Question: Hello I am trying to do this I am having problem can please check and explain thank you Blank Form 57 (Bank Reconciliation Worksheet) Pen

Hello I am trying to do this I am having problem can please check and explain thank you

Hello I am trying to do this I am having problem can please check and explain thank you

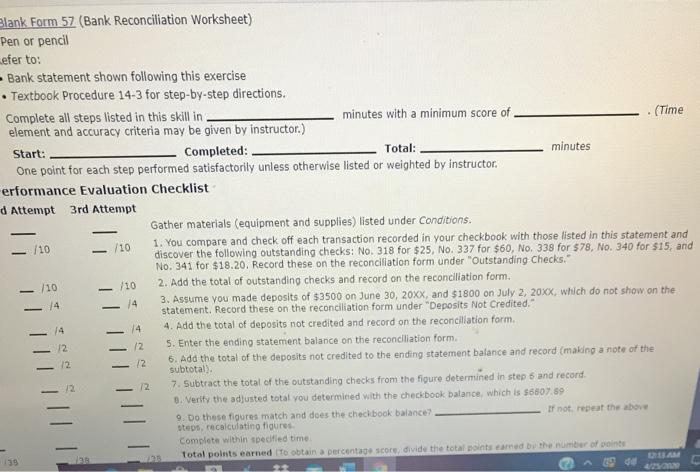

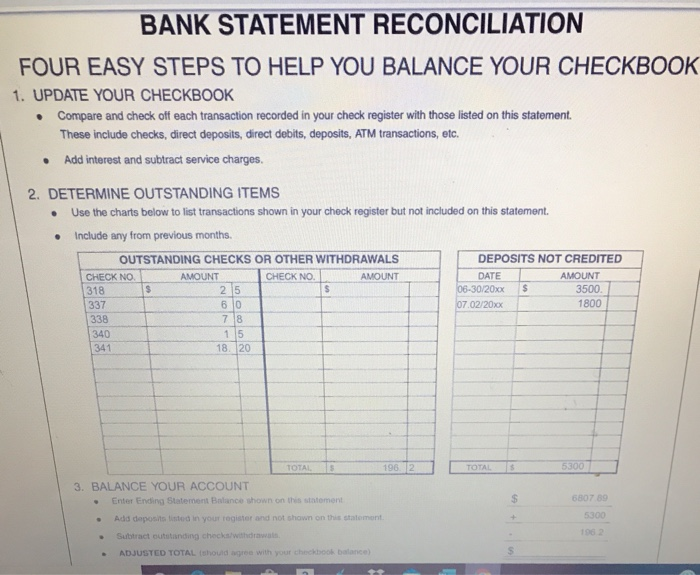

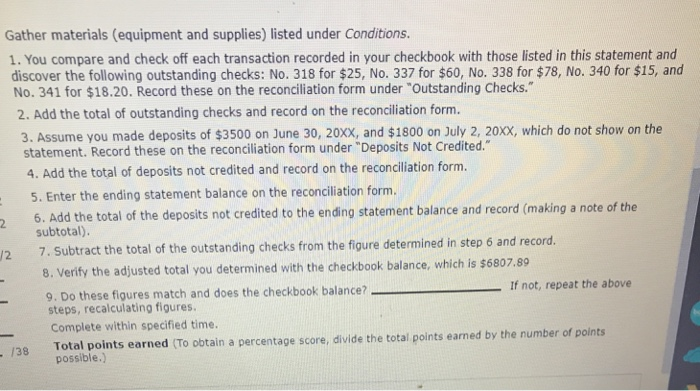

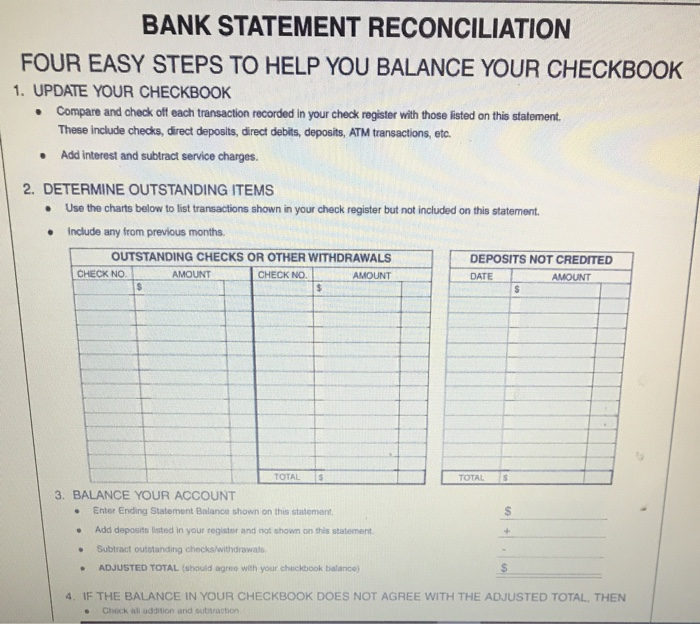

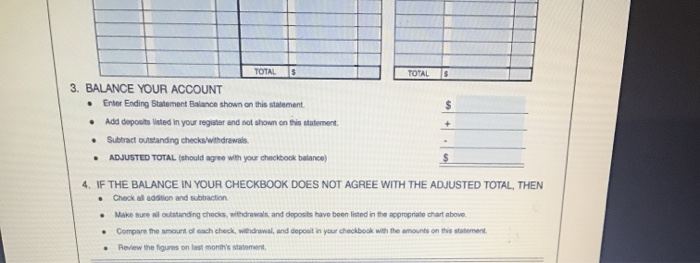

Blank Form 57 (Bank Reconciliation Worksheet) Pen or pencil efer to: - Bank statement shown following this exercise Textbook Procedure 14-3 for step-by-step directions. Complete all steps listed in this skill in - minutes with a minimum score of (Time element and accuracy criteria may be given by instructor.) Start: - - Completed: Total: minutes One point for each step performed satisfactorily unless otherwise listed or weighted by instructor. erformance Evaluation Checklist d Attempt 3rd Attempt Gather materials (equipment and supplies) listed under Conditions. 110 - 1. You compare and check off each transaction recorded in your checkbook with those listed in this statement and /10 discover the following outstanding checks: No. 318 for $25, No. 337 for $60, No. 338 for $78, No. 340 for $15, and No. 341 for $18.20. Record these on the reconciliation form under "Outstanding Checks." 2. Add the total of outstanding checks and record on the reconciliation form. 3. Assume you made deposits of $3500 on June 30, 20xx, and $1800 on July 2, 20xx, which do not show on the statement. Record these on the reconciliation form under "Deposits Not Credited. 4. Add the total of deposits not credited and record on the reconciliation form. 5. Enter the ending statement balance on the reconciliation form. 6. Add the total of the deposits not credited to the ending statement balance and record (making a note of the subtotal) 7. Subtract the total of the outstanding checks from the figure determined in step 6 and record. 8. Verify the adjusted total you determined with the checkbook balance, which is $6807.89 9. Do these figures match and does the checkbook balance? - If not repeat the above steps, recalculating figures. Complete within specified time. Total points earned to obtain a percentage score, divide the total points earned by the number of points 2 AM - 12 BANK STATEMENT RECONCILIATION FOUR EASY STEPS TO HELP YOU BALANCE YOUR CHECKBOOK 1. UPDATE YOUR CHECKBOOK Compare and check off each transaction recorded in your check register with those listed on this statement. These include checks, direct deposits, direct debits, deposits, ATM transactions, etc. Add interest and subtract service charges 2. DETERMINE OUTSTANDING ITEMS Use the charts below to list transactions shown in your check register but not included on this statement Include any from previous months. OUTSTANDING CHECKS OR OTHER WITHDRAWALS DEPOSITS NOT CREDITED CHECK NO AMOUNT CHECK NO. AMOUNT DATE AMOUNT 318 25 06-30/20xx $ 3500. 337 60 07.02/20xx 1800 338 78 340 15 341 18.20 TOTAL 680739 SO 3. BALANCE YOUR ACCOUNT Enter Ending Statement Balance shown on this statement Add deposi ted in your register and not shown on this statement Subtract outstanding checks withdrawal . ADJUSTED TOTAL should with your checksook balance) 1982 Gather materials (equipment and supplies) listed under Conditions. 1. You compare and check off each transaction recorded in your checkbook with those listed in this statement and discover the following outstanding checks: No. 318 for $25, No. 337 for $60, No. 338 for $78, No. 340 for $15, and No. 341 for $18.20. Record these on the reconciliation form under "Outstanding Checks." 2. Add the total of outstanding checks and record on the reconciliation form. 3. Assume you made deposits of $3500 on June 30, 20XX, and $1800 on July 2, 20xx, which do not show on the statement. Record these on the reconciliation form under "Deposits Not Credited." 4. Add the total of deposits not credited and record on the reconciliation form. 5. Enter the ending statement balance on the reconciliation form. 6. Add the total of the deposits not credited to the ending statement balance and record (making a note of the subtotal). 7. Subtract the total of the outstanding checks from the figure determined in step 6 and record. 8. Verify the adjusted total you determined with the checkbook balance, which is $6807.89 9. Do these figures match and does the checkbook balance? If not, repeat the above steps, recalculating figures. Complete within specified time. 138 Total points earned (To obtain a percentage score, divide the total points earned by the number of points possible.) BANK STATEMENT RECONCILIATION FOUR EASY STEPS TO HELP YOU BALANCE YOUR CHECKBOOK 1. UPDATE YOUR CHECKBOOK Compare and check off each transaction recorded in your check register with those listed on this statement These include checks, direct deposits, direct debits, deposits, ATM transactions, etc. Add interest and subtract service charges. 2. DETERMINE OUTSTANDING ITEMS . Use the charts below to list transactions shown in your check register but not included on this statement Include any from previous months OUTSTANDING CHECKS OR OTHER WITHDRAWALS DEPOSITS NOT CREDITED CHECK NO AMOUNT CHECK NO. AMOUNT AMOUNT DATE TOTALS 3. BALANCE YOUR ACCOUNT Enter Ending Statement Balance shown on this statement Add deposits listed in your register and not shown on this statement . Subtract outstanding checks withdrawal ADJUSTED TOTAL should agree with your checkbook balance 4. IF THE BALANCE IN YOUR CHECKBOOK DOES NOT AGREE WITH THE ADJUSTED TOTAL, THEN Check altion and traction 3. BALANCE YOUR ACCOUNT Erler Ending Statement Balance shown on this statement Add dopouts listed in your register and not shown on this statement Subtract outstanding checks withdrawals ADJUSTED TOTAL should agree with your checkbook blanco) 4. IF THE BALANCE IN YOUR CHECKBOOK DOES NOT AGREE WITH THE ADJUSTED TOTAL, THEN Chac o n and subaction Make sure outstanding the withdrawals and deposits have been listed in the propriate chat above Compare the amount of each check withdrawal and deposit in your checkbook with the amounts on this statement Review the figures ont montestament

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts