Question: hello dear Sir/Madam please find attached case study for our homework we would like to hear your respond with most clarification not only numbers as

hello dear Sir/Madam

please find attached case study for our homework we would like to hear your respond with most clarification not only numbers as introduction and conclusion also required (full summary )

many thanks

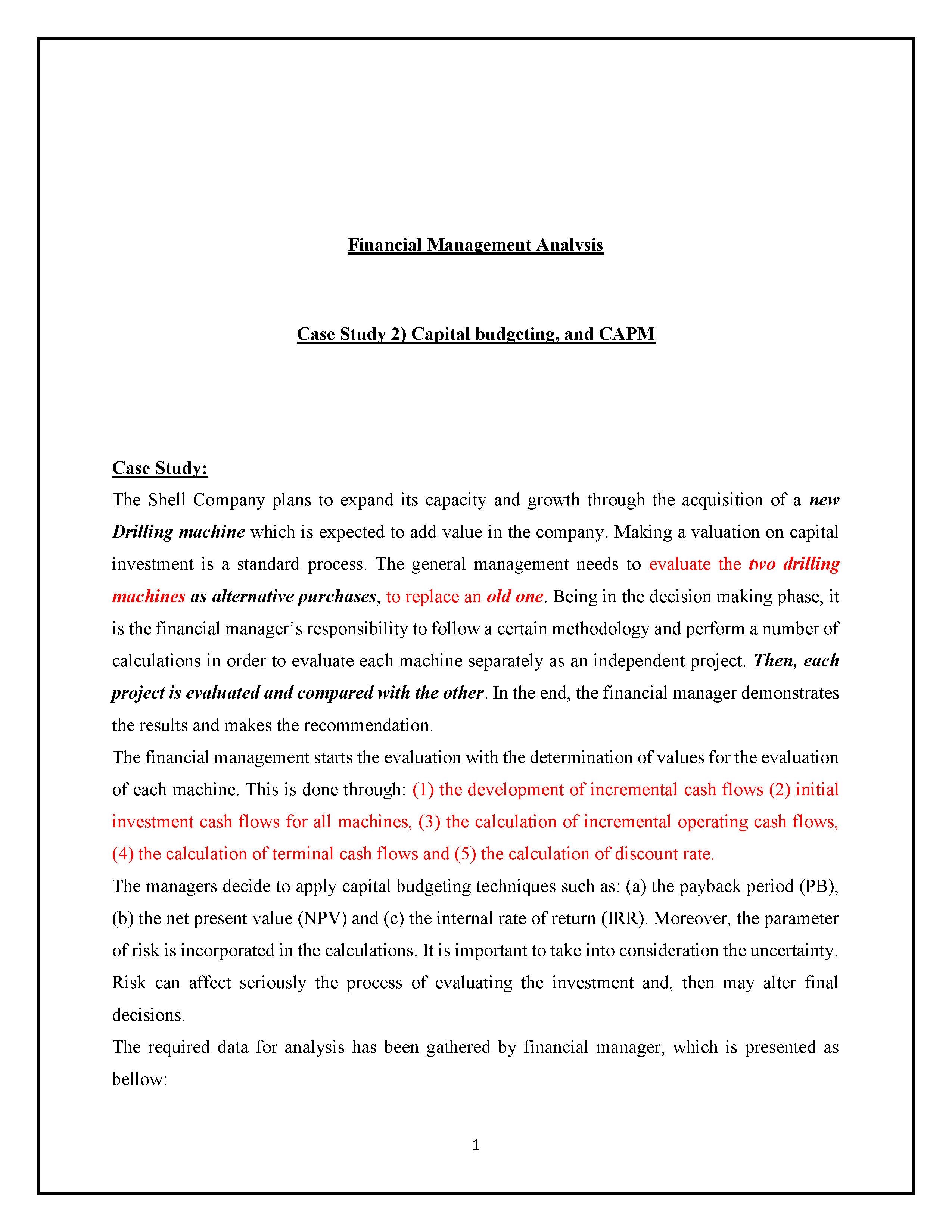

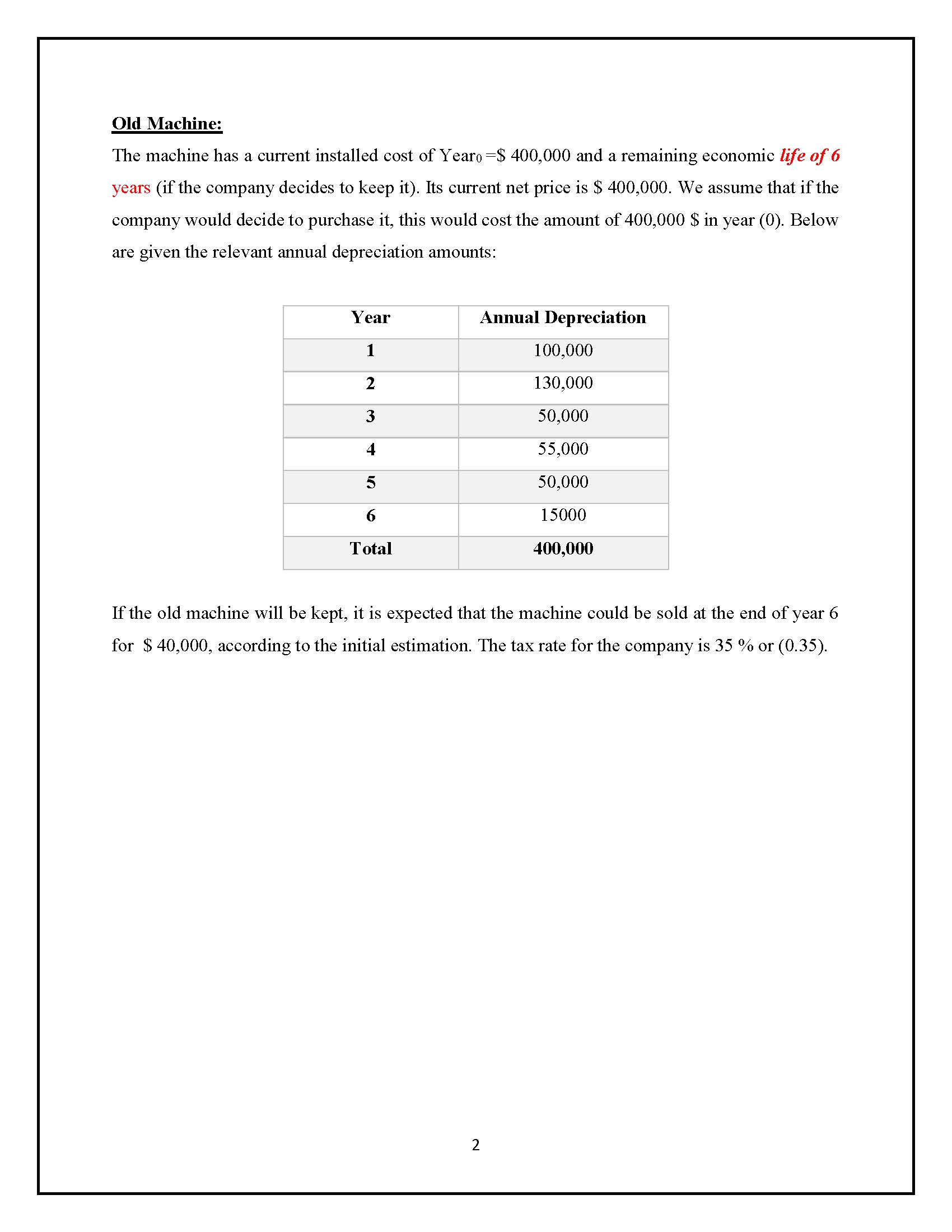

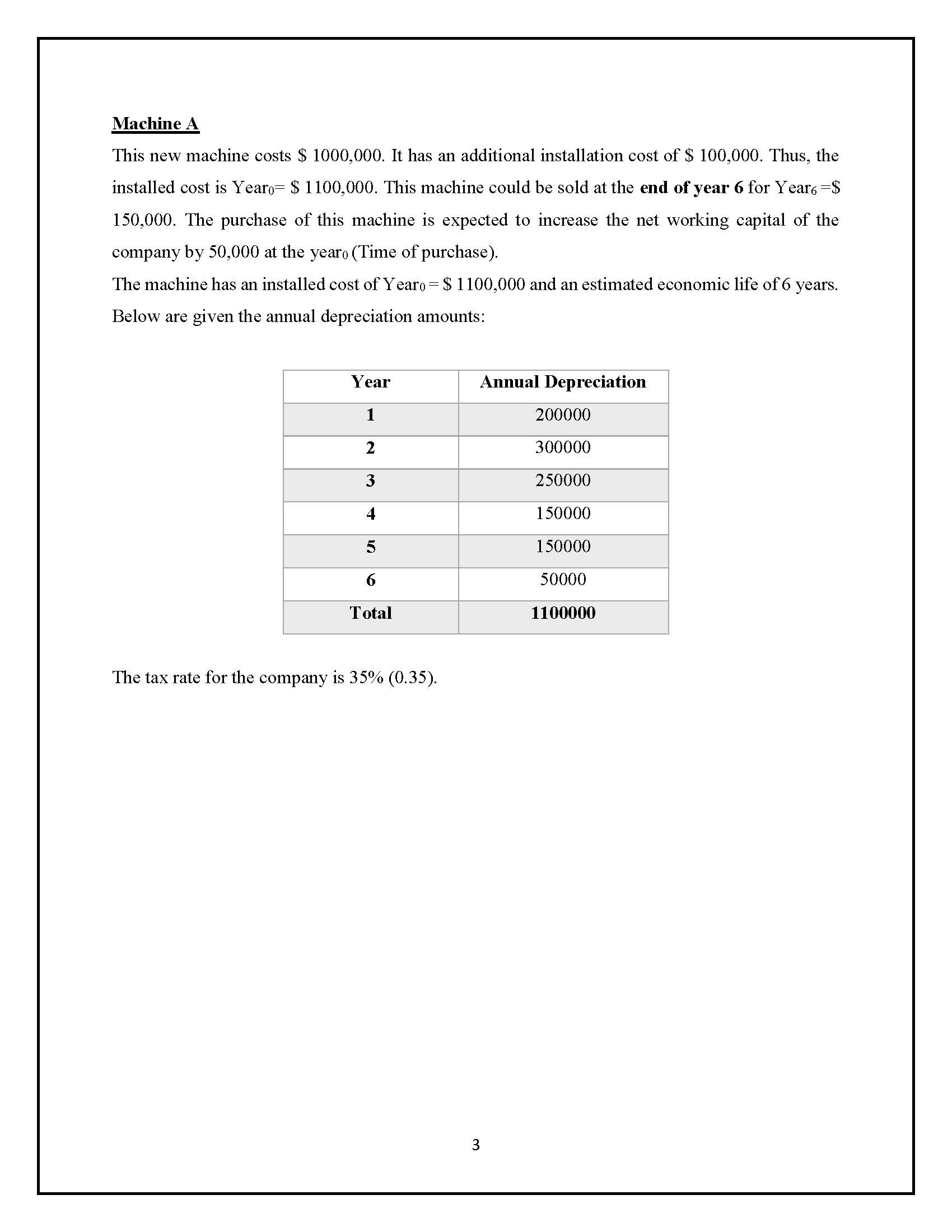

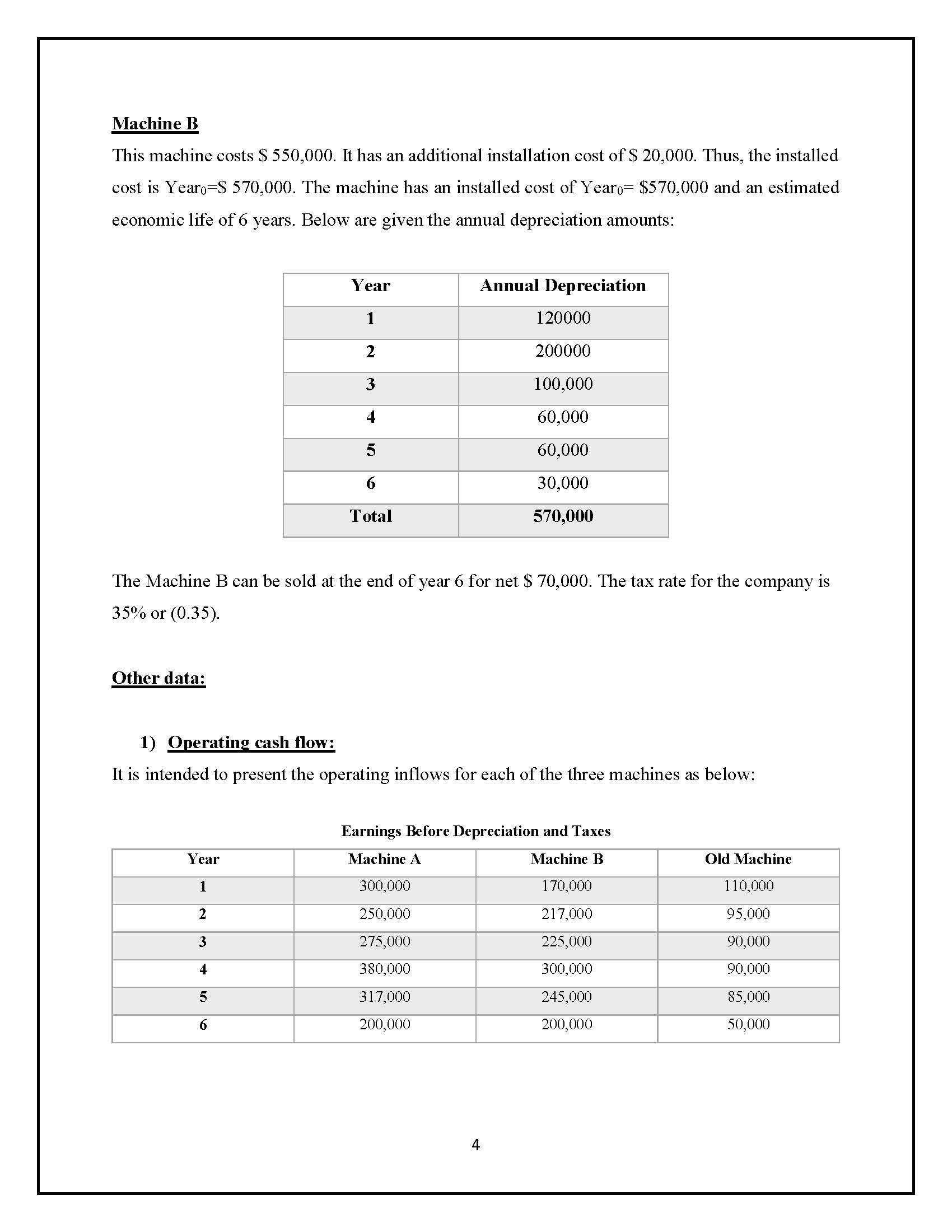

Financial Management Analysis Case Study 2) Capital budgeting, and CAPM Case Study: The Shell Company plans to expand its capacity and growth through the acquisition of a new Drilling machine which is expected to add value in the company. Making a valuation on capital investment is a standard process. The general management needs to evaluate the two drilling machines as alternative purchases, to replace an old one. Being in the decision making phase, it is the financial manager's responsibility to follow a certain methodology and perform a number of calculations in order to evaluate each machine separately as an independent project. Then, each project is evaluated and compared with the other. In the end, the financial manager demonstrates the results and makes the recommendation. The financial management starts the evaluation with the determination of values for the evaluation of each machine. This is done through: (1) the development of incremental cash flows (2) initial investment cash flows for all machines, (3) the calculation of incremental operating cash flows, (4) the calculation of terminal cash flows and (5) the calculation of discount rate The managers decide to apply capital budgeting techniques such as: (a) the payback period (PB), (b) the net present value (NPV) and (c) the internal rate of return (IRR). Moreover, the parameter of risk is incorporated in the calculations. It is important to take into consideration the uncertainty. Risk can affect seriously the process of evaluating the investment and, then may alter final decisions. The required data for analysis has been gathered by financial manager, which is presented as bellow:Old Machine: The machine has a current installed cost of Yearo :$ 400,000 and a remaining economic life of 6 years (if the company decides to keep it). Its current net price is $ 400,000. We assume that if the company would decide to purchase it, this would cost the amount of 400,000 $ in year (0). Below are given the relevant annual depreciation amounts: Year : Annual Depreciation 1 100,000 = 130,000 50,000 55,000 50,000 15000 400,000 If the old machine will be kept, it is expected that the machine could be sold at the end of year 6 for $ 40,000, according to the initial estimation. The taX rate for the company is 35 % or (0.35). Machine A This new machine costs $ 1000,000. It has an additional installation cost of $ 100,000. Thus, the installed cost is Yearo= $ 1100,000. This machine could be sold at the end of year 6 for Years =$ 150,000. The purchase of this machine is expected to increase the net working capital of the company by 50,000 at the yearo (Time of purchase). The machine has an installed cost of Yearo : $ 1100,000 and an estimated economic life of 6 years. Below are given the annual depreciation amounts: Year Annual Depreciation 1 200000 2 300000 3 250000 4 5 150000 150000 6 50000 1100000 The taX rate for the company is 35% (0.35). Machine B This machine costs $ 550,000. It has an additional installation cost of $ 20,000. Thus, the installed cost is Yearo=$ 570,000. The machine has an installed cost of Yearo= $570,000 and an estimated economic life of 6 years. Below are given the annual depreciation amounts: Year Annual Depreciation 1 120000 2 200000 3 100,000 4 5 60,000 60,000 6 30,000 570,000 The Machine B can be sold at the end of year 6 for net '5 70,000. The tax rate for the company is 35% or (0.35). Other data: 1) Operating cash ow: It is intended to present the operating inows for each of the three machines as below: Earnings Before Depreciation and Taxes - 275,000 225,000 90,000 380,000 300,000 2) Cost 0: Capital: When evaluating an investment, it is required to take into consideration (a) the time value of money to be invested (opportunity cost) and (b) the risk taken in the investment (risk premium). The Capital Asset Pricing Model (CAPM) is used as a formula to estimate the cost of capital which is the key input in the capital budgeting process and the valuation of an investment, financial manager will follow CAPM to calculate the cost of capital which is actually the required rate of return. It is worth to mention that all percentages are given by the general manager and they are based on assumptions. a. Rf = 4.5 % b. Rm=10% c. B=l.5 Required: 1) Compute Total Initial Net Investment (Cash outflow at the time of purchase) 2) Calculate incremental operating cash flows 3) Calculate incremental Relevant cash ows (Machine A Old Machine) and (Machine B- Old Machine) 4) Calculate terminal cash ow (Cash ow at the time of sale of the machines, End of year (5) 5) Calculate discount rate (WACC) using CAPM equation 6) Evaluate the projects using capital budgeting techniques: a. Payback Period b. Net Present Value (NPV) c. Internal Rate of Return (IRR) 7) Finally, which projects would be selected based on your investigations Instructions : / Students should use Excel worksheet for calculation and put the results in the tables / The equation and the calculation process should be written