Question: Hello, I am currently having trouble solving parts C), D), and E) . The following focus on computing ratios, and the problem as well as

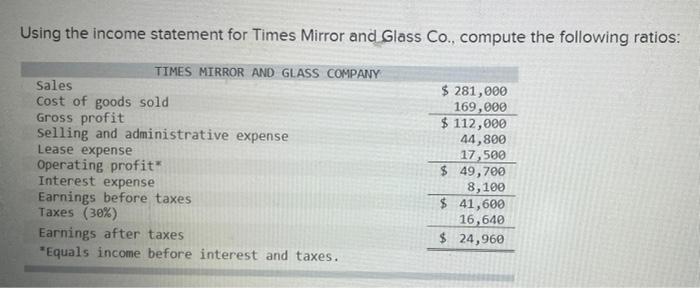

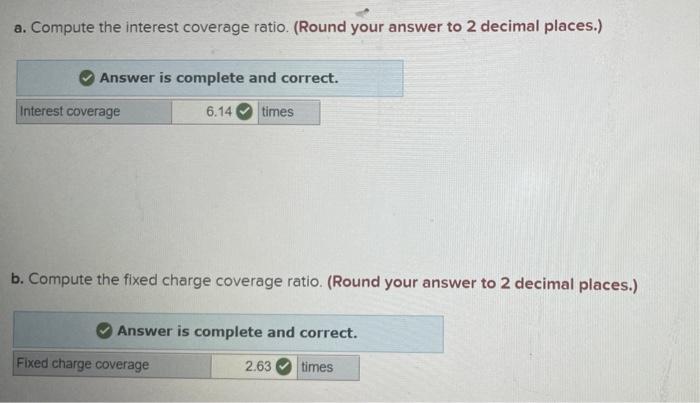

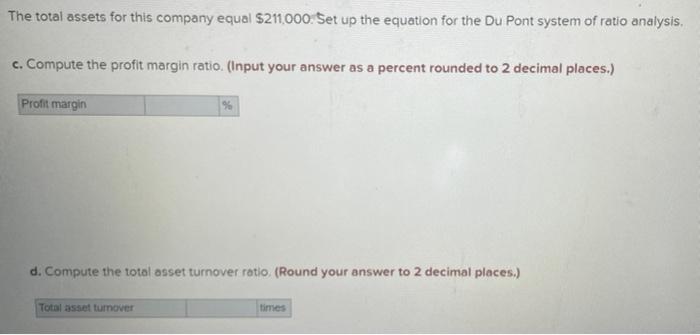

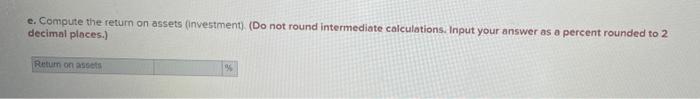

Using the income statement for Times Mirror and Glass Co., compute the following ratios: TIMES MIRROR AND GLASS COMPANY Sales Cost of goods sold Gross profit Selling and administrative expense Lease expense Operating profit* Interest expense Earnings before taxes Taxes (30%) Earnings after taxes "Equals income before interest and taxes. $ 281,000 169,000 $ 112,000 44,800 17,500 $ 49,700 8,100 $ 41,600 16,640 $ 24,960 a. Compute the interest coverage ratio. (Round your answer to 2 decimal places.) Answer is complete and correct. Interest coverage 6.14 times b. Compute the fixed charge coverage ratio. (Round your answer to 2 decimal places.) Answer is complete and correct. Fixed charge coverage 2.63 times The total assets for this company equal $211,000. Set up the equation for the Du Pont system of ratio analysis, c. Compute the profit margin ratio. (Input your answer as a percent rounded to 2 decimal places.) Profit margin d. Compute the total asset turnover ratio (Round your answer to 2 decimal places.) Totale turnover times e. Compute the return on assets (investment) (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return on as 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts