Question: Hello I am stuck on problems 40 and 41, the equations tie into each other and I get lost somewhere. I am hoping a tutor

Hello I am stuck on problems 40 and 41, the equations tie into each other and I get lost somewhere. I am hoping a tutor can show me the steps so I can understand these. Thank you

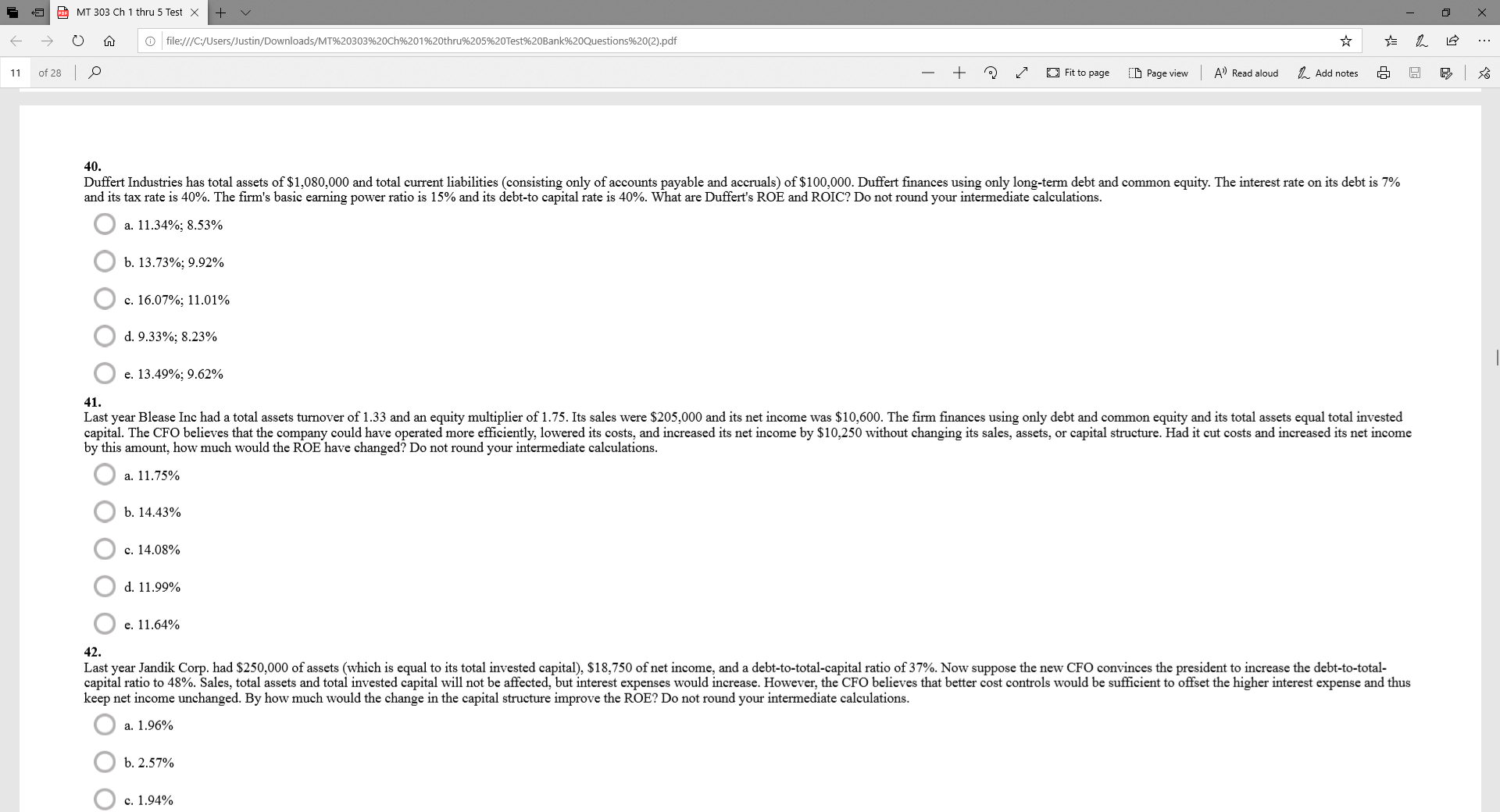

MT 303 Ch 1 thru 5 Test X + v X O file:///C:/Users/Justin/Downloads/MT%20303%20Ch6201%20thru6205%20Test%20Bank%20Questions%20(2).pdf . .. 11 of 28 0 + 2 Fit to page [ Page view A') Read aloud Add notes 40. Duffert Industries has total assets of $1,080,000 and total current liabilities (consisting only of accounts payable and accruals) of $100,000. Duffert finances using only long-term debt and common equity. The interest rate on its debt is 7% and its tax rate is 40%. The firm's basic earning power ratio is 15% and its debt-to capital rate is 40%. What are Duffert's ROE and ROIC? Do not round your intermediate calculations. a. 11.34%; 8.53% O b. 13.73%; 9.92% O c. 16.07%; 11.01% O d. 9.33%; 8.23% e. 13.49%; 9.62% 41. Last year Blease Inc had a total assets turnover of 1.33 and an equity multiplier of 1.75. Its sales were $205,000 and its net income was $10,600. The firm finances using only debt and common equity and its total assets equal total invested capital. The CFO believes that the company could have operated more efficiently, lowered its costs, and increased its net income by $10,250 without changing its sales, assets, or capital structure. Had it cut costs and increased its net income by this amount, how much would the ROE have changed? Do not round your intermediate calculations. a. 11.75% b. 14.43% O c. 14.08% O d. 11.99% O e. 11.64% 42. Last year Jandik Corp. had $250,000 of assets (which is equal to its total invested capital), $18,750 of net income, and a debt-to-total-capital ratio of 37%. Now suppose the new CFO convinces the president to increase the debt-to-total- capital ratio to 48%. Sales, total assets and total invested capital will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged. By how much would the change in the capital structure improve the ROE? Do not round your intermediate calculations. a. 1.96% b. 2.57% c. 1.94%