Question: Hello, Everything with a RED X is wrong, could you help me? O'Riley Company's payroll costs and fringe benefit expenses include the normal CPP and

Hello,

Hello,

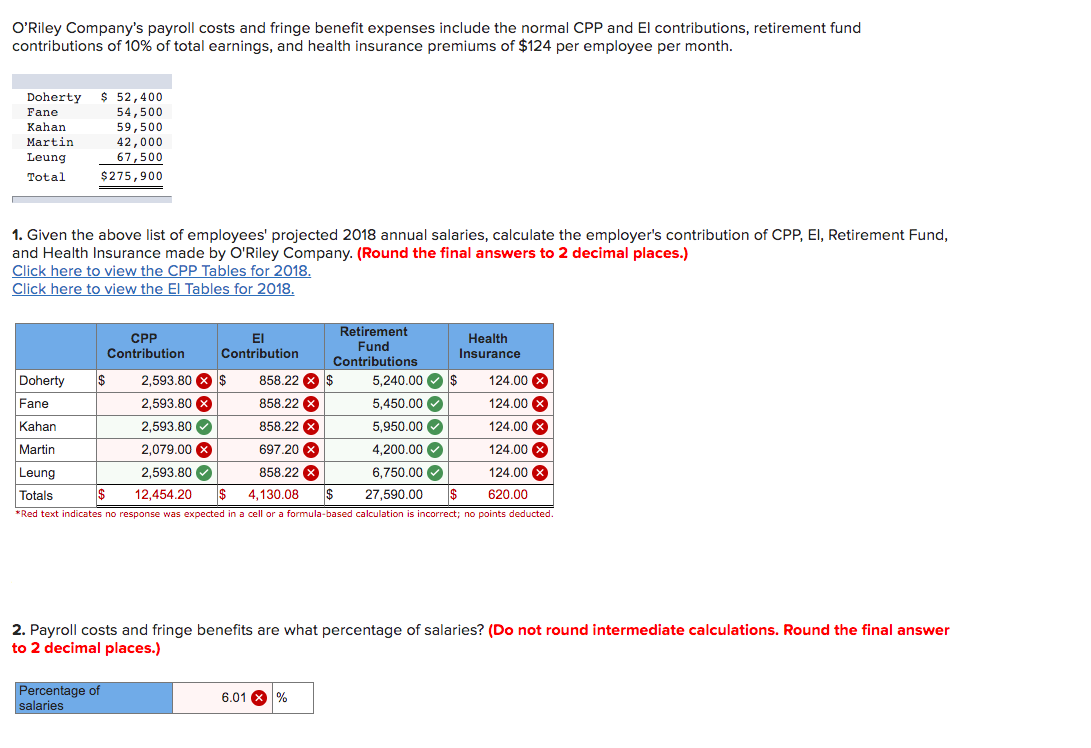

Everything with a RED X is wrong, could you help me?

O'Riley Company's payroll costs and fringe benefit expenses include the normal CPP and El contributions, retirement fund contributions of 10% of total earnings, and health insurance premiums of $124 per employee per month. Doherty Fane Kahan Martin Leung Total 52,400 54,500 59,500 42,000 67,500 $275,900 1. Given the above list of employees' projected 2018 annual salaries, calculate the employer's contribution of CPP, EI, Retirement Fund, and Health Insurance made by O'Riley Company. (Round the final answers to 2 decimal places.) Click here to view the CPP Tables for 2018. Click here to view the El Tables for 2018. Retirement CPP Health Fund Contribution Contribution Insurance Contributions Doherty 2,593.80 X $ 858.22 X $ 5,240.00 $ 124.00 X Fane 2,593.80 X 858.22 X 5,450.00 124.00 X Kahan 2,593.80 858.22 X 5,950.00 124.00 X Martin 2,079.00 697.20 X 4,200.00 124.00 X Leung 2,593.80 858.22 X 6,750.00 124.00 X Totals $ 12,454.20 $ 4,130.08 $ 27,590.00 $ 620.00 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. 2. Payroll costs and fringe benefits are what percentage of salaries? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Percentage of salaries 6.01 X %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts