Question: Hello, I did the questions already using the manual method (number line) but apparently these questions can be done with a Financial Calculator? I just

Hello, I did the questions already using the manual method (number line) but apparently these questions can be done with a Financial Calculator? I just don't know how.

Hello, I did the questions already using the manual method (number line) but apparently these questions can be done with a Financial Calculator? I just don't know how.

Please explain step by step on how to solve the above questions on a TI-84 Plus CE (same as TI-84 Plus) graphing calculator

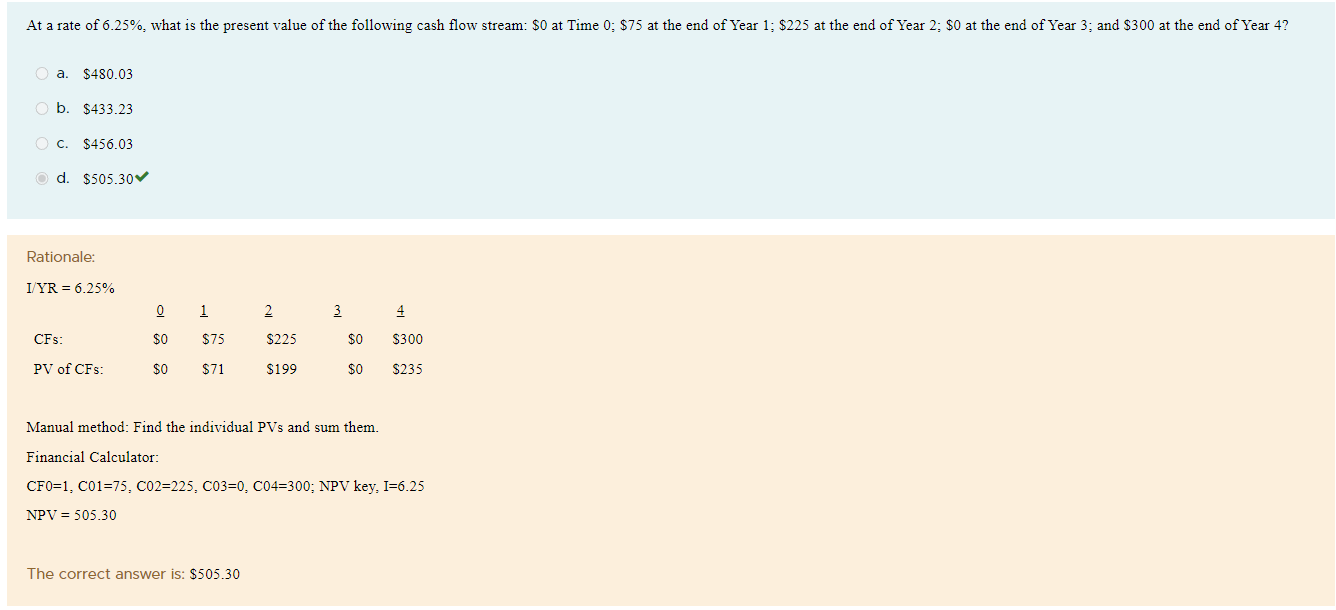

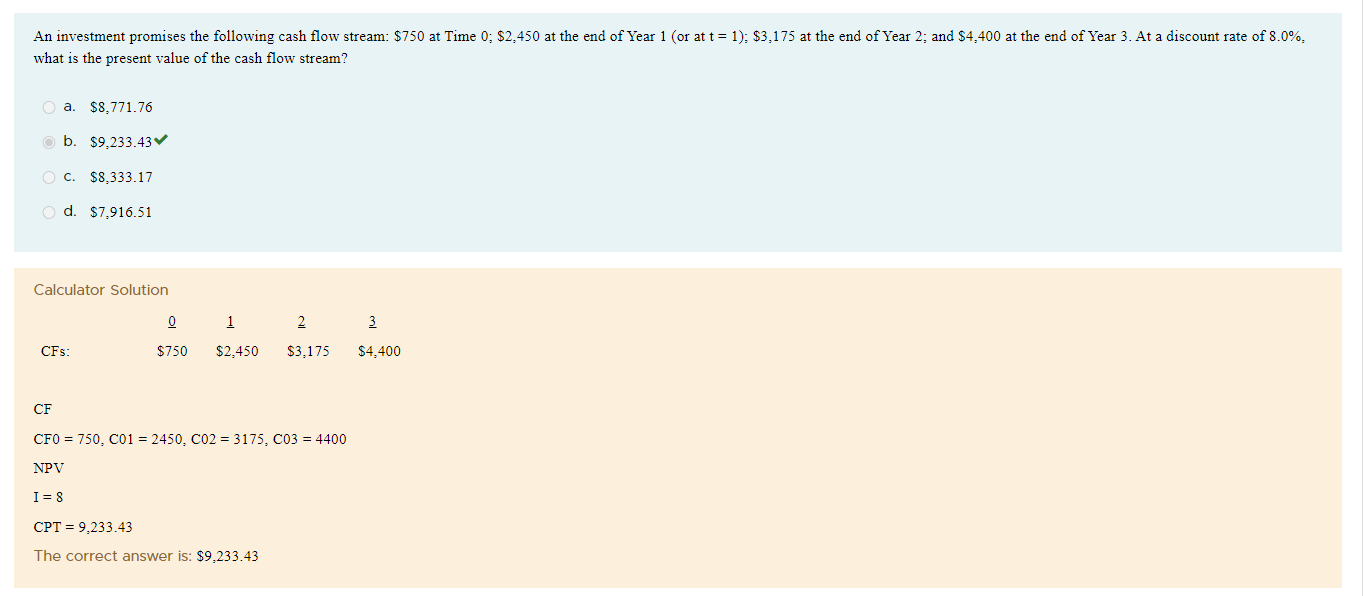

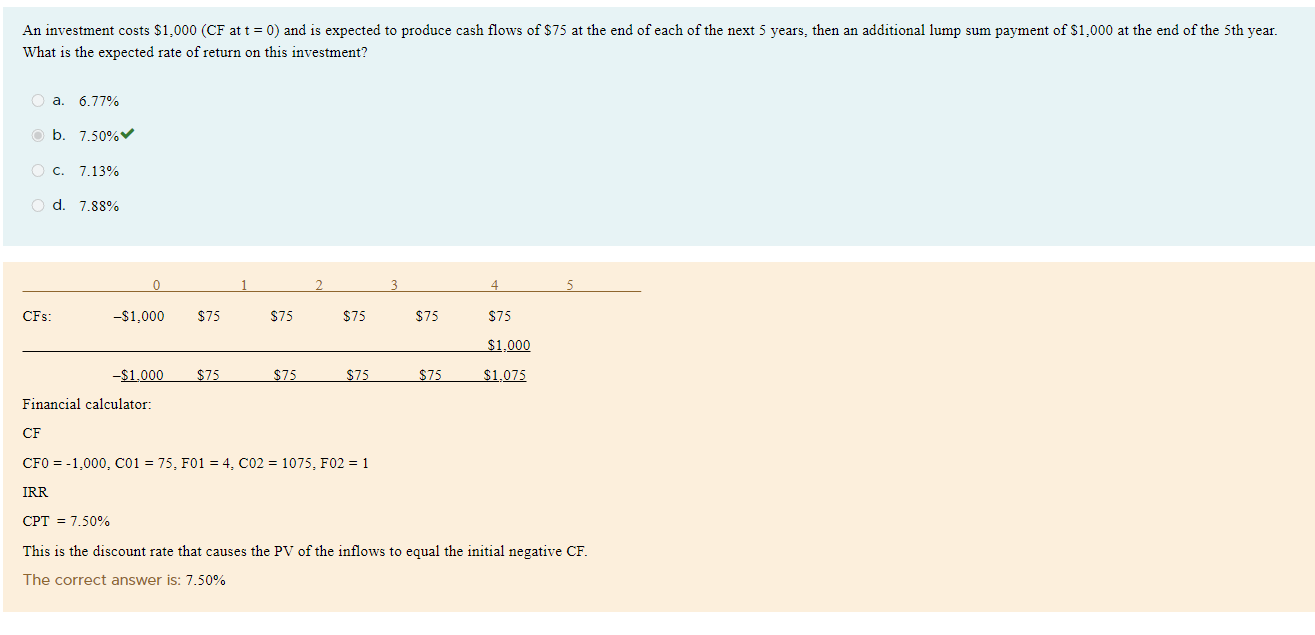

a. $480.03 b. $433.23 C. $456.03 d. $505.30 Rationale: I/YR=6.25% Manual method: Find the individual PVs and sum them. Financial Calculator: CF0=1,C01=75,C02=225,C03=0,C04=300;NPVkey,I=6.25 NPV=505.30 The correct answer is: $505.30 what is the present value of the cash flow stream? a. $8,771.76 b. $9,233.43 C. $8,333.17 d. $7,916.51 Calculator Solution CF CF0=750,C01=2450,C02=3175,C03=4400 NPV I=8 CPT=9,233.43 The correct answer is: $9,233.43 What is the expected rate of return on this investment? a. 6.77% b. 7.50% C. 7.13% d. 7.88% Financial calculator: CF CF0=1,000,C01=75,F01=4,C0=1075,F02=1 IRR CPT=7.50% This is the discount rate that causes the PV of the inflows to equal the initial negative CF. The correct answer is: 7.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts