Question: Hello everyone! Could you help me to do these exercise, please! We will use unusually small numbers to simplify the calculations and to emphasize the

Hello everyone! Could you help me to do these exercise, please!

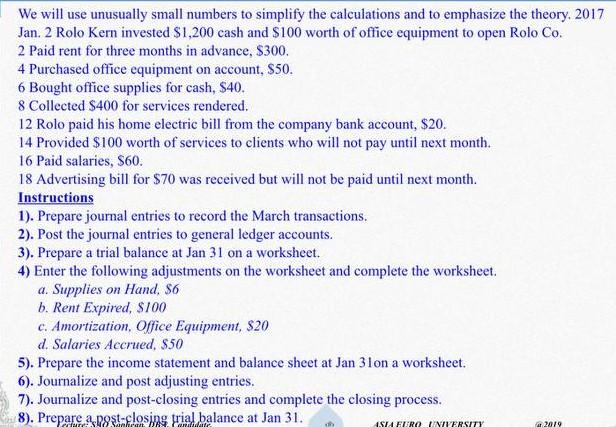

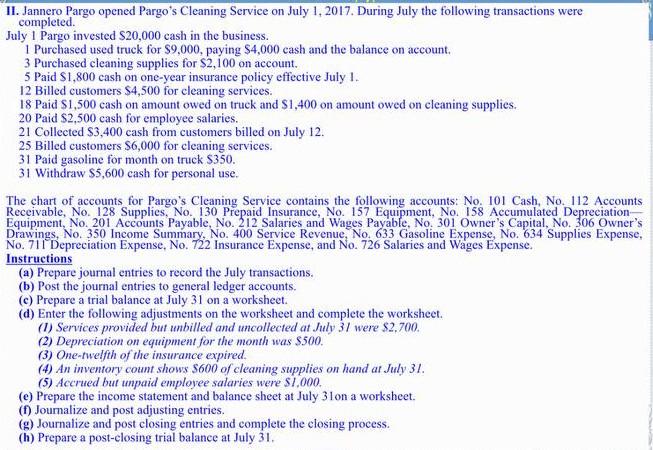

We will use unusually small numbers to simplify the calculations and to emphasize the theory, 2017 Jan. 2 Rolo Kern invested $1,200 cash and $100 worth of office equipment to open Rolo Co. 2 Paid rent for three months in advance, $300. 4 Purchased office equipment on account. $50. 6 Bought office supplies for cash, $40. 8 Collected $400 for services rendered. 12 Rolo paid his home electric bill from the company bank account, $20. 14 Provided $100 worth of services to clients who will not pay until next month. 16 Paid salaries, $60. 18 Advertising bill for $70 was received but will not be paid until next month. Instructions 1). Prepare journal entries to record the March transactions. 2). Post the journal entries to general ledger accounts. 3). Prepare a trial balance at Jan 31 on a worksheet. 4) Enter the following adjustments on the worksheet and complete the worksheet. a. Supplies on Hand, $6 b. Rent Expired, $100 c. Amortization, Office Equipment, $20 d. Salaries Accrued, $50 5). Prepare the income statement and balance sheet at Jan 3lon a worksheet. 6). Journalize and post adjusting entries. 7). Journalize and post-closing entries and complete the closing process. 8). Prepare a 18st-closing trial balance at Jan 31. Yin AS EROTINILERSITY 2019 II. Jannero Pargo opened Pargo's Cleaning Service on July 1, 2017. During July the following transactions were completed. July 1 Pargo invested $20,000 cash in the business. 1 Purchased used truck for $9,000, paying $4,000 cash and the balance on account. 3 Purchased cleaning supplies for $2,100 on account. 5 Paid S1,800 cash on one-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services. 18 Paid S1,500 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. 20 Paid $2,500 cash for employee salaries. 21 Collected $3,400 cash from customers billed on July 12. 25 Billed customers $6,000 for cleaning services. 31 Paid gasoline for month on truck $350. 31 Withdraw $5,600 cash for personal use. The chart of accounts for Pargo's Cleaning Service contains the following accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 128 Supplies. No. 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation Equipment, No 201 Accounts Payable, No. 212 Salaries and Wages Payable, No. 301 Owner's Capital, No. 306 Owner's Drawings, No. 350 Income Summary, No. 400 Service Revenue, No. 633 Gasoline Expense, No. 634 Supplies Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries and Wages Expense. Instructions (a) Prepare journal entries to record the July transactions. (b) Post the journal entries to general ledger accounts. (e) Prepare a trial balance at July 31 on a worksheet. (d) Enter the following adjustments on the worksheet and complete the worksheet. (1) Services provided but unbilled and uncollected at July 31 were $2,700. (2) Depreciation on equipment for the month was $500. (3) One-twelfth of the insurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $1,000. (e) Prepare the income statement and balance sheet at July 31on a worksheet. (f) Joumalize and post adjusting entries. (9) Journalize and post closing entries and complete the closing process. (h) Prepare a post-closing trial balance at July 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts