Question: Hello I have posted the problem below. Could you look it over and show me how to incorporate the discount rate 20% into this problem.

Hello I have posted the problem below. Could you look it over and show me how to incorporate the discount rate 20% into this problem. If the way I did it is wrong, could you please correct it?

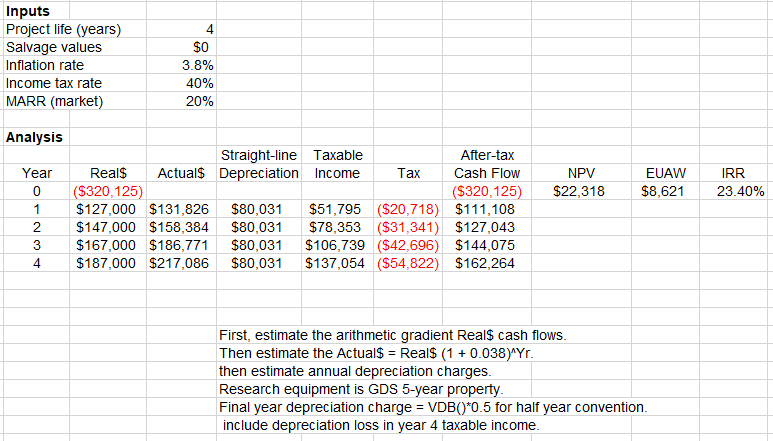

Question: The research and development division of a large corporation is considering the purchase of a new tunneling X-ray microscope for $320,125. The projected net benefits from gains in materials engineering is projected to be $127,000 in todays real dollars for the first year, increasing by an arithmetic gradient of $20,000 per year in real dollars for years 2 to 4. The unit will be depreciated under MACRS. Due to increasing advances in tunneling X-ray microscope technology, the unit will have $60,000 market value in todays real dollars at the end of the 4 year project life. During the 4 year analysis period, inflation is expected to be steady at 3.8% per year. The corporation has a combined state and federal income tax rate of 40.0%. The corporation requires a 20.0% after-tax market rate of return on its research and development investments. Should the X-ray unit be purchased?

Answer:

Inputs Project life (years) Salvage values Inflation rate Income tax rate MARR (market) 4 S0 3.8% 40% 20% Analysis Straight-line Taxable RealsActual$ Depreciation Income After-tax NPV $22.318 Year EUAW $8,621 IRR 23.40% Tax Cash Flow 0 ($320,125) S320,125 $127,000 $131,826 $80,031 $51,795 ($20,718) $111,108 2 $147,000 $158,384 $80,031 $78,353 ($31,341) $127,043 3 $167,000 $186,771 $80,031 $106,739 ($42,696) $144,075 4 $187,000 $217,086 $80,031 $137,054 ($54,822) $162,264 First, estimate the arithmetic gradient Reals cash flows Then estimate the ActualSRealS (1 0.038MYr then estimate annual depreciation charges Research equipment is GDS 5-year property Final year depreciation charge VDB0 0.5 for half year convention include depreciation loss in vear 4 taxable income Inputs Project life (years) Salvage values Inflation rate Income tax rate MARR (market) 4 S0 3.8% 40% 20% Analysis Straight-line Taxable RealsActual$ Depreciation Income After-tax NPV $22.318 Year EUAW $8,621 IRR 23.40% Tax Cash Flow 0 ($320,125) S320,125 $127,000 $131,826 $80,031 $51,795 ($20,718) $111,108 2 $147,000 $158,384 $80,031 $78,353 ($31,341) $127,043 3 $167,000 $186,771 $80,031 $106,739 ($42,696) $144,075 4 $187,000 $217,086 $80,031 $137,054 ($54,822) $162,264 First, estimate the arithmetic gradient Reals cash flows Then estimate the ActualSRealS (1 0.038MYr then estimate annual depreciation charges Research equipment is GDS 5-year property Final year depreciation charge VDB0 0.5 for half year convention include depreciation loss in vear 4 taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts