Question: Hello, I have having difficulty in solving a part of an accounting problem. I am having trouble with #3 part A as well as part

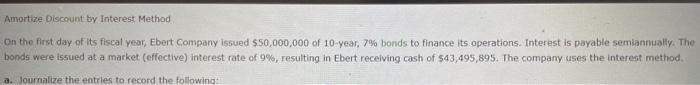

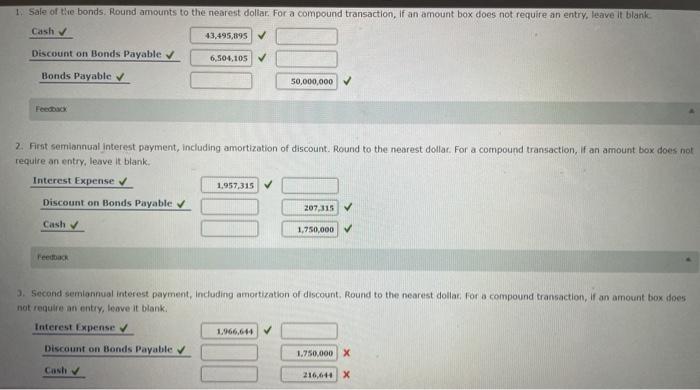

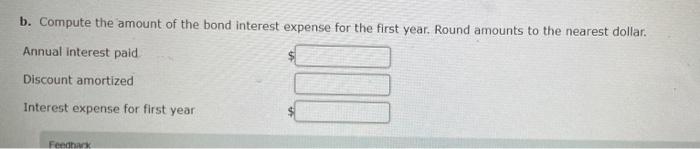

Amortize Discount by Interest Method On the first day of its fiscal year, Ebert Company issued $50,000,000 of 10 year, 7% bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 9%, resulting in Ebert receiving cash of 543,495,895. The company uses the interest method a. Journalize the entries to record the following: 1. Sale of the bonds. Round amounts to the nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank Cash 43,495,895 Discount on Bonds Payable 6,504,105 Bonds Payable 50,000,000 Feedback 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. For a compound transaction, If an amount box does not require an entry, leave it blank Interest Expense 1,957,315 Discount on Bonds Payable 207,315 Cash 1,750,000 Feedback 3. Second semiannual interest payment, including amortization of discount. Round to the nearest dollar, For a compound transaction. If an amount box does not require an entry, leave it blank Interest Expense 1,966,644 Discount on Bonds Payable 1.750,000 X Cash 216,640 X b. Compute the amount of the bond interest expense for the first year. Round amounts to the nearest dollar. Annual interest paid Discount amortized Interest expense for first year Feedha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts