Question: Hello guys Pls need quick accurate answer and short answer I will upvote your answer thank you note ) pls write answer on paper if

Hello guys Pls need quick accurate answer and short answer I will upvote your answer thank you

note ) pls write answer on paper if possible

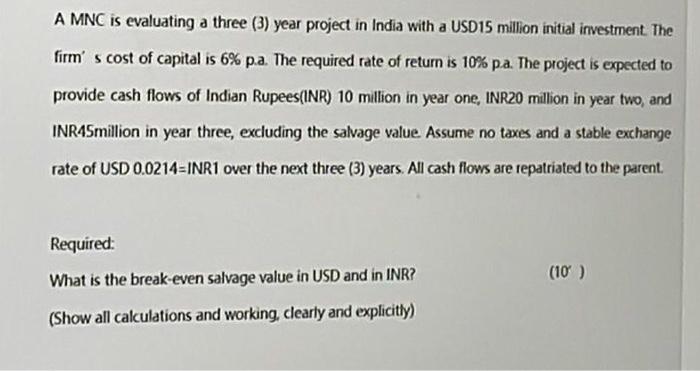

A MNC is evaluating a three (3) year project in India with a USD15 million initial investment. The firm's cost of capital is 6% p.a. The required rate of return is 10% pa. The project is expected to provide cash flows of Indian Rupees(INR) 10 million in year one, INR20 million in year two, and INR45million in year three, excluding the salvage value. Assume no taxes and a stable exchange rate of USD 0.0214=INR1 over the next three (3) years. All cash flows are repatriated to the parent. Required: What is the break-even salvage value in USD and in INR? (10) (Show all calculations and working, clearly and explicitly)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts