Question: Hello, I am having trouble computing the amounts for the journal entries that are red. I am using a financial calculator, so I would prefer

Hello, I am having trouble computing the amounts for the journal entries that are red. I am using a financial calculator, so I would prefer step by step instructions on how to get the correct answer using a calculator. Thank you!

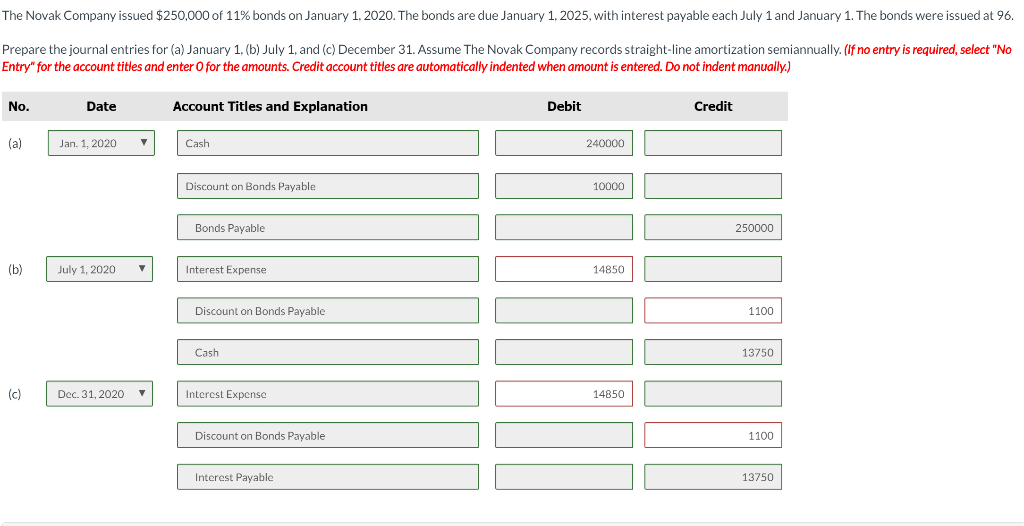

The Novak Company issued $250,000 of 11% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest payable each July 1 and January 1. The bonds were issued at 96. Prepare the journal entries for (a) January 1. (b) July 1, and (c) December 31. Assume The Novak Company records straight-line amortization semiannually. (if no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) Jan 1, 2020 Cash 240000 Discount on Bonds Payable 10000 Bonds Payable 250000 (b) July 1, 2020 | Interest Expense 14850 Discount on Bonds Payable 1100 Cash 13750 (c) Dec 31, 2020 Interest Expense 14850 Discount on Bonds Payable 1100 Interest Payable 13750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts