Question: Hello does anyone know how to solve this mini case question. hext l the end rate of retn 4-32. (Commun stockholder expected reture) If you

Hello does anyone know how to solve this mini case question.

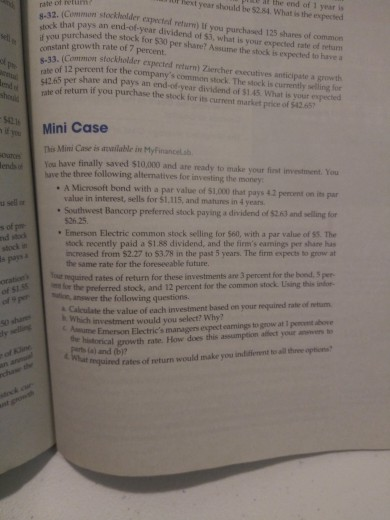

hext l the end rate of retn 4-32. (Commun stockholder expected reture) If you purchased 125 shares of common n that pays an end-of-year dividend of S3, what is your expected rate of return t vou purchased the stock for $30 per share? Assume the stock is expected to have a of 1 year is year should be $2.84. What is the expected constant growth rate of 7 percent s-33. of 12 percent for the company's common stock. The stock is currently selling for 65 per share and pays an end-of year dividend of $1.45 What is your expected Common stockholder expected return) Ziercher executives anticipate a growth e of return if you purchase the stock for its current market price of $412.657 rate Mini Case This Mini Case is arvailable in Myfinance arcs You have finally saved $10,000 and are ready to make your first investment. You . A Microsoft bond with a par value of $1,000 that pays 42 percent on its par . Southwest Bancorp preferred stock paying a dividend of S263 and velling for * Emerson Electric common stock selling for 560, with a par value of S5. The uve the three following alternatives for investing the money value in interest, sells for $1.115, and matunes in 4 years u sel s of p stock in 526.25 stock recently paid a $1.88 dividend, and the fire's eamings per share has ncreased from $2.27 to $3.78 in the past 5 years. The firm expects to grow at the same rate for the foreseeable future s poys a t niquired rates of return for these investments are 3 percent for the bond, 5 per 15for the preferred stock, and 12 percent for the common stock Lising this inor of each investment based on your requined rate of etum Emerson Electric's managers expect eanings to grow at 1 pecent above n anser the following questions Calculate the value t nvestment would you select? Why? 0 shares historical growth rate. How does this assumption alfect your anvers prs la) and (b)? of Jine njuired rates of return would make you inditierent to ll tho

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts