Question: Hello, I am stuck on this question and i really need some help. Id greatly appreciate it. Thank you. :) Part 1 of Question 1

![2 of Question 1 [Picture 1] Part 2 of Question 1 [Picture](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6719d5c3cabc5_3716719d5c3604f1.jpg)

![2] Part 3 of Question 1 [Picture 1] Part 3 of Question](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6719d5c476b98_3726719d5c415681.jpg)

![1 [Picture 2] Required information Problem 8-6A (Algo) Disposal of plant assets](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6719d5c50a94e_3726719d5c4a36b0.jpg)

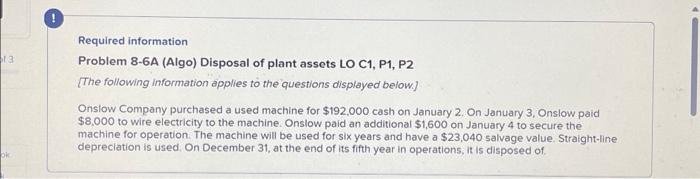

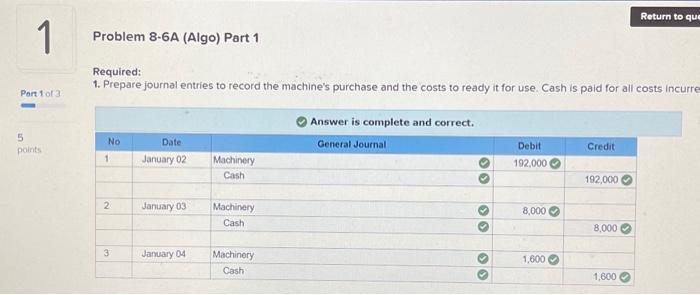

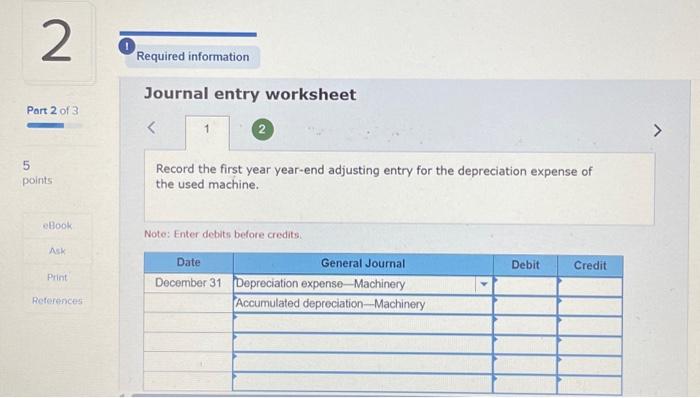

Required information Problem 8-6A (Algo) Disposal of plant assets LO C1, P1, P2 The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $192,000 cash on January 2 . On January 3, Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for $1x years and have a $23,040 salvage value. Straight-line depreciation is used, On December 31, at the end of its fifth year in operations, it is disposed of. Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurr Journal entry worksheet Record the first year year-end adjusting entry for the depreciation expense of the used machine. Note: Enter debits before credits: Journal entry worksheet Record the year of disposal year-end adjusting entry for the depreciation expense of the used machine. Note: Enter debits before credits: Journal entry worksheet Record the sale of the used machine for $21,000 cash. Note: Enter debits before credits. Journal entry worksheet Record the sale of the used machine for $84,000 cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts