Question: hello everyone, please help with the answer for the future value factor. i tried using the 5year time period with 2% interest rate as the

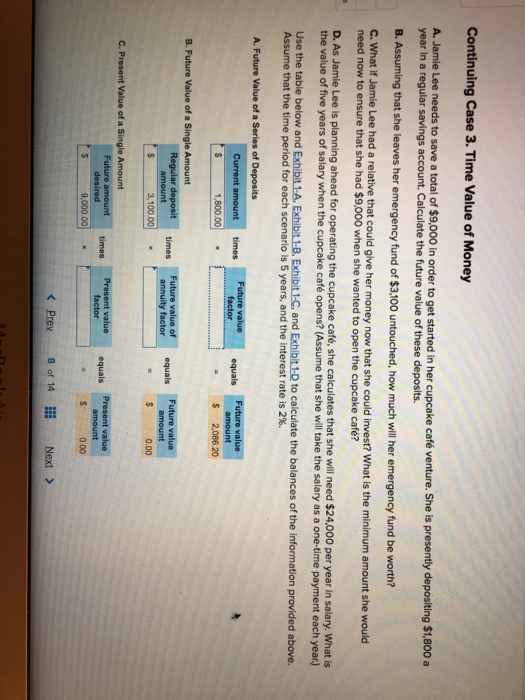

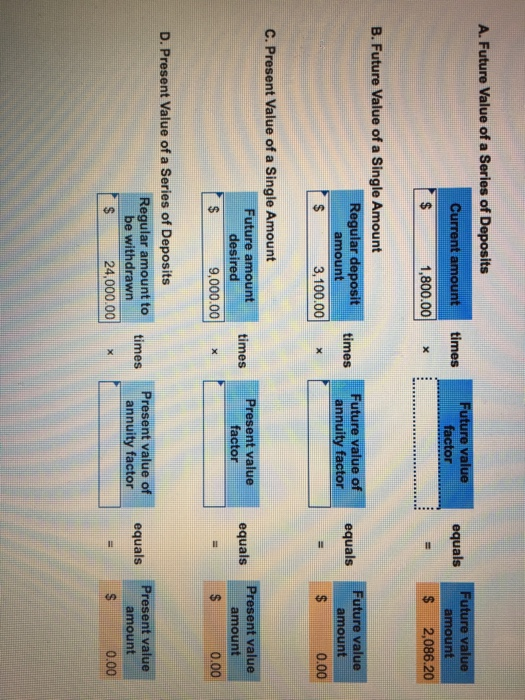

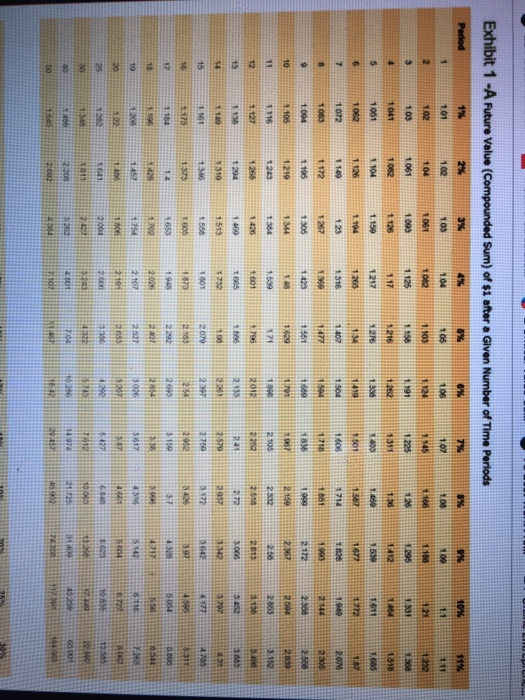

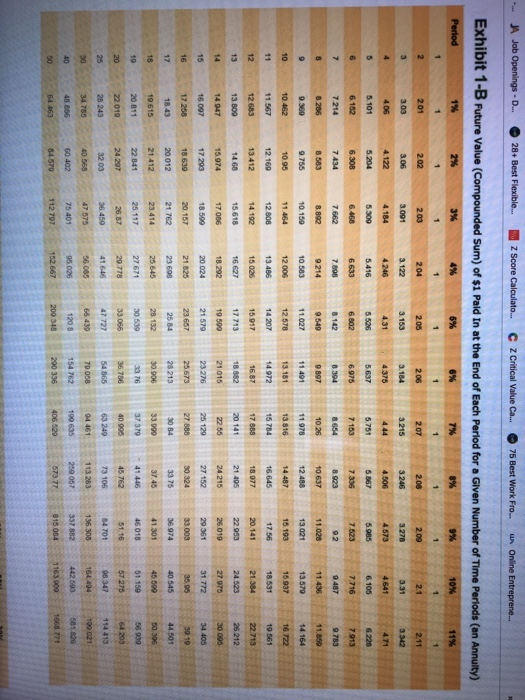

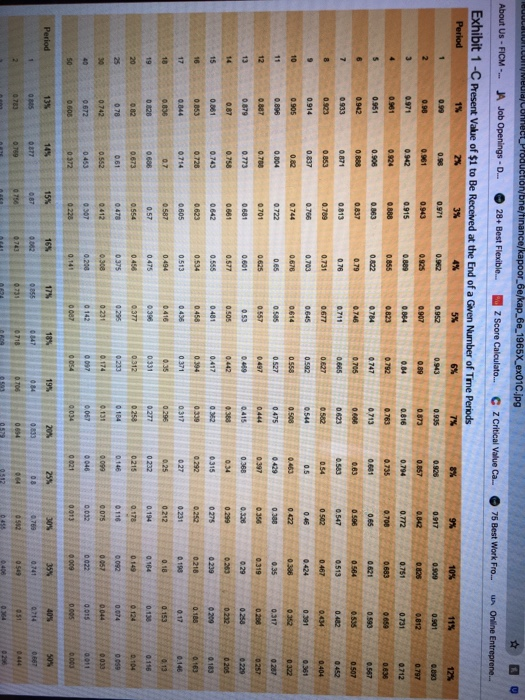

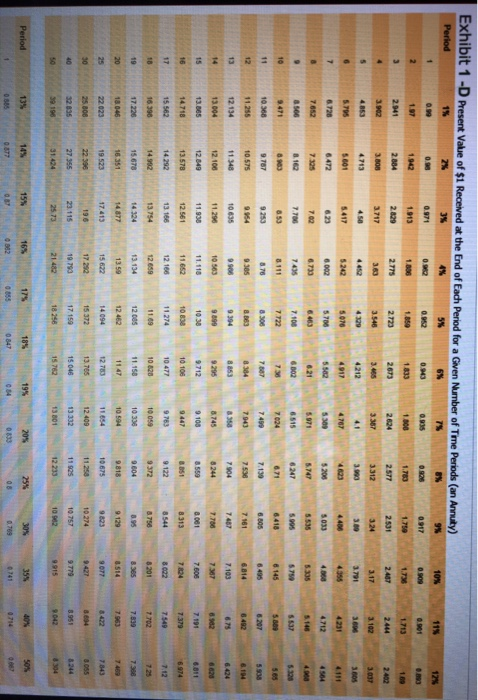

Continuing Case 3. Time Value of Money A. Jamie Lee needs to save a total of $9,000 in order to get started in her cupcake caf venture. She is presently depositing $1,800 a year in a regular savings account. Calculate the future value of these deposits. B. Assuming that she leaves her emergency fund of $3,100 untouched, how much will her emergency fund be worth? c. What if Jamie Lee had a relative that could give her money now that she could invest? What is the minimum amount she would need now to ensure that she had $9,000 when she wanted to open the cupcake caf? D. As Jamie Lee is planning ahead for operating the cupcake caf, she calculates that she will need $24,000 per year in salary. What is the value of five years of salary when the cupcake caf opens? (Assume that she will take the salary as a one-time payment each year.) Use the table below and Exhibit 1-A. Exhibit 1-B. Exhibit 1-C. and Exhibit 1-D to calculate the balances of the information provided above. Assume that the time period for each scenario is 5 years, and the interest rate is 2%. A. Future Value of a Series of Deposits Current amount $ 1,800.00 times * Future value factor equals Future value amount $ 2.086 20 B. Future Value of a Single Amount Regular deposit amount 3,100.00 times Future value of annuity factor equals Future value amount $ 0.00 C. Present Value of a Single Amount Future amount desired 9,000.00 times Present value factor equals Present value amount $ 0.00 DO A. Future Value of a Series of Deposits times Future value factor equals Current amount ( $ 1,800.00 Future value amount $ 2,086.20 * B. Future Value of a Single Amount Regular deposit amount $ 3,100.00 times Future value of annuity factor equals Future value amount 0.00 C. Present Value of a Single Amount Future amount desired 9,000.00 times Present value factor equals Present value amount $ 0.00 D. Present Value of a Series of Deposits Regular amount to be withdrawn 24,000.00 Present value of annuity factor equals Present value amount $ 0.00 Exhibit 1 -A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods min to Home 10 Over moet 93 die ander toegang I denne - A Job Openings - D. 28+ Best Flexible... Z Score Calculato. C z Critical Value Ca. 75 Best Work Fro. Un Online Entreprene... Exhibit 1-B Future Value (Compounded Sum) of $1 Pald In at the End of Each Perlod for a Given Number of Time Periods (en Annuity) Period 1% 5% 8% 10% 11% 201 202 203 2.04 206 206 207 21 2.00 3.246 2.11 3342 3.091 3.158 406 4.164 4 246 5.101 6204 5.300 5.416 5 526 6 228 6 802 6 152 7 214 7.913 6.308 7.434 5867 7.336 8.923 6.466 7.662 7 596 142 9.487 9.783 3 286 8 583 8.892 9.214 9.549 10.637 11.028 11.436 8394 9 897 11 491 13 181 9.360 9.755 10.15 10 583 11027 12.488 13021 13.579 14. 164 12 006 12578 13 816 14 487 15.193 15 937 10 452 11567 10.95 12. 160 13.412 11.464 12 808 13 486 14 207 16.645 17.56 18.531 10 561 14 972 16.87 12 12 683 14.192 15 025 20.141 21.384 22.713 15 917 17.713 14.68 13 809 15618 16 627 24.523 **********........ 26 212 16 784 17 588 20141 2256 25 120 27.888 18 977 21 495 24.215 27 152 14 947 15.974 17 006 18.292 27.975 22 953 26.010 29 361 19 599 21 579 3 0 095 16.097 18882 21015 23276 25673 28 213 17 293 18 599 20 024 31 772 34.405 18 639 20.167 30.324 33003 35.00 39.10 17.258 18.43 21 625 23 695 21 762 3054 3375 36 974 40 545 44 501 19 615 20.012 21412 22 841 23.414 30.906 33.999 37.45 41.301 45.690 00304 20 811 25. 117 25 645 27 671 29.778 37 379 46018 56939 51.159 24 297 26.87 23.657 25 84 25 132 30 539 33.056 47727 66.439 1208 200348 40 996 51.16 57 275 5420 36.459 84 701 98 347 114 413 22.019 26 243 34.785 48 606 54 463 3376 36 786 54 865 70.008 154 762 290 336 136 308 164.404 41.446 45 762 73 106 113 283 269057 5 73 77 3203 40.668 60 402 84570 109.021 63 249 94461 190 635 406.529 47 575 75 401 112 797 36.065 95026 152667 581.826 337882 442 593 1163 909 1668771 75 Best Work Fro. A Online Entreprene... ULUI.CUITMEuld connect Production/bne/finance/kapoor_6e/kap_6e_1965X_ex01c.jpg About Us - FICM - Job Openings - D. 28+ Best Flexible. z Score Calculato.. C z Critical Value Ca. Exhibit 1 - Present Value of $1 to Be Received at the End of a Given Number of Time Periods Period 5% 0.12 0.952 0826 0.943 0.907 0.864 0.942 0.915 329 0.816 0.961 0.924 0.855 0.323 0.951 0.908 0.132 0784 0713 0.863 0.837 0.813 0.79 0.746 0.006 0.711 0823 0.452 0.789 0.731 0.677 0.54 756 0.703 0.645 0.592 0.744 0.678 0722 0701 0.65 0.625 0.601 0.577 0.326 0.556 6.315 27 0.681 0.642 0.623 0.605 0587 0534 0292 0.252 0.231 0212 0.194 0.19 010 0164 0.475 0.456 0.375 0.82 0.78 0,104 478 116 092 05 0.075 0 057 0044 0.742 05520 412 0672 0307 S0060603726228 0.200 0142 0.032 0022 0.141 0.005 Period 135 175 184 35% 40% 145 15% 02770 87 0741 0.667 16% 0855 0.833 0 8 07007185 012 9512 - 49 Exhibit 1-D Present Value of $1 Received at the End of Each Period for a Given Number of Time Periods (an Annuky) Period 115 0.935 1.650 2.771 2694 6.472 623 7.02 7.706 8.162 10.368 9.787 9253 10 575 11.255 12.134 8.384 7940 7536 7181 11 348 10635 13 094 12.100 11.296 13.065 12.849 11 938 760 14.718 13.578 12.561 11652 11.652 12.166 13.166 1083 11274 11.69 9447 978 10 058 9.122 .313 544 14.292 14.992 8 12 659 9372 17.226 10.336 9804 13.754 14324 14877 17.413 1 96 23.115 25 73 15.678 16.351 19 523 2 2300 2 7356 31424 6514796 2017 22.023 25.806 32.635 10.106 10477 10 28 11.158 1147 12.783 13.705 15 046 15762 13.134 1350 15 622 17292 10790 21482 12.006 12462 14 094 1 5372 17 159 18258 10.594 1654 12.400 13332 13801 0818 1 28 10 675 9823 11258 10274 11005 10757 1223310902 9 .779 9915 8951 9042 Period 3 13% 088 14% 087 15% 00 16% 02 17% 0856 18% 0847 19% 0 84 20% 0833 25% 0 8 305 0.709 9 741 40% 071 0807

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts