Question: Hello, i asked this question earlier but got the wrong answer. This is the table 3.6 for reference : no, the table 3.6 is below

Hello, i asked this question earlier but got the wrong answer.

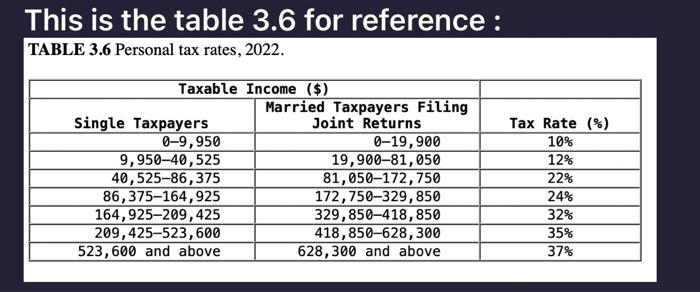

This is the table 3.6 for reference :

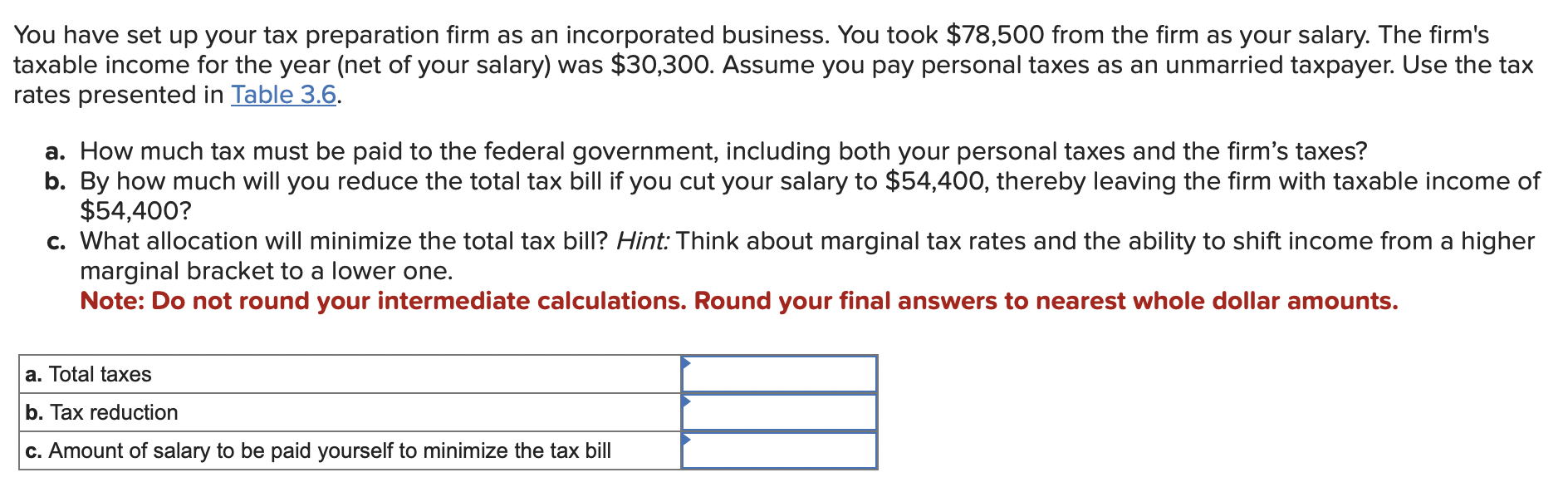

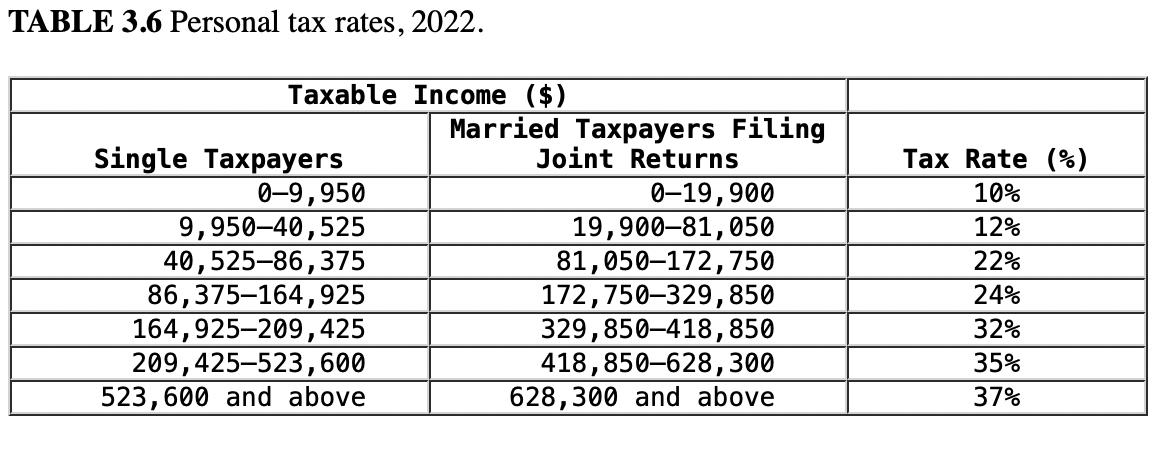

You have set up your tax preparation firm as an incorporated business. You took $78,500 from the firm as your salary. The firm's taxable income for the year (net of your salary) was $30,300. Assume you pay personal taxes as an unmarried taxpayer. Use the tax rates presented in Table 3.6. a. How much tax must be paid to the federal government, including both your personal taxes and the firm's taxes? b. By how much will you reduce the total tax bill if you cut your salary to $54,400, thereby leaving the firm with taxable income of $54,400 ? c. What allocation will minimize the total tax bill? Hint: Think about marginal tax rates and the ability to shift income from a higher marginal bracket to a lower one. Note: Do not round your intermediate calculations. Round your final answers to nearest whole dollar amounts. TABLE 3.6 Personal tax rates, 2022. This is the table 3.6 for reference : TABLE 3.6 Personal tax rates, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts