Question: Hello, I am having difficulty calculating the yield to the mortgage. The answers for A and B are already understood and correct. Thank you. A

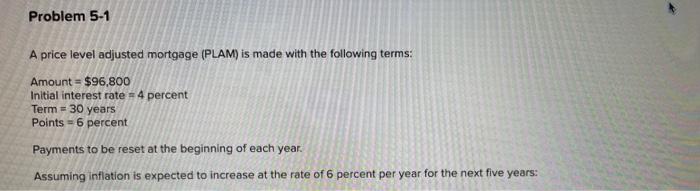

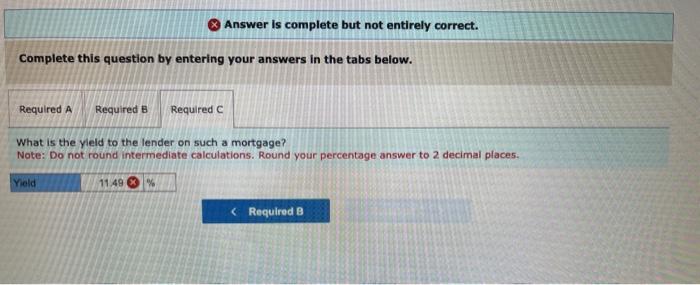

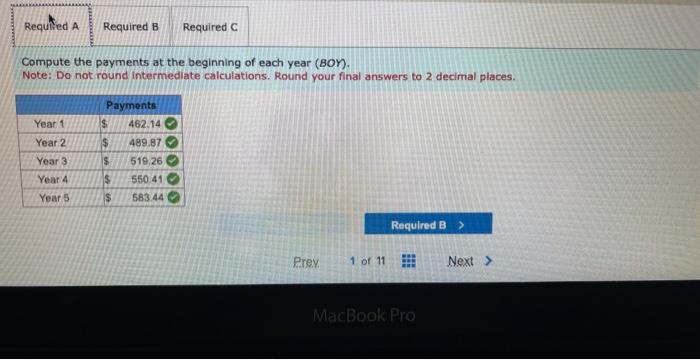

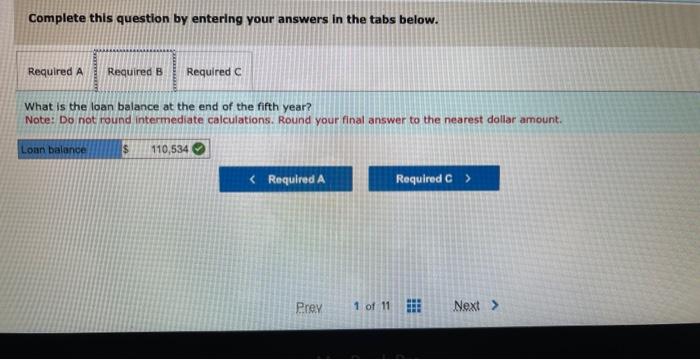

A price level adjusted mortgage (PLAM) is made with the following terms: Amount =$96,800 Initial interest rate =4 percent Term =30 years Points =6 percent Payments to be reset at the beginning of each year. Assuming inflation is expected to increase at the rate of 6 percent per year for the next five years: Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the yield to the lender on such a mortgage? Note: Do not round intermediate calculations. Round your percentage answer to 2 decimal places. Compute the payments at the beginning of each year (BON). Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Complete this question by entering your answers in the tabs below. What is the loan balance at the end of the fifth year? Note: Do not round intermediate calculations. Round your final answer to the nearest dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts