Question: Hello, I know I have already solved this question. Please see highligted part at very bottom of question and please help me understand where this

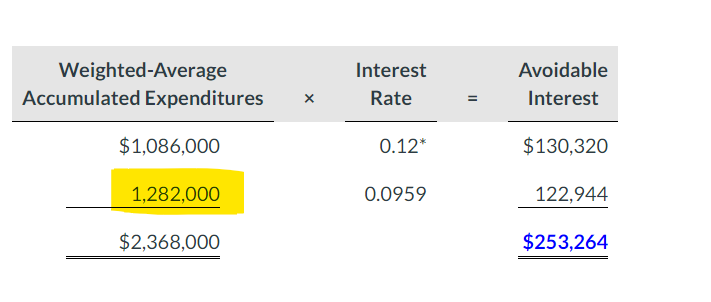

Hello, I know I have already solved this question. Please see highligted part at very bottom of question and please help me understand where this number is coming from. I do not understand how this number is calculated. Thank you!!!

Hello, I know I have already solved this question. Please see highligted part at very bottom of question and please help me understand where this number is coming from. I do not understand how this number is calculated. Thank you!!!

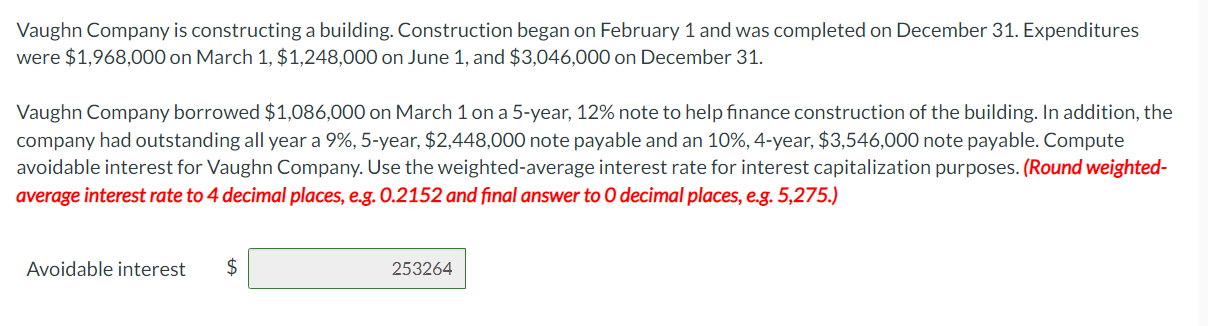

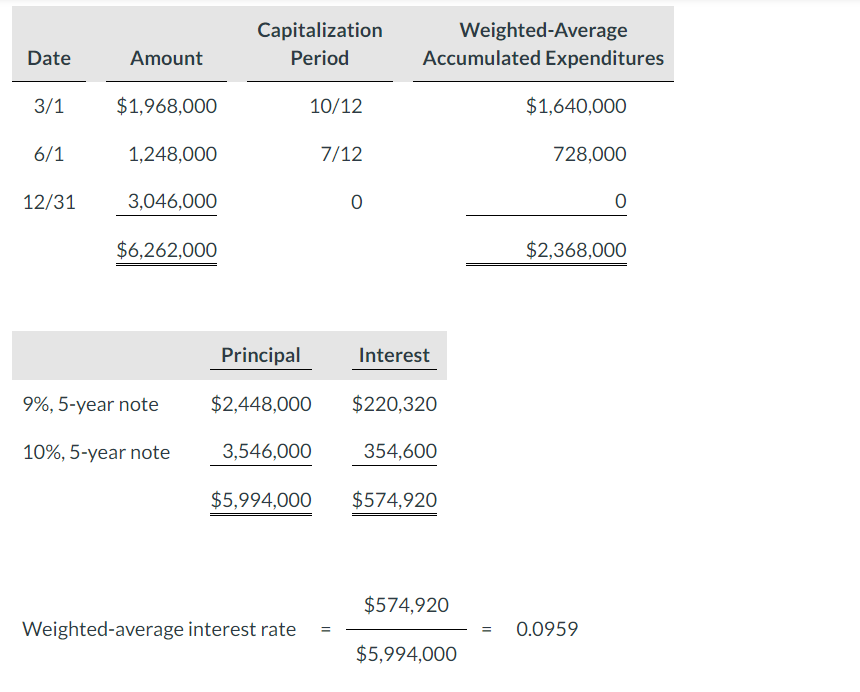

Vaughn Company is constructing a building. Construction began on February 1 and was completed on December 31 . Expenditures were $1,968,000 on March 1, $1,248,000 on June 1, and $3,046,000 on December 31. Vaughn Company borrowed $1,086,000 on March 1 on a 5-year, 12\% note to help finance construction of the building. In addition, the company had outstanding all year a 9\%, 5-year, \$2,448,000 note payable and an 10\%, 4-year, \$3,546,000 note payable. Compute avoidable interest for Vaughn Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weightedaverage interest rate to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) Avoidable interest $ Weighted-average interest rate =$5,994,000$574,920=0.0959

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts