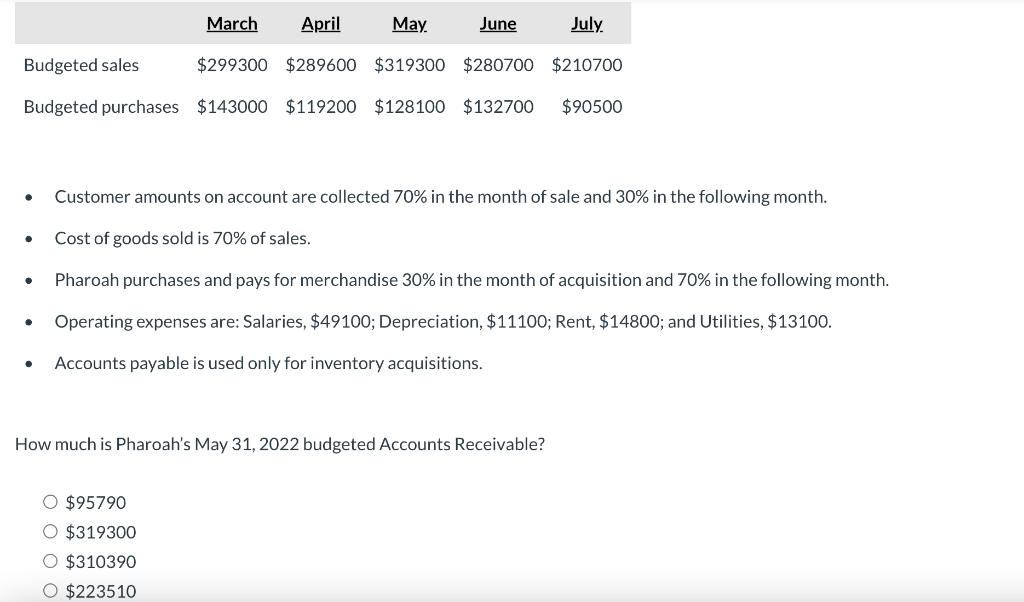

Question: Hello I know these are two questions but I would appreciate. I will thumbs up March April May June July Budgeted sales $299300 $289600 $319300

Hello I know these are two questions but I would appreciate. I will thumbs up

Hello I know these are two questions but I would appreciate. I will thumbs up

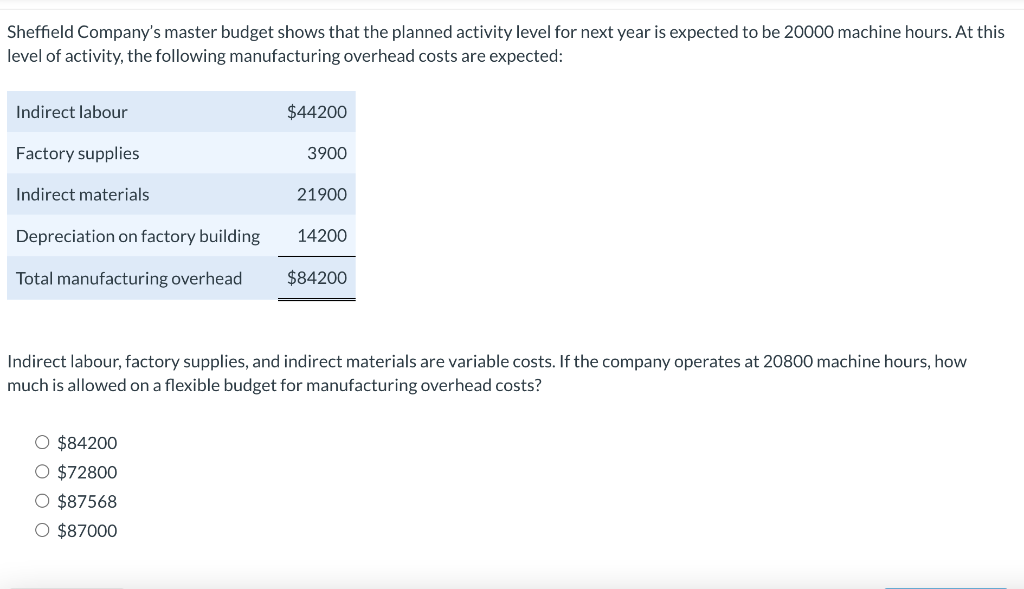

March April May June July Budgeted sales $299300 $289600 $319300 $280700 $210700 Budgeted purchases $143000 $119200 $128100 $132700 $90500 Customer amounts on account are collected 70% in the month of sale and 30% in the following month. Cost of goods sold is 70% of sales. Pharoah purchases and pays for merchandise 30% in the month of acquisition and 70% in the following month. Operating expenses are: Salaries, $49100; Depreciation, $11100; Rent, $14800; and Utilities, $13100. . Accounts payable is used only for inventory acquisitions. How much is Pharoah's May 31, 2022 budgeted Accounts Receivable? O $95790 O $319300 O $310390 O $223510 Sheffield Company's master budget shows that the planned activity level for next year is expected to be 20000 machine hours. At this level of activity, the following manufacturing overhead costs are expected: Indirect labour $44200 Factory supplies 3900 Indirect materials 21900 Depreciation on factory building 14200 Total manufacturing overhead $84200 Indirect labour, factory supplies, and indirect materials are variable costs. If the company operates at 20800 machine hours, how much is allowed on a flexible budget for manufacturing overhead costs? O $84200 O $72800 O $87568 O $87000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts