Question: Hello, I got question 1 right but 2 and 3 wrong and I need help seeing what I did wrong with those two questions. Problem

Hello, I got question 1 right but 2 and 3 wrong and I need help seeing what I did wrong with those two questions. Problem 11-22 Special Order Decisions [LO11-4]

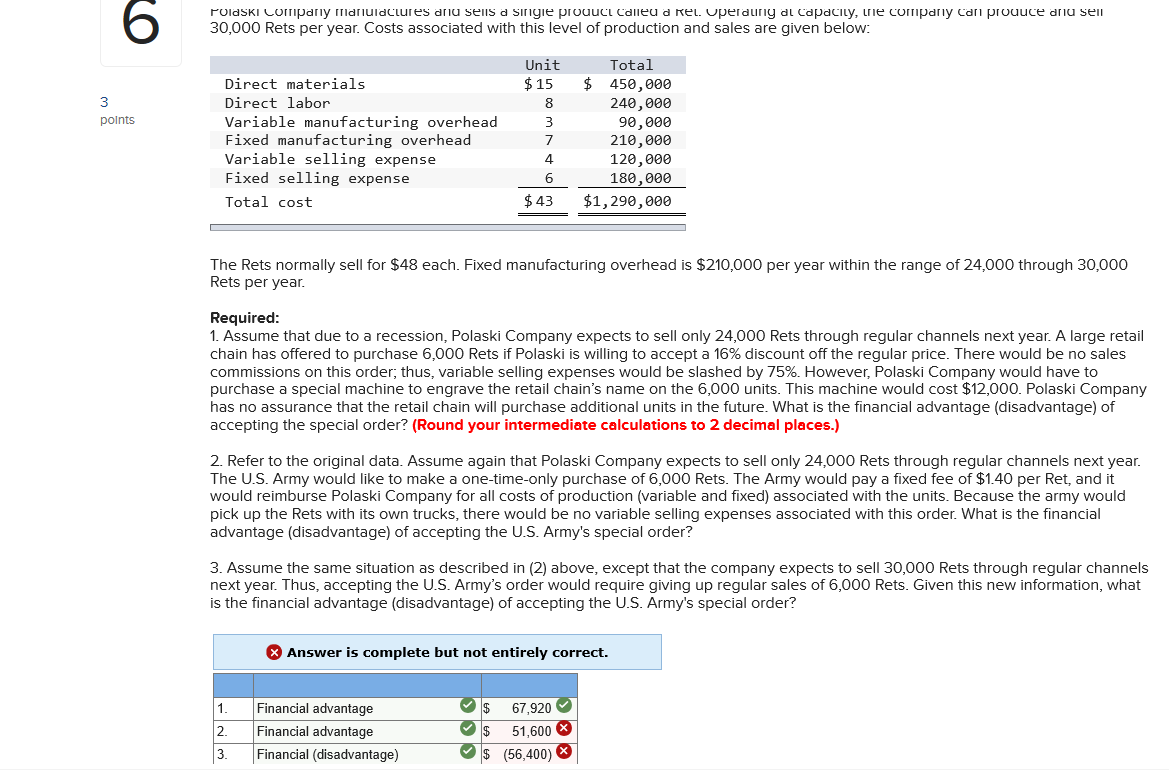

Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 30,000 Rets per year. Costs associated with this level of production and sales are given below:

| Unit | Total | ||||||

| Direct materials | $ | 15 | $ | 450,000 | |||

| Direct labor | 8 | 240,000 | |||||

| Variable manufacturing overhead | 3 | 90,000 | |||||

| Fixed manufacturing overhead | 7 | 210,000 | |||||

| Variable selling expense | 4 | 120,000 | |||||

| Fixed selling expense | 6 | 180,000 | |||||

| Total cost | $ | 43 | $ | 1,290,000 | |||

The Rets normally sell for $48 each. Fixed manufacturing overhead is $210,000 per year within the range of 24,000 through 30,000 Rets per year.

Required:

1. Assume that due to a recession, Polaski Company expects to sell only 24,000 Rets through regular channels next year. A large retail chain has offered to purchase 6,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chains name on the 6,000 units. This machine would cost $12,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your intermediate calculations to 2 decimal places.)

2. Refer to the original data. Assume again that Polaski Company expects to sell only 24,000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 6,000 Rets. The Army would pay a fixed fee of $1.40 per Ret, and it would reimburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order?

3. Assume the same situation as described in (2) above, except that the company expects to sell 30,000 Rets through regular channels next year. Thus, accepting the U.S. Armys order would require giving up regular sales of 6,000 Rets. Given this new information, what is the financial advantage (disadvantage) of accepting the U.S. Army's special order?

PodSKI LOIpariy ildniuidClures diu sens d Single prouci colleu d Rel. uperduriy al capacity, lle compariy cari prouuce diu sen 30,000 Rets per year. Costs associated with this level of production and sales are given below: Unit $15 points Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense Total cost nomno Total $ 450,000 240,000 90,000 210,000 120,000 180,000 $1,290,000 $ 43 The Rets normally sell for $48 each. Fixed manufacturing overhead is $210,000 per year within the range of 24,000 through 30,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 24,000 Rets through regular channels next year. A large retail chain has offered to purchase 6,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain's name on the 6,000 units. This machine would cost $12,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Polaski Company expects to sell only 24,000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 6,000 Rets. The Army would pay a fixed fee of $1.40 per Ret, and it would reimburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 30,000 Rets through regular channels next year. Thus, accepting the U.S. Army's order would require giving up regular sales of 6,000 Rets. Given this new information, what is the financial advantage (disadvantage) of accepting the U.S. Army's special order? Answer is complete but not entirely correct. 1. 2. 3. Financial advantage Financial advantage Financial (disadvantage) $ 67,920 $ 51,600 $ (56,400)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts