Question: Hello, I am having issues with Part B and C, Please advise. Consider two local banks. Bank A has 100 loans outstanding, each for $1.0

Hello, I am having issues with Part B and C, Please advise.

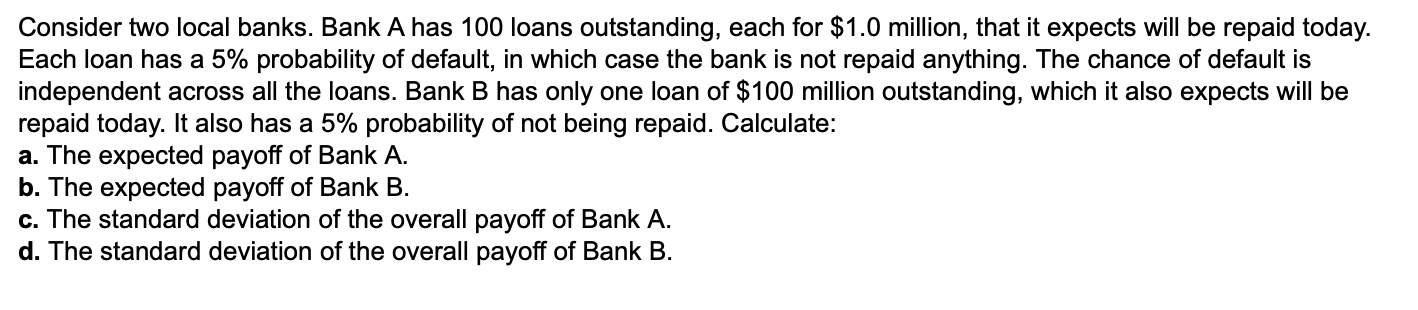

Consider two local banks. Bank A has 100 loans outstanding, each for $1.0 million, that it expects will be repaid today. Each loan has a 5% probability of default, in which case the bank is not repaid anything. The chance of default is independent across all the loans. Bank B has only one loan of $100 million outstanding, which it also expects will be repaid today. It also has a 5% probability of not being repaid. Calculate: a. The expected payoff of Bank A. b. The expected payoff of Bank B. c. The standard deviation of the overall payoff of Bank A. d. The standard deviation of the overall payoff of Bank B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts