Question: Hello, I am having a difficult time solving the questions in these images (the boxes that are blank I need help with). Thank you. Problem

Hello, I am having a difficult time solving the questions in these images (the boxes that are blank I need help with). Thank you.

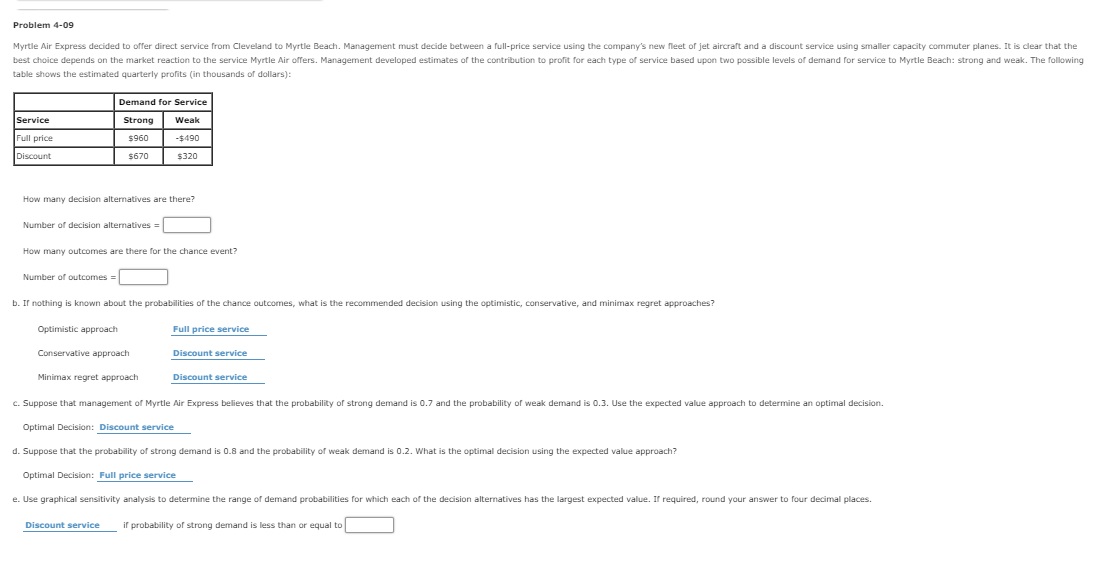

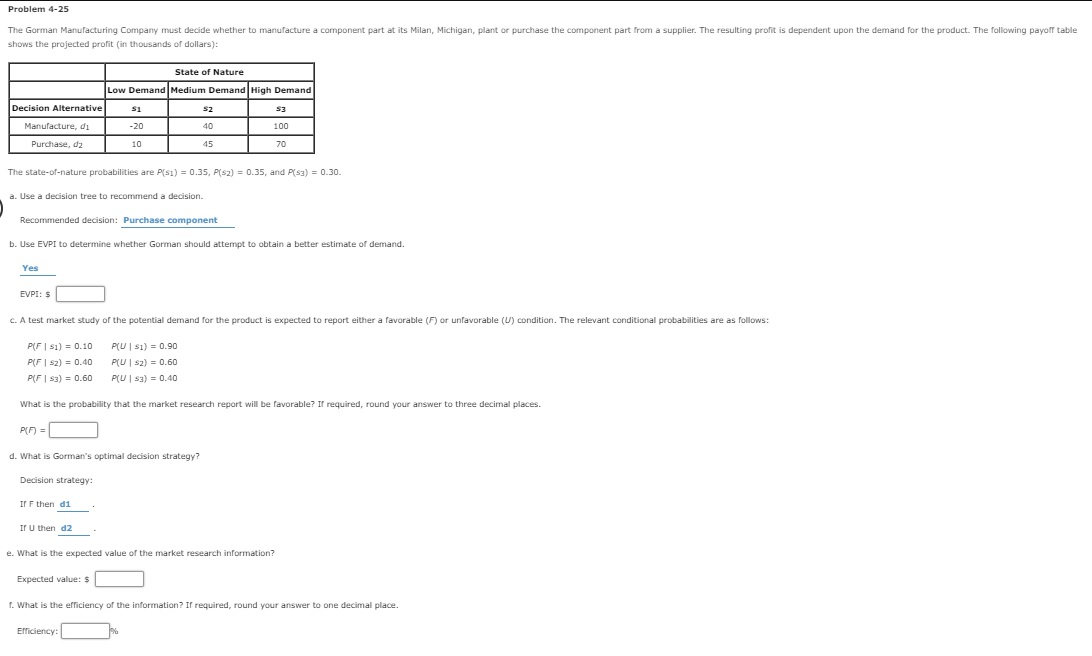

Problem 4-09 Myrtle Air Express decided to offer direct service from Cleveland to Myrtle Beach. Management must decide between a full-price service using the company's new fleet of jet aircraft and a discount service using smaller capacity commuter planes. It is clear that the best choice depends on the market reaction to the service Myrtle Air offers. Management developed estimates of the contribution to profit for each type of service based upon two possible levels of demand for service to Myrtle Beach: strong and weak. The following table shows the estimated quarterly profits (in thousands of dollars): Demand for Service Service Strong Weak Full price $960 $490 Discount $670 $320 How many decision alternatives are there? Number of decision alternatives = How many outcomes are there for the chance event? Number of outcomes = b. If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches? Optimistic approach Full price service Conservative approach Discount service Minimax regret approach Discount service C. Suppose that management of Myrtle Air Express believes that the probability of strong demand is 0.7 and the probability of weak demand is 0.3. Use the expected value approach to determine an optimal decision. Optimal Decision: Discount service . Suppose that the probability of strong demand is 0.8 and the probability of weak demand is 0.2. What is the optimal decision using the expected value approach? Optimal Decision: Full price service e. Use graphical sensitivity analysis to determine the range of demand probabilities for which each of the decision alternatives has the largest expected value. If required, round your answer to four decimal places. Discount service if probability of strong demand is less than or equal toProblem 4-25 The Gorman Manufacturing Company must decide whether to manufacture a component part at its Milan, Michigan, plant or purchase the component part from a supplier. The resulting profit is dependent upon the demand for the product. The following payoff table shows the projected profit (in thousands of dollars): State of Nature Low Demand Medium Demand High Demand Decision Alternative $1 $3 Manufacture, di -20 40 100 Purchase, d2 10 45 70 The state-of-nature probabilities are P(51) = 0.35, P(s2) = 0.35, and P(s3) = 0.30. a. Use a decision tree to recommend a decision. Recommended decision: Purchase component b. Use EVPI to determine whether Gorman should attempt to obtain a better estimate of demand. Yes EVPI: $ C. A test market study of the potential demand for the product is expected to report either a favorable (F) or unfavorable (U) condition. The relevant conditional probabilities are as follows: P(F | $1) = 0.10 P(W | $1) = 0.90 P(F | $2) = 0.40 P(U | $2) = 0.60 P(F | $3) = 0.60 P(U | $3) = 0.40 What is the probability that the market research report will be favorable? If required, round your answer to three decimal places. P(F) = d. What is Gorman's optimal decision strategy? Decision strategy: If F then di If U then d2 e. What is the expected value of the market research information? Expected value: $ 1. What is the efficiency of the information? If required, round your answer to one decimal place. Efficiency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts