Question: Hello, I am posting an assignment that is due and is a major part of my grade. I have attempted and completed to my best

Hello, I am posting an assignment that is due and is a major part of my grade. I have attempted and completed to my best ability but need help to make sure that my answers can compare. If you are willing please help as I really need to get the best possible grade I can. Thank you all!

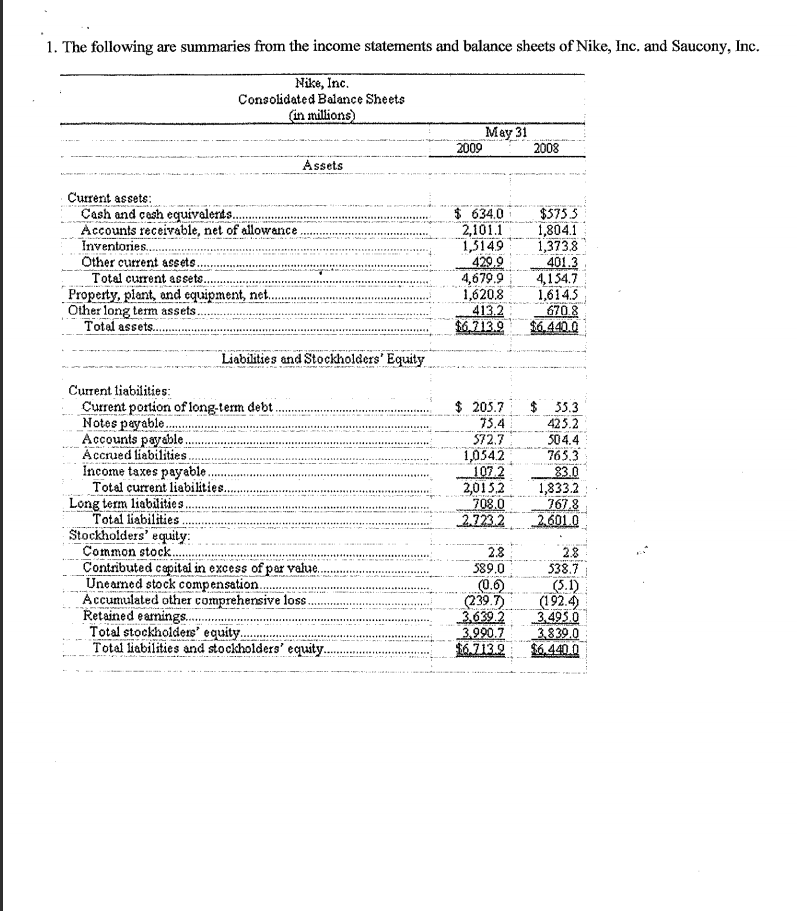

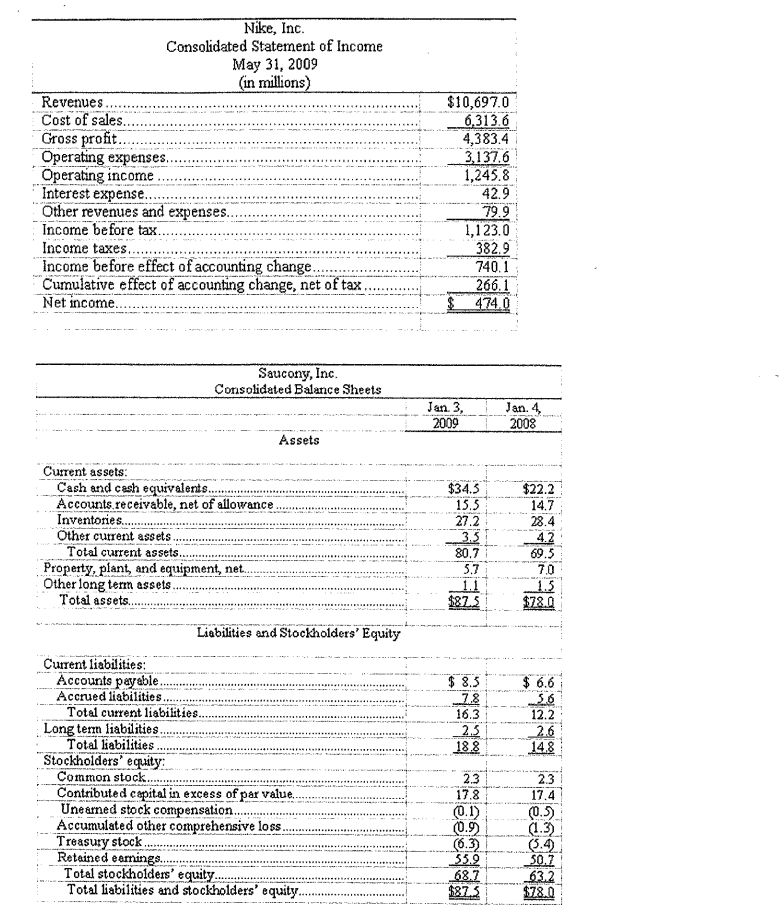

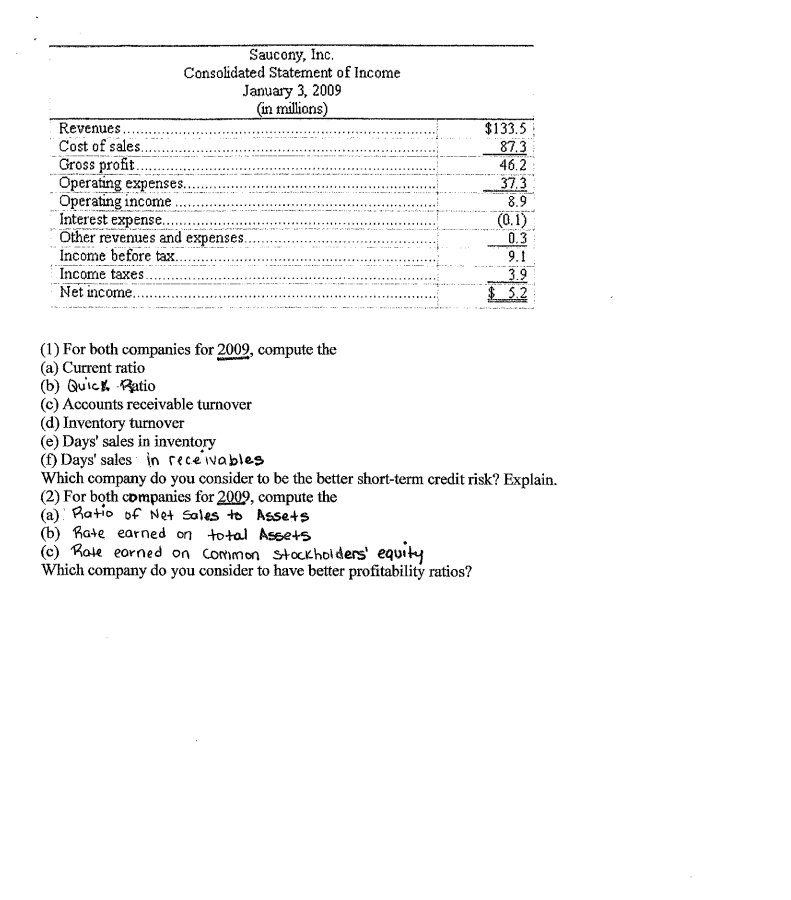

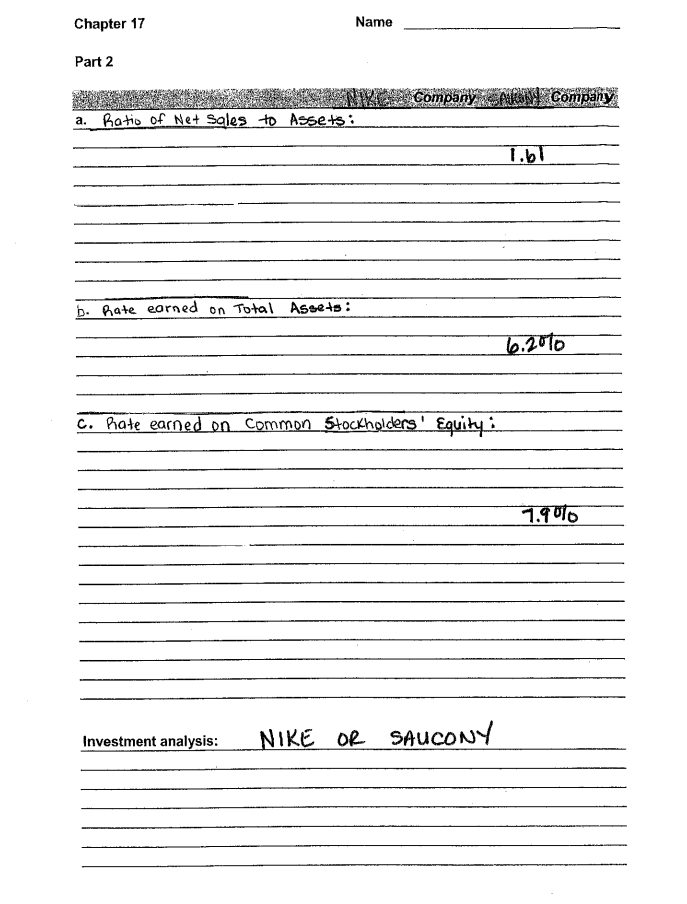

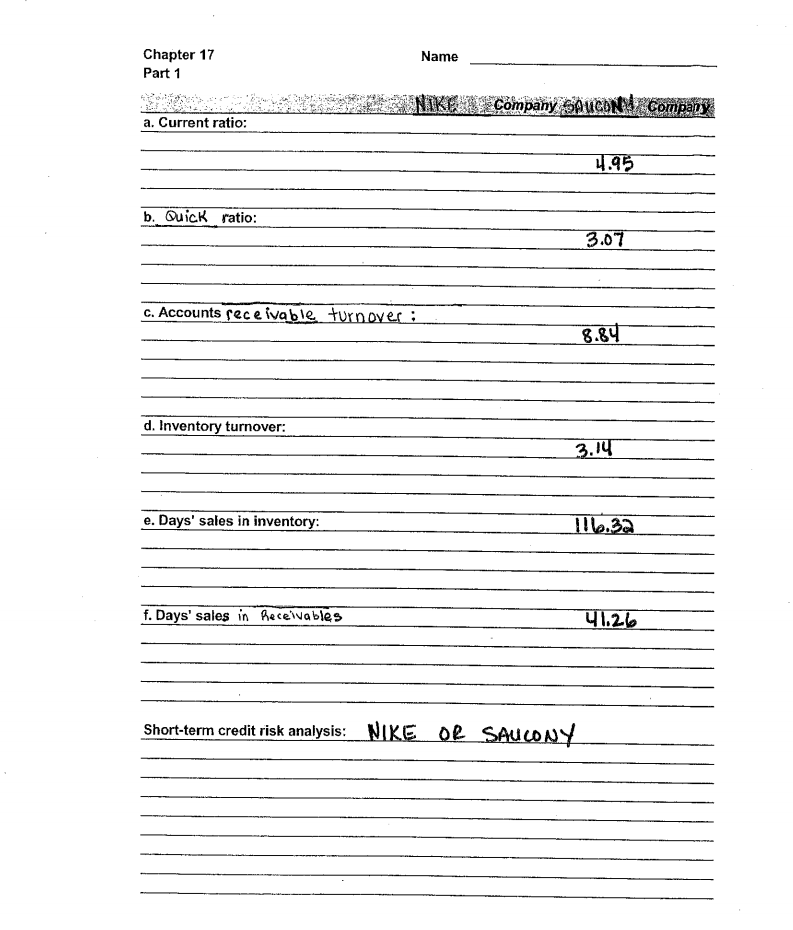

1. The following are summaries from the income statements and balance sheets of Nike, Inc. and Saucony, Inc. Nike, Inc. Consolidated Balance Sheets (in millions) May 31 2009 2008 Assets Current assets: Cash and cash equivalents... Accounts receivable, net of allowance Inventories Other current assets. Total current assets. Property, plant, and equipment, net. Other long term assets Total assets.. Liabilities and Stockholders' Equity $ 634.0 2,101.1 1,5149 429.9 4,679.9 1,620.8 413.2 $6.213.9 $5753 1,8041 1,3738 401.3 4,154.7 1,614.5 670.8 96.440.0 Current liabilities: Current portion of long-term debt Notes payable Accounts payable. Accrued liabilities Income taxes payable Total current liabilities. Long term liabilities. Total liabilities Stockholders' equity: Common stock. Contributed capital in excess of par value. Uneamed stock compensation Accumulated other comprehensive loss Retained earnings. Total stockholders' equity. Total liabilities and stockholders' equity. $ 205.7 75.4 572.7 1,054.2 1072 2,015,2 708.0 2.723.2 33.3 425.2 504.4 765.3 83.0 1,833.2 767.8 2.601.0 2.8 389.0 0.6) (239.7) 3.6392 3.990.7 $6.712.9 . 2.8 538.7 (5.1) (192.42 3.4950 3.839.0 $6.440.0 Nike, Inc. Consolidated Statement of Income May 31, 2009 (in millions) Revenues. Cost of sales. Cross profit. Operating expenses. Operating income Interest expense. Other revenues and expenses. Income before tax.... Income taxes Income before effect of accounting change. Cumulative effect of accounting change, net of tax Net income. $10,697.0 6.313.6 4,383.4 3.137.6 1,245.8 42.9 79.9 1,123.0 382.9 740.1 266.1 $ 474.0 Saucony, Inc. Consolidated Balance Sheets Jan. 3, 2009 Jan. 4, 2008 Assets $34.5 15.5 27.2 3.5 Current assets: Cash and cash equivalents. Accounts receivable, net of allowance. Inventories... Other current assets Total current assets. Property, plant, and equipment, net.. Other long term assets. Total assets. Liabilities and Stockholders' Equity $22.2 14.7 28.4 4.2 69.5 7,0 80.7 5.7 $87.5 $78.0 $ 8.3 7.8 16.3 2.3 18.8 $ 6.6 56 12.2 2.6 14.8 Current liabilities: Accounts payable. Accrued liabilities. Total current liabilities. Long term liabilities. Total liabilities Stockholders' equity: Common stock. Contributed capital in excess of par value. Uneared stock compensation... Accumulated other comprehensive loss. Treasury stock Retained earnings.. Total stockholders' equity. Total liabilities and stockholders' equity. 2.3 17.8 (0.1) (0.9) 6.32 55.9 68.7 $87.5 2.3 17.4 (0.5) (1.3) 50.7 63.2 $78.0 Saucony, Inc. Consolidated Statement of Income January 3, 2009 (in Millions) Revenues. Cost of sales Cross profit. Operating expenses. Operating income Interest expense.. Other revenues and expenses. Income before tax Income taxes Net income. $133.5 87.3 46.2 37.3 8.9 (0.1) 0.3 9.1 3.9 $ 52 (1) For both companies for 2009, compute the (a) Current ratio (b) Quick Ratio (c) Accounts receivable turnover (d) Inventory turnover (e) Days' sales in inventory (1) Days' sales in receivables Which company do you consider to be the better short-term credit risk? Explain. (2) For both companies for 2009, compute the (a) Ratio of Net soles to Assets (b) Rate earned on total Assets (c) Rate earned on common Stockholders' equity Which company do you consider to have better profitability ratios? Chapter 17 Name Part 2 Company Company a. Ratio of Net Sales to Assets: 1.by b. Rate earned on Total Assets : 6.2010 C. hate earned on Common Stockholders' Equity : 1.9010 Investment analysis: NIKE OR SAUCONY Chapter 17 Part 1 Name NIKON Company SAUCONAX Company a. Current ratio: 4.95 b. Quick ratio: 3.07 C. Accounts receivable turnover : 8.84 d. Inventory turnover: 3.14 e. Days' sales in inventory: f. Days' sales in Receivables 41.26 Short-term credit risk analysis: NIKE OR Saucony

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts