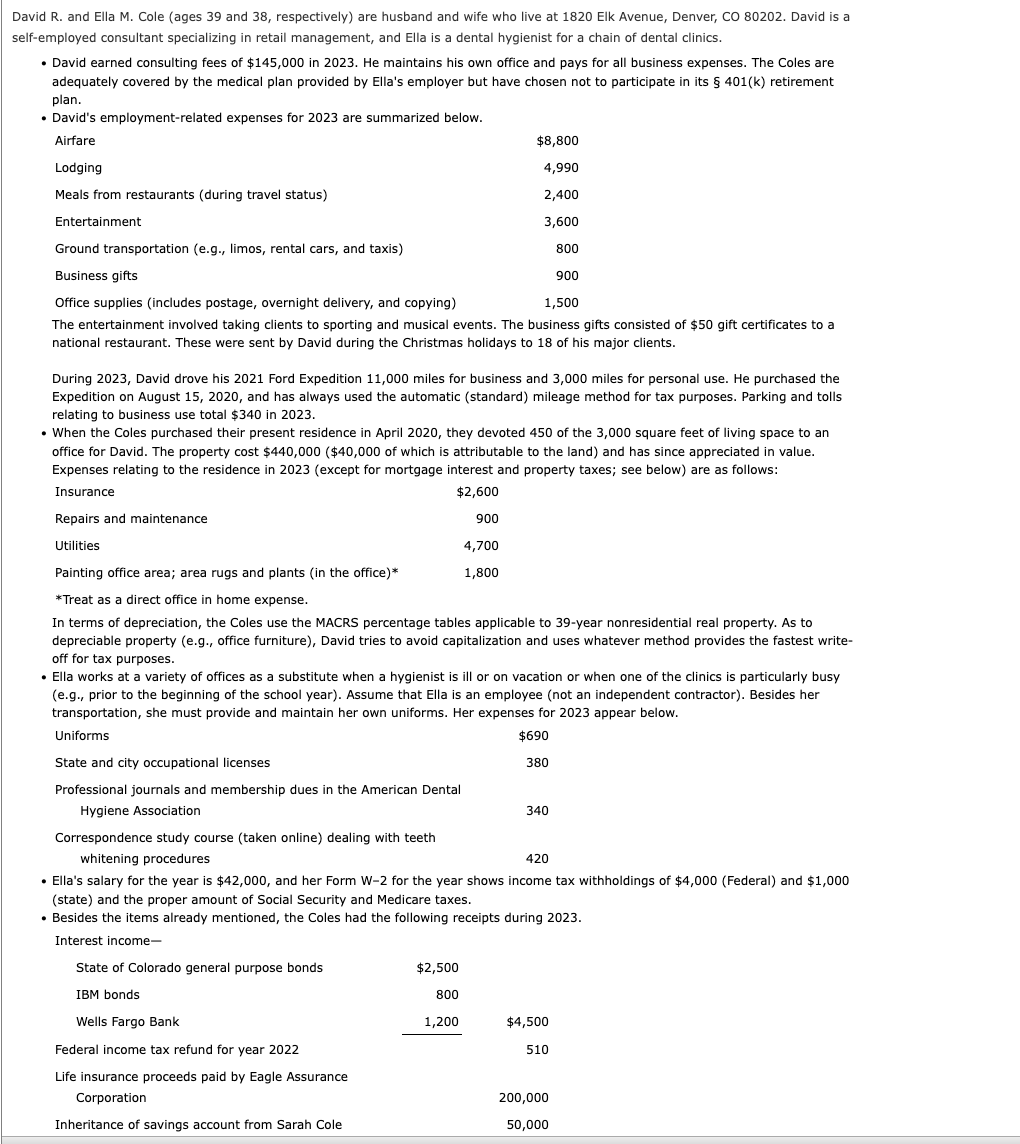

Question: Hello I am having trouble with this assignment and need help. I uploaded the numbers given and i have to fill out form 1 0

Hello I am having trouble with this assignment and need help. I uploaded the numbers given and i have to fill out form schedule schedule schedule b schedule c scheduel se and form Sales proceeds from two ATVs

For several years, the Coles' household has included David's divorced mother, Sarah, who has been claimed as their dependent. In

late December Sarah unexpectedly died of heart attack in her sleep. Unknown to Ella and David, Sarah had a life insurance

policy and a savings account with David as the designated beneficiary of each In the Coles purchased two ATVs for $

After several near mishaps, they decided that the sport was too dangerous. In they sold the ATVs to their neighbor.

Additional expenditures for include:

Funeral expenses for Sarah

In the Coles made quarterly estimated tax payments of $Federal and $state for a total of $Federal and

$state

Relevant Social Security numbers are:

David Cole

Ella Cole

During the year, the Coles purchased $ of bitcoin. They do not want to contribute to the Presidential Election Campaign Fund.

Also, the Coles want any overpayment of tax refunded to them and not applied toward next year's tax liability. David will have a self

employment tax liability.

Required:

Using the appropriate forms and schedules, compute the Coles' Federal income tax for Disregard the alternative minimum tax AMT

and the various education credits.

Make realistic assumptions about any missing data.

Enter all amounts as positive numbers.

If an amount box does not require an entry or the answer is zero, enter

If required, round all dollar amounts to the nearest dollar.

It may be necessary to complete the tax schedules before completing Form

Use the included tax rate schedules to compute the tax. When computing the tax liability on Line of Form do

not round your intermediate calculations. If required, round your final answers to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock