Question: Hello! I have to do these 3 exercises for my Managerial Accounting Class and I don't succeed to do it. Could you do it, please

Hello! I have to do these 3 exercises for my Managerial Accounting Class and I don't succeed to do it. Could you do it, please ? It would be wonderful if you can help me to do these exercises.

The professor told us to buy the book written by Eric Noreen named "Managerial Accounting" but nothing is explained well.

Thank You!

Raphael

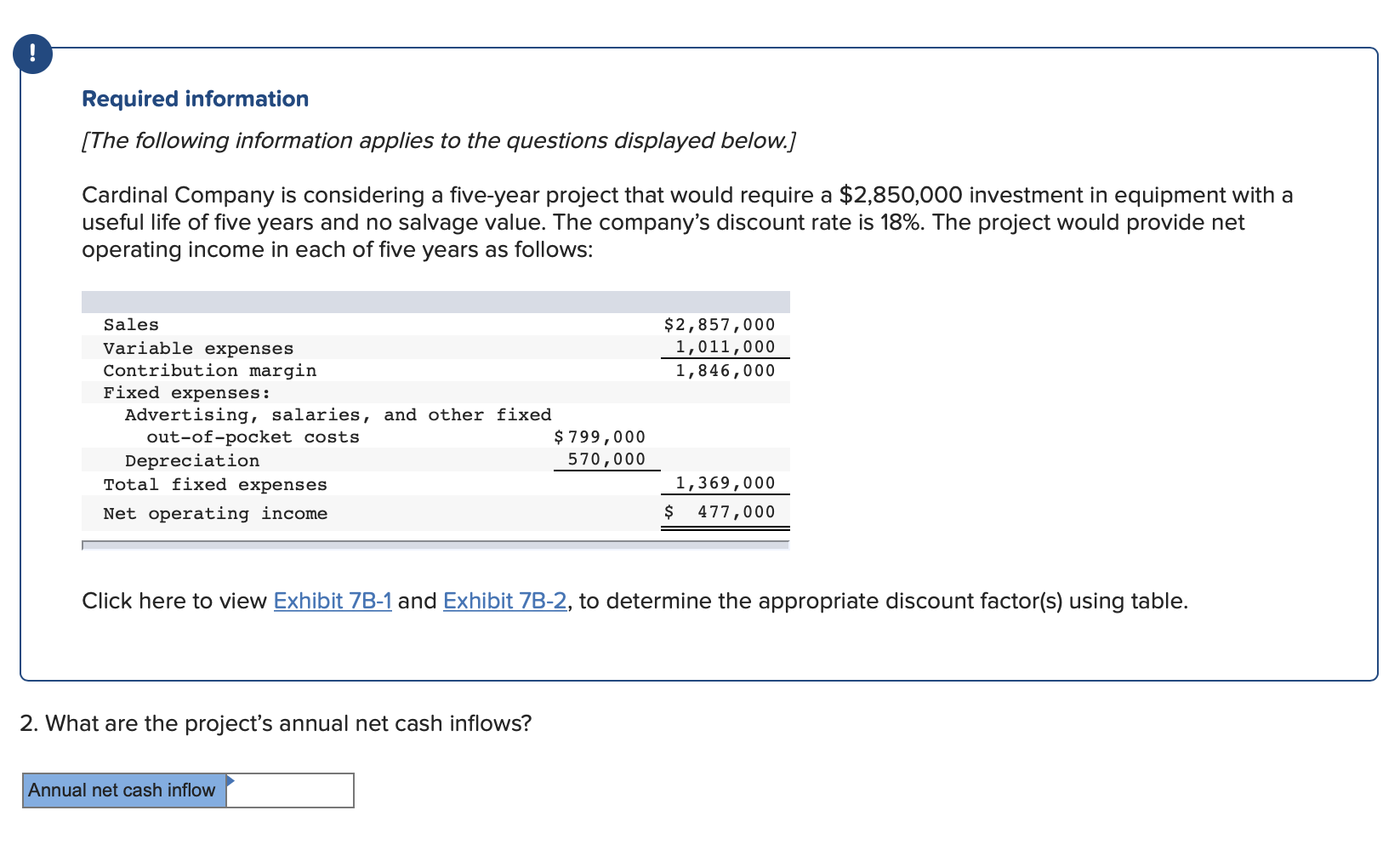

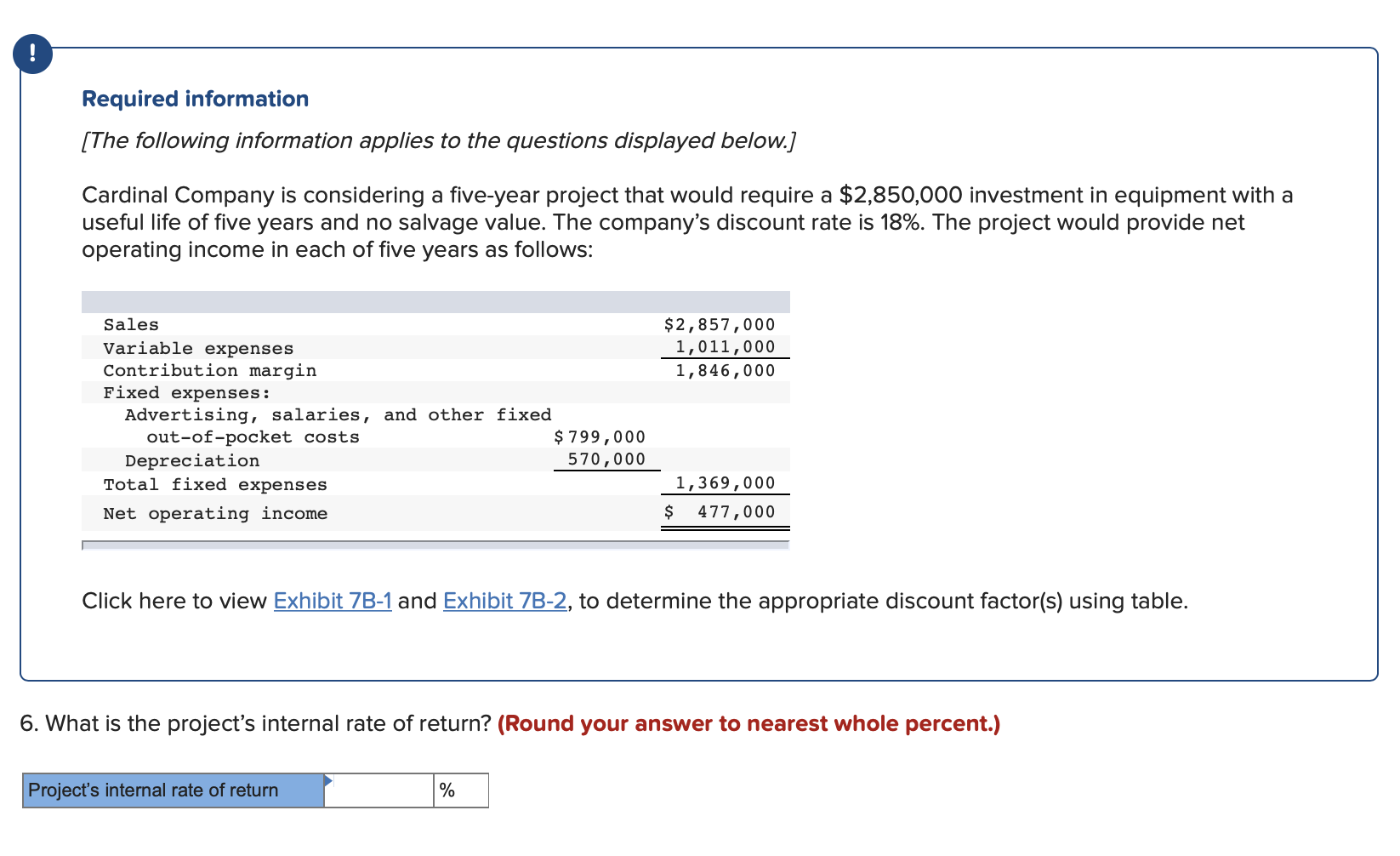

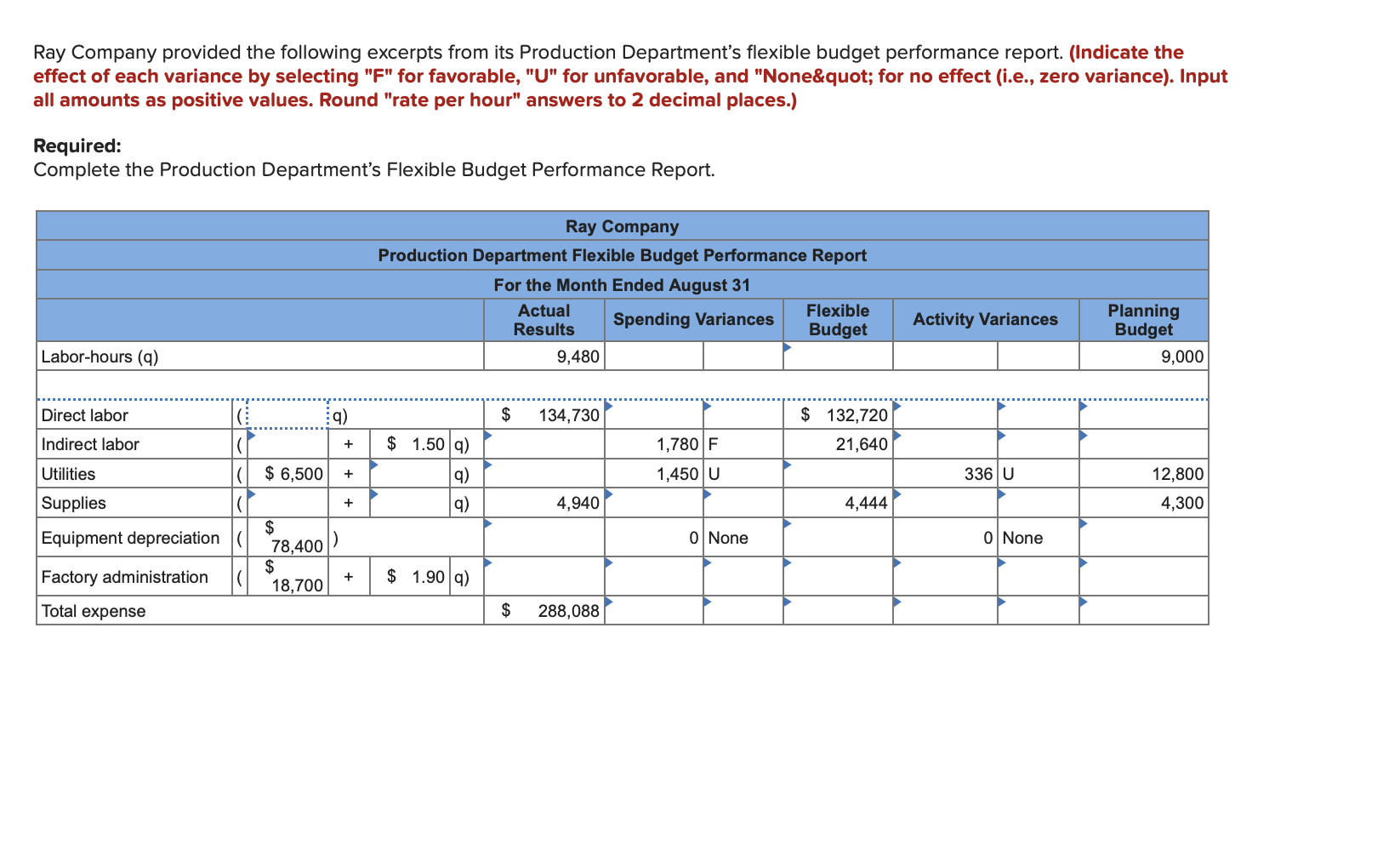

Required information [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,850,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: $2,857,000 1,011,000 1,846,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 799,000 Depreciation 570,000 Total fixed expenses Net operating income 1,369,000 $ 477,000 Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table. 2. What are the project's annual net cash inflows? Annual net cash inflow Required information [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,850,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: $2,857,000 1,011,000 1,846,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 799,000 Depreciation 570,000 Total fixed expenses Net operating income 1,369,000 $ 477,000 Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table. 6. What is the project's internal rate of return? (Round your answer to nearest whole percent.) Project's internal rate of return Ray Company provided the following excerpts from its Production Department's flexible budget performance report. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour" answers to 2 decimal places.) Required: Complete the Production Department's Flexible Budget Performance Report. Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Spending Variances Flexible Results Budget 9,480 Activity Variances Planning Budget 9,000 Labor-hours (9) Direct labor $ 134,730 $ 2 132,720 21,640 Indirect labor $ 1.50 ) + 1,780 F 1,450 U $ 6,500 336 U + Utilities Supplies 12,800 4,300 + a) 4,940 4,444 Equipment depreciation 78,4 0 None 0 None $ 18,700 + Factory administration Total expense $ 1.90 q) $ 288,088

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts