Question: Hello, I am having trouble figuring out the excel sheet for this question and need help with the formulas Questions 4-6 Binomial option pricing and

Hello, I am having trouble figuring out the excel sheet for this question and need help with the formulas

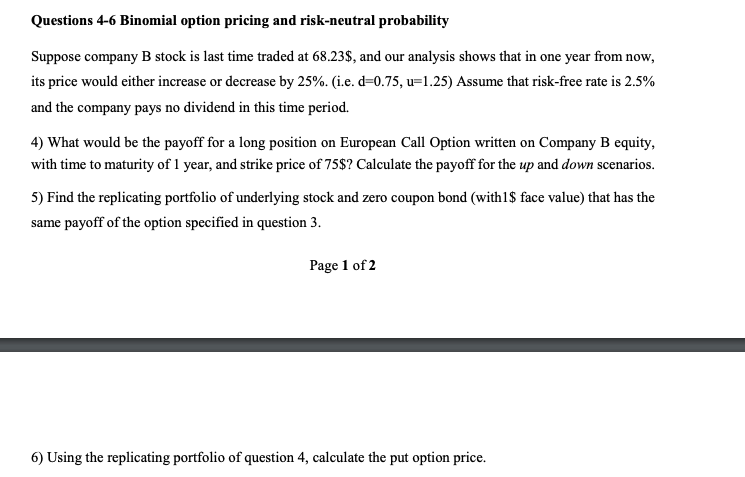

Questions 4-6 Binomial option pricing and risk-neutral probability Suppose company B stock is last time traded at 68.23$, and our analysis shows that in one year from now, its price would either increase or decrease by 25%. (i.e. d=0.75, u=1.25) Assume that risk-free rate is 2.5% and the company pays no dividend in this time period. 4) What would be the payoff for a long position on European Call Option written on Company B equity, with time to maturity of 1 year, and strike price of 75$? Calculate the payoff for the up and down scenarios. 5) Find the replicating portfolio of underlying stock and zero coupon bond (with 1$ face value) that has the same payoff of the option specified in question 3. Page 1 of 2 6) Using the replicating portfolio of question 4, calculate the put option price. Questions 4-6 Binomial option pricing and risk-neutral probability Suppose company B stock is last time traded at 68.23$, and our analysis shows that in one year from now, its price would either increase or decrease by 25%. (i.e. d=0.75, u=1.25) Assume that risk-free rate is 2.5% and the company pays no dividend in this time period. 4) What would be the payoff for a long position on European Call Option written on Company B equity, with time to maturity of 1 year, and strike price of 75$? Calculate the payoff for the up and down scenarios. 5) Find the replicating portfolio of underlying stock and zero coupon bond (with 1$ face value) that has the same payoff of the option specified in question 3. Page 1 of 2 6) Using the replicating portfolio of question 4, calculate the put option price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts