Question: Hello, having trouble with these 2 questions. Any help will be appreciated. Use the following facts for Multiple Choice problems 19 through 20: On November

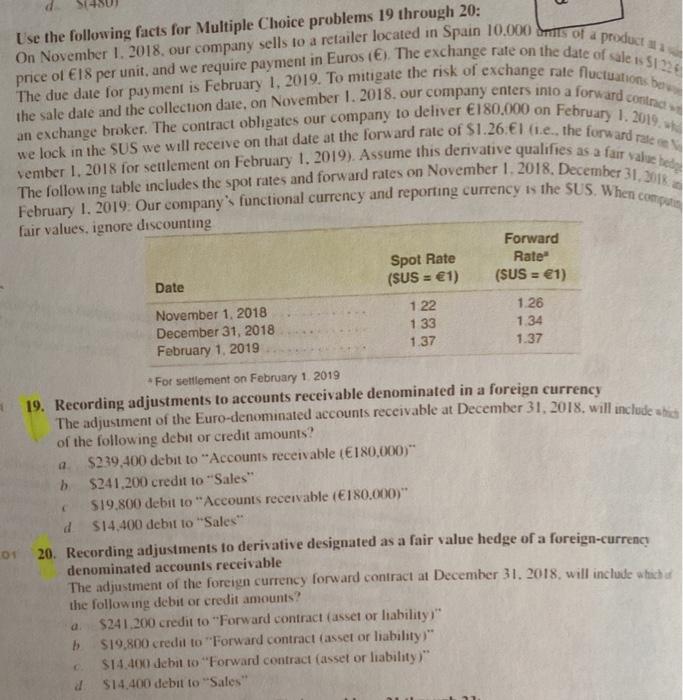

Use the following facts for Multiple Choice problems 19 through 20: On November 1. 2018, our company sells to a retailer located in Spain 10.000 of a products price of E18 per unit, and we require payment in Euros (). The exchange rate on the date of sale is 51226 The due date for payment is February 1, 2019. To mitigate the risk of exchange rale fluctuationsbo the sale dale and the collection date, on November 1. 2018. Our company enters into a forward coning an exchange broker. The contract obligates our company to deliver 180,000 on February 1, 2019 we lock in the SUS we will receive on that date at the forward rate of $1.26.Eli.e., the forward rale vember 1, 2018 for settlement on February 1. 2019). Assume this derivative qualifies as a fair value The following table includes the spot rates and forward rates on November 1. 2018, December 31, 2016 February 1, 2019. Our company's functional currency and reporting currency is the SUS. When com fair values, ignore discounting Forward Rate Date (SUS = 1) (SUS = 1) November 1, 2018 1 22 1.26 December 31, 2018 1 33 1.34 February 1, 2019 1.37 Spot Rate 1.37 For settlement on February 1 2019 19. Recording adjustments to accounts receivable denominated in a foreign currency The adjustment of the Euro-denominated accounts receivable at December 31, 2018. will include abil of the following debitor credit amounts? a $239,400 debit to "Accounts receivable (E180,000)" b S241.200 credit to "Sales" S19.800 debit to "Accounts receivable (180.000)" d S14,400 debit to Sales or 20. Recording adjustments to derivative designated as a fair value hedge of a foreign-currency denominated accounts receivable The adjustment of the foreign currency forward contract at December 31. 2018, will include which the following debit or credit amounts? $241.200 credit to "Forward contract (asset or liability, bS19.800 credit to "Forward contract casset or liability)" $14.400 debit to "Forward contract (asset or liability)" a $14.400 debit to Sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts