Question: Hello, I am having difficulty finding the begining price range for required B. I would appreciate it if you can show me how to get

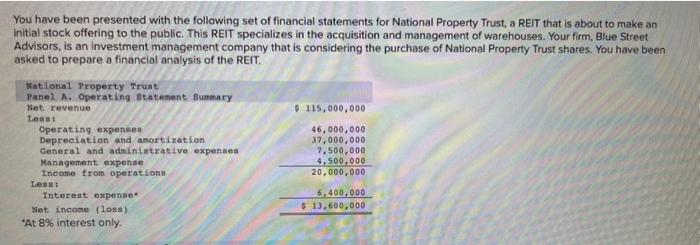

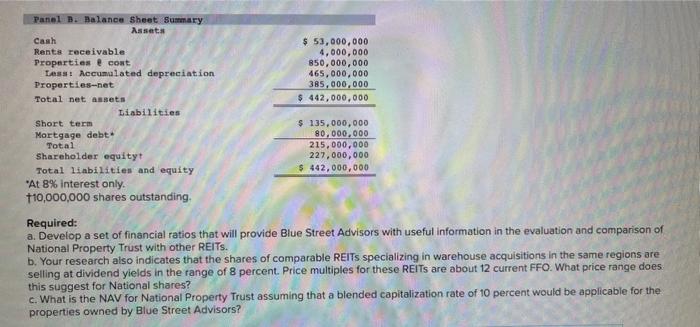

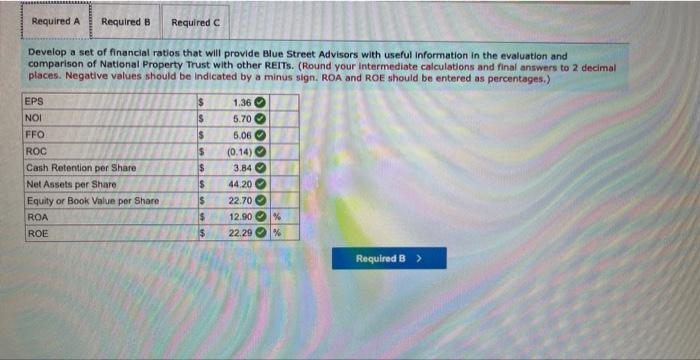

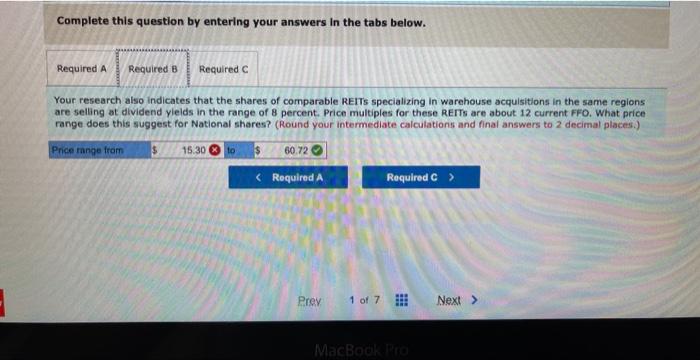

You have been presented with the following set of financial statements for National Property Trust, a REIT that is about to make an initial stock offering to the public. This REIT specializes in the acquisition and management of warehouses. Your firm, Blue Street Advisors, is an investment management company that is considering the purchase of National Property Trust shares. You have been asked to prepare a financial analysis of the REIT. Required: a. Develop a set of financial ratios that will provide Blue Street Advisors with useful information in the evaluation and comparison of National Property Trust with other REITs. b. Your research also indicates that the shares of comparable REITs specializing in warehouse acquisitions in the same regions are selling at dividend yields in the range of 8 percent. Price multiples for these REITs are about 12 current FFO. What price range does this suggest for National shares? c. What is the NAV for National Property Trust assuming that a blended capitalization rate of 10 percent would be applicable for the properties owned by Blue Street Advisors? Develop a set of financial ratios that will provide Blue Street Advisors with useful information in the evaluation and comparison of National Property Trust with other REITs. (Round your intermediate calculations and final answers to 2 decimal places. Negative values should be indicated by a minus sign. ROA and ROE should be entered as percentages.) Complete this question by entering your answers In the tabs below. Your research also indicates that the shares of comparable REITs specializing in warehouse acquisitions in the same regions are selling at dividend yleids in the range of 8 percent. Price multiples for these REITs are about 12 current FFO. What price range does this suggest for National shares? (Round your intermediate calculations and final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts