Question: Hello, How can I answer the question below correctly? Calculate the current ratio, profit margin, and after tax ROE, of the publicly traded company you

Hello, How can I answer the question below correctly?

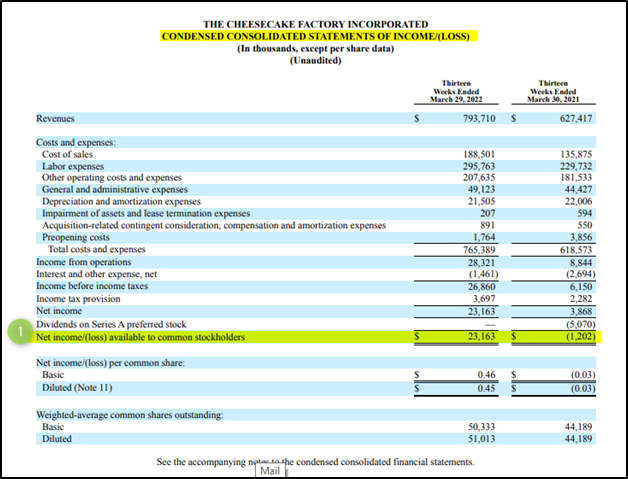

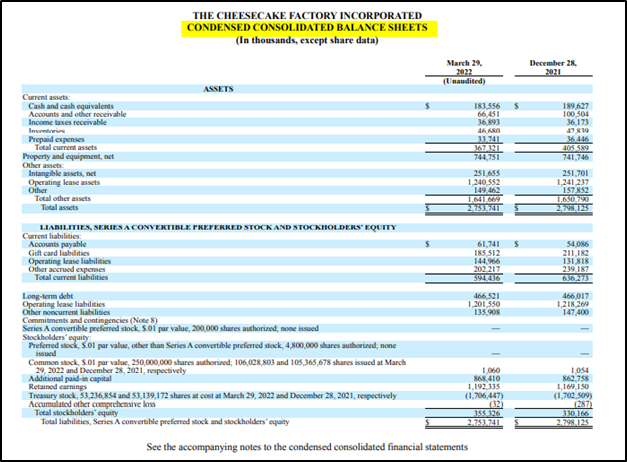

- Calculate the current ratio, profit margin, and after tax ROE, of the publicly traded company you found. Display your calculations.

Thanks, GB

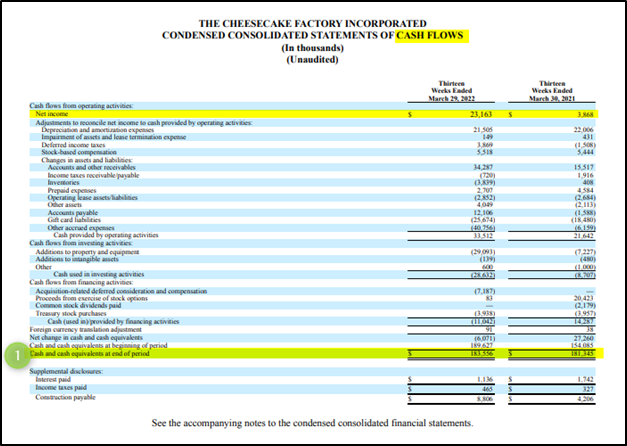

THE CHEESECAKE FACTORY INCORPORATED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) Thirteen Weeks Ed March 29, 2017 23,163 2150 149 1 5.518 Three Weeks Ended March 20.2021 308 (ISO) Cash flows from operating activities Net income Adjustments to reconcile net income to cash provided by operating activities Depreciation and amortisation expenses Impairment of wists and lose termination expose Derod income wes Stock-based competin Changes in wes and liabilities Accounts and other receivables Income taxes receivable payable Investors Prepaid expenses Operating sessibilities Other assets Accounts payable Godt card labels (720) 15.517 1916 408 4584 (2.684) 2.700 (232) 400 12.106 (25694 (158) (619) 21 6 33512 wat (2903) (119 Cashflows from investing active Additions to engineers Additions to property and equipment Other Cashed in investing is Cash flows from financing activities Acquisitioned deferral onder and compensation Proceeds from exercise of stock options (7.227 (40) (10) 8.2011 7.187 20433 2.1 957) (9) THI 80 1897427 27.260 154 135 Net change in cash and cash equivalents Cash and cash equivalents at beginning of period 1 Cash and cash equivalents at end of period Supplemental disclosures Interest paid Income taxes paid Construction payable 1.142 LIM 14 See the accompanying notes to the condensed consolidated financial statements. THE CHEESECAKE FACTORY INCORPORATED CONDENSED CONSOLIDATED STATEMENTS OF INCOME/(LOSS) (In thousands, except per share data) (Unaudited) Thirteen Werks Ended March 29, 2022 Thirteen Weeks Ended March 30, 2021 Revenues 793,710 627,417 Costs and expenses Cost of sales Labor expenses Other operating costs and expenses General and administrative expenses Depreciation and amortization expenses Impairment of assets and lease termination expenses Acquisition-related contingent consideration, compensation and amortization expenses Preopening costs Total costs and expenses Income from operations Interest and other expense, net Income before income taxes Income tax provision Net income Dividends on Series A preferred stock Net income (loss) available to common stockholders Net income/loss) per common share: Diluted (Note II) 188,501 295,763 207,635 49,123 21,505 207 891 1,764 765,389 28,321 (1,461) 26,860 3,697 23,163 135,875 229,732 181,533 44,427 22.006 594 550 3,856 618,573 8,844 (2,694) 6,150 2,282 3,868 (5.070) (1.202) 23,163 Basic 0.46 0.45 (0.03) (0.03) Weighted-average common shares outstanding Basic 50,333 51,013 44,189 44,189 Diluted See the accompanying notac to the condensed consolidated financial statements, Mail THE CHEESECAKE FACTORY INCORPORATED CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except share data) March 29. December 28, 2071 189,627 100 504 36.173 10 16.446 405589 741,746 251,701 1,241 237 157832 1,602 s (Unaudited) ASSETS Current assets Cash and cash equivalents 183.556 Accounts and other receivable 66 451 Income taxes receivable 36.893 & Prepaid expenses 33.741 Total current assets Property and equipment, net 744.751 Other assets Intangible assets, net 251,655 Operating lease assets 1.240.552 Other 149 462 Total other assets 1.641.669 Total assets 27333741 LIABILITIES, SERIES A CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable 61,741 Gift card liabilities 185512 Operating lease liabilities 144966 Other accrued expenses 202.217 Total current liabilities 594836 Long-term debe 466,521 Operating lease liabilities 1,201 550 Other moncurrent liabilities 135.0 Commitments and contingencies (Note 8) Series A convertible preferred stock, 5.01 par value, 200,000 shares authorized, nome issued Stockholders' equity Preferred stock, S.1 par value, other than Series A convertible preferred stock 4.800,000 shares authorized; none Common stock, sol par value 250,000,000 shares authorized 106,028,803 and 105,365,678 shares issued at March 29, 2022 and December 28, 2021, respectively 1.060 Additional paid-in capital 868.410 Retained carnings 1,192 335 Treasury stock, 53.236.854 and 53,139,172 shares at cost at March 29, 2022 and December 28, 2021, respectively (1.706,447) Accumulated other comprehensive loss Total stockholders' equity 355 326 Total liabilities, Series Aconvertible preferred stock and stockholders' oquity 2.753,741 See the accompanying notes to the condensed consolidated financial statements 54,086 211,182 131 818 239.187 466,017 1.218.269 147.400 1054 862,758 1,169,150 (1.702 509) (287) 330,166 2.798 125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts