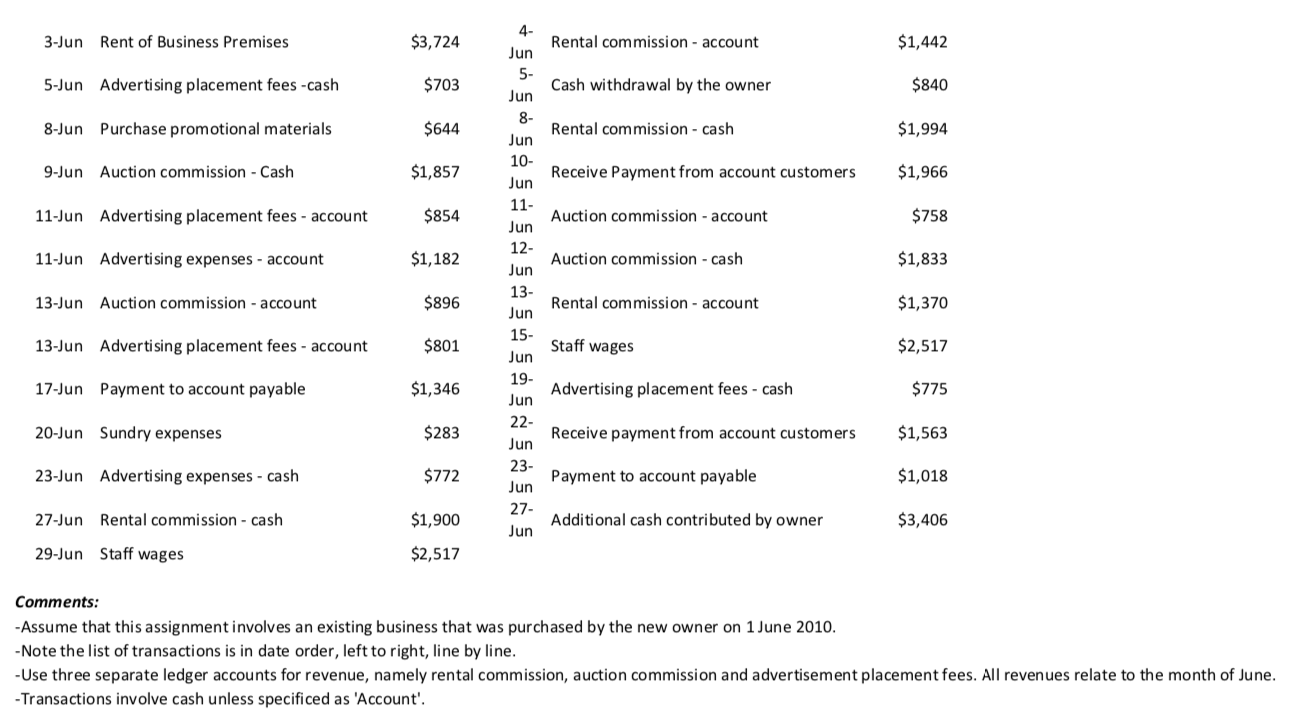

Proprietor: Mr. Isell Holmes Name of the private business: Realtor 21 Description: Real Estate Agent Staff number: 20 The business has the following opening balances: Additional information: Cash at bank $11,674 Bank loan interest rate (% per year) 10 Account receivable $16,961 Motor vehicle useful life(years) 3 Motor Vehicle $35,313 Motor vehicle scrap value ($) $2,810 Account payable $7,679 Insurance paid for (months) 4 Bank loan (due 2013) $28,425 Rent paid for (months) 3 Furniture $23,407 Furniture useful life(years) 2 Promotional Material Supplies $503 Furniture scrap value ($) $0 Capital ? Closing stock of promotional materials on 30/6($) $959 Staff work a 14 days forngiht and are paid on the 15th day. Transaction: Date Description Amount Date Description Amount 1-Jun Motor Vehicle Expenses $408 1- Jun Paid general insurance $2,6273-Jun Rent of Business Premises $3,724 4- Jun Rental commission - account $1,442 5-Jun Advertising placement fees -cash $703 5- Jun Cash withdrawal by the owner $840 8-Jun Purchase promotional materials $644 8- Jun Rental commission - cash $1,994 9-Jun Auction commission - Cash $1, 857 10- Jun Receive Payment from account customers $1,966 11-Jun Advertising placement fees - account $854 11- Jun Auction commission - account $758 11-Jun Advertising expenses - account $1,182 12- Jun Auction commission - cash $1,833 13-Jun Auction commission - account $896 13- Jun Rental commission - account $1,370 13-Jun Advertising placement fees - account $801 15- Jun Staff wages $2,517 17-Jun Payment to account payable $1,346 19- Jun Advertising placement fees - cash $775 20-Jun Sundry expenses $283 22- Jun Receive payment from account customers $1,563 23-Jun Advertising expenses - cash $772 23- Jun Payment to account payable $1,018 27-Jun Rental commission - cash $1,900 27- Jun Additional cash contributed by owner $3,406 29-Jun Staff wages $2,517 Comments: Assume that this assignment involves an existing business that was purchased by the new owner on 1 June 2010. -Note the list of transactions is in date order, left to right, line by line. -Use three separate ledger accounts for revenue, namely rental commission, auction commission and advertisement placement fees. All revenues relate to the month of June. -Transactions involve cash unless specificed as 'Account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts