Question: Hello, I have this excercise/answer but I don't understand the problem. Could someone explain step by step how to get to the answer? Jos is

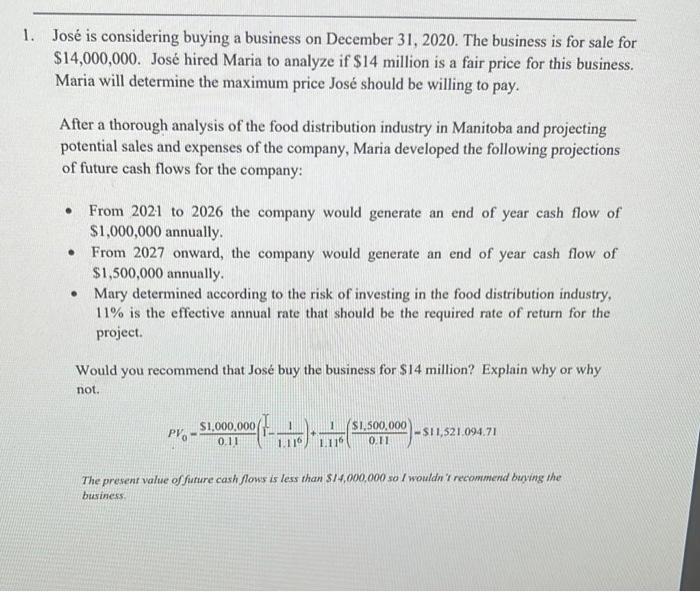

Jos is considering buying a business on December 31,2020 . The business is for sale for $14,000,000. Jos hired Maria to analyze if $14 million is a fair price for this business. Maria will determine the maximum price Jos should be willing to pay. After a thorough analysis of the food distribution industry in Manitoba and projecting potential sales and expenses of the company, Maria developed the following projections of future cash flows for the company: - From 2021 to 2026 the company would generate an end of year cash flow of $1,000,000 annually. - From 2027 onward, the company would generate an end of year cash flow of $1,500,000 annually. - Mary determined according to the risk of investing in the food distribution industry, 11% is the effective annual rate that should be the required rate of return for the project. Would you recommend that Jos buy the business for $14 million? Explain why or why not. PV0=0.1151.000.000(111.1161)+1.1161(0.1151,500,000)511,521.094.71 The present value of future cash flows is less than SIt,000,000 so I wouldn't recommend buying the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts