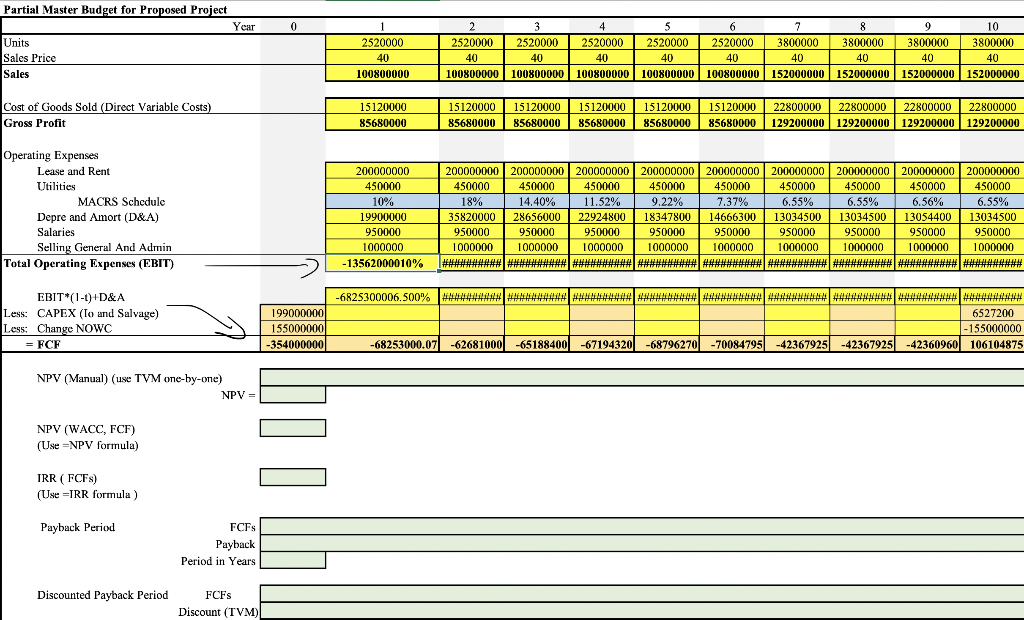

Question: Hello! I just need help for Total Operating Expenses, EBIT*(1-t)+D&A, CAPEX (Io and Salvage), Change NOWC, and FCF. I know It looks like I completed

Hello! I just need help for Total Operating Expenses, EBIT*(1-t)+D&A, CAPEX (Io and Salvage), Change NOWC, and FCF. I know It looks like I completed it in the begining, but I think is wrong because I get a negative number. Thanks

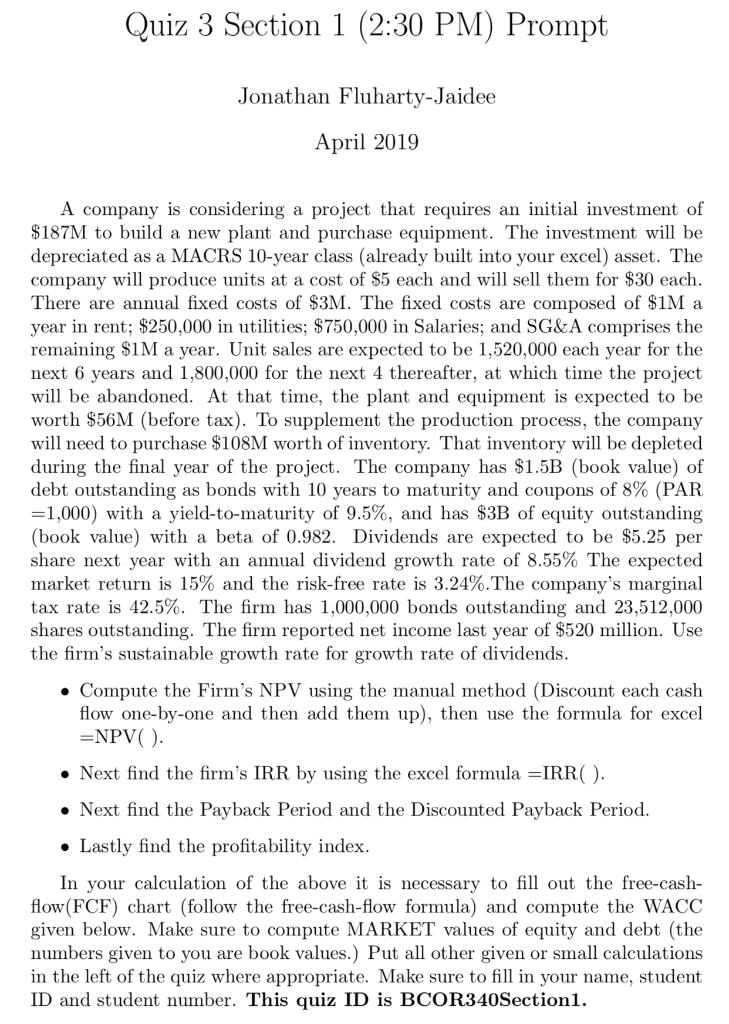

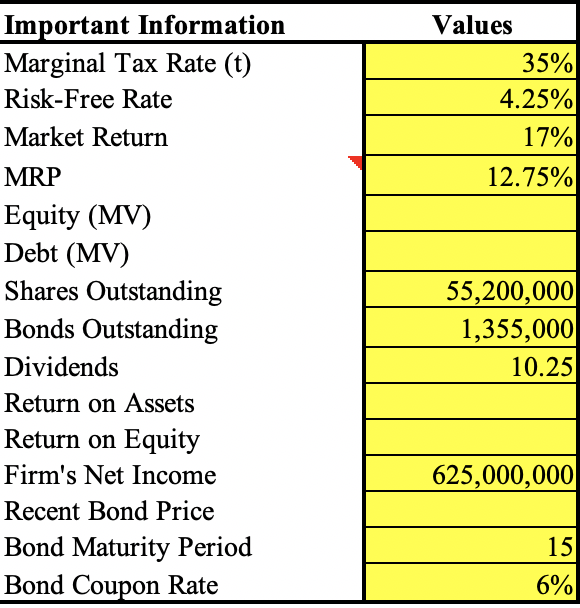

Quiz 3 Section 1 (2:30 PM) Prompt Jonathan Fluharty-Jaidee April 2019 A company is considering a project that requires an initial investment of $187M to build a new plant and purchase equipment. The investment will be depreciated as a MACRS 10-year class (already built into your excel) asset. The company will produce units at a cost of S5 each and will sell them for $30 each There are annual fixed costs of $3M. The fixed costs are composed of $1Ma year in rent; $250,000 in utilities; $750,000 in Salaries; and SG&&A comprises the remaining $1M a year. Unit sales are expected to be 1,520,000 each year for the next 6 years and 1,800,000 for the next 4 thereafter, at which time the project will be abandoned. At that time, the plant and equipment is expected to be worth $56M (before tax). To supplement the production process, the company will need to purchase $108M worth of inventory. That inventory will be depleted during the final year of the project. The company has $1.5B (book value) of debt outstanding as bonds with 10 years to maturity and coupons of 8% (PAR -1,000) with a yield-to-maturity of 9.5%, and has $3B of equity outstanding (book value) with a beta of 0.982. Dividends are expected to be $5.25 per share next year with an annual dividend growth rate of 8.55% The expected market return is 15% and the risk-free rate is 3.24%,The company's marginal tax rate is 42.5%. The firm has 1,000,000 bonds outstanding and 23,512,000 shares outstanding. The firm reported net income last year of $520 million. Use the firm's sustainable growth rate for growth rate of dividends . Compute the Firm's NPV using the manual method (Discount each cash flow one-by-one and then add them up), then use the formula for excel -NPV( Next find the firm's IRR by using the excel formula IRRO Next find the Payback Period and the Discounted Payback Period Lastly find the profitability index In your calculation of the above it is necessary to fill out the free-cash flow(FCF) chart (follow the free-cash-flow formula) and compute the WACC given below. Make sure to compute MARKET values of equity and debt (the numbers given to you are book values.) Put all other given or small calculations in the left of the quiz where appropriate. Make sure to fill in your name, student ID and student number. This quiz ID is BCOR340Sectionl. Important Information Marginal Tax Rate (t) Risk-Free Rate Market Return MRP Equity (MV) Debt (MV) Shares Outstanding Bonds Outstanding Dividends Return on Assets Return on Equity Firm's Net Income Recent Bond Price Bond Maturity Period Bond Coupon Rate Values 35% 4.25% 17% 12.75% 55,200,000 1,355,000 10.25 625,000,000 15 5% Quiz 3 Section 1 (2:30 PM) Prompt Jonathan Fluharty-Jaidee April 2019 A company is considering a project that requires an initial investment of $187M to build a new plant and purchase equipment. The investment will be depreciated as a MACRS 10-year class (already built into your excel) asset. The company will produce units at a cost of S5 each and will sell them for $30 each There are annual fixed costs of $3M. The fixed costs are composed of $1Ma year in rent; $250,000 in utilities; $750,000 in Salaries; and SG&&A comprises the remaining $1M a year. Unit sales are expected to be 1,520,000 each year for the next 6 years and 1,800,000 for the next 4 thereafter, at which time the project will be abandoned. At that time, the plant and equipment is expected to be worth $56M (before tax). To supplement the production process, the company will need to purchase $108M worth of inventory. That inventory will be depleted during the final year of the project. The company has $1.5B (book value) of debt outstanding as bonds with 10 years to maturity and coupons of 8% (PAR -1,000) with a yield-to-maturity of 9.5%, and has $3B of equity outstanding (book value) with a beta of 0.982. Dividends are expected to be $5.25 per share next year with an annual dividend growth rate of 8.55% The expected market return is 15% and the risk-free rate is 3.24%,The company's marginal tax rate is 42.5%. The firm has 1,000,000 bonds outstanding and 23,512,000 shares outstanding. The firm reported net income last year of $520 million. Use the firm's sustainable growth rate for growth rate of dividends . Compute the Firm's NPV using the manual method (Discount each cash flow one-by-one and then add them up), then use the formula for excel -NPV( Next find the firm's IRR by using the excel formula IRRO Next find the Payback Period and the Discounted Payback Period Lastly find the profitability index In your calculation of the above it is necessary to fill out the free-cash flow(FCF) chart (follow the free-cash-flow formula) and compute the WACC given below. Make sure to compute MARKET values of equity and debt (the numbers given to you are book values.) Put all other given or small calculations in the left of the quiz where appropriate. Make sure to fill in your name, student ID and student number. This quiz ID is BCOR340Sectionl. Important Information Marginal Tax Rate (t) Risk-Free Rate Market Return MRP Equity (MV) Debt (MV) Shares Outstanding Bonds Outstanding Dividends Return on Assets Return on Equity Firm's Net Income Recent Bond Price Bond Maturity Period Bond Coupon Rate Values 35% 4.25% 17% 12.75% 55,200,000 1,355,000 10.25 625,000,000 15 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts