Question: Hello, I need assistance with preparing the adjusting entries. I cannot seem to get the bad debt expense and allowance for doubtful accounts corrrect. Please

Hello,

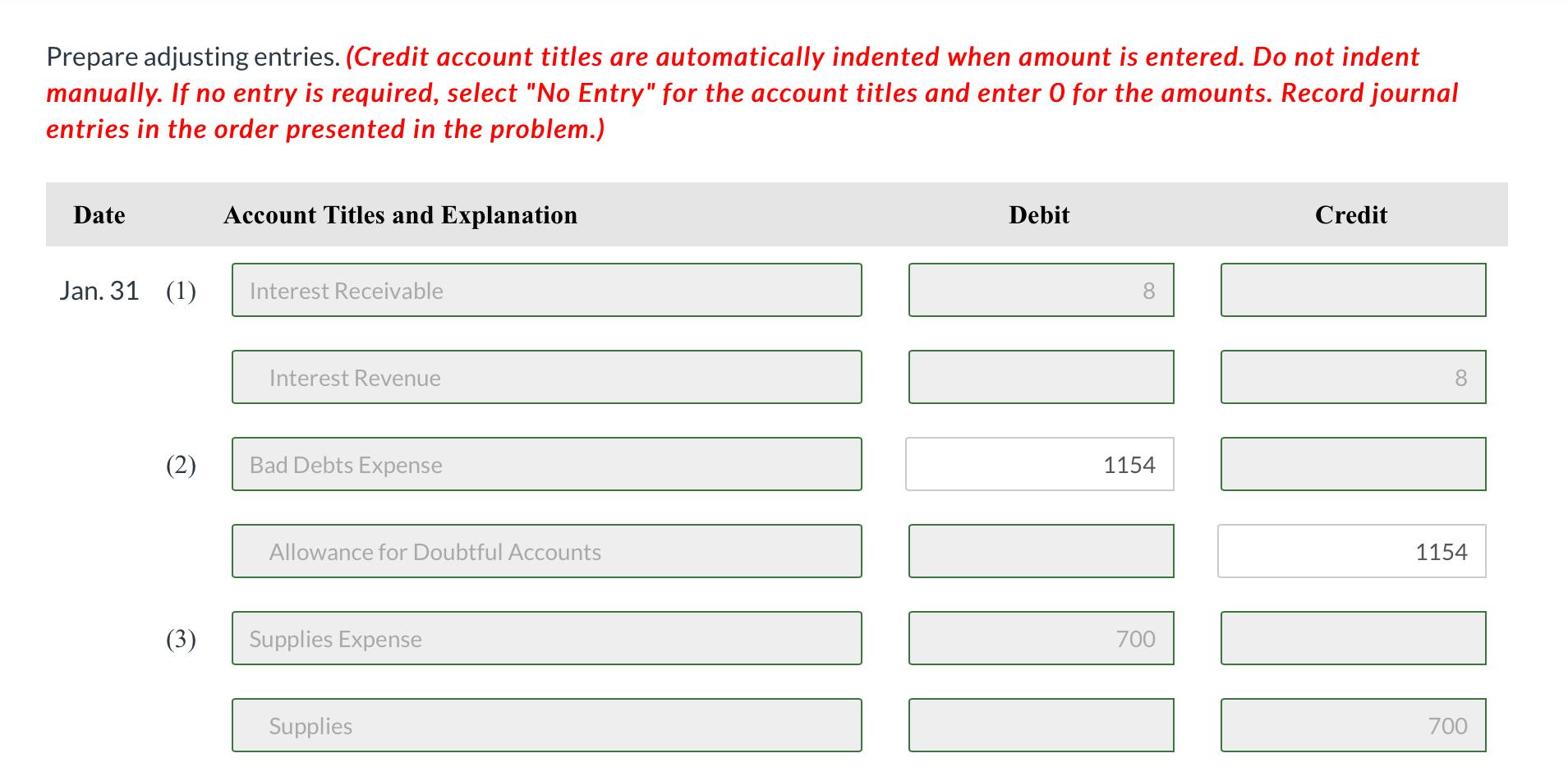

I need assistance with preparing the adjusting entries. I cannot seem to get the bad debt expense and allowance for doubtful accounts corrrect.

Please help.

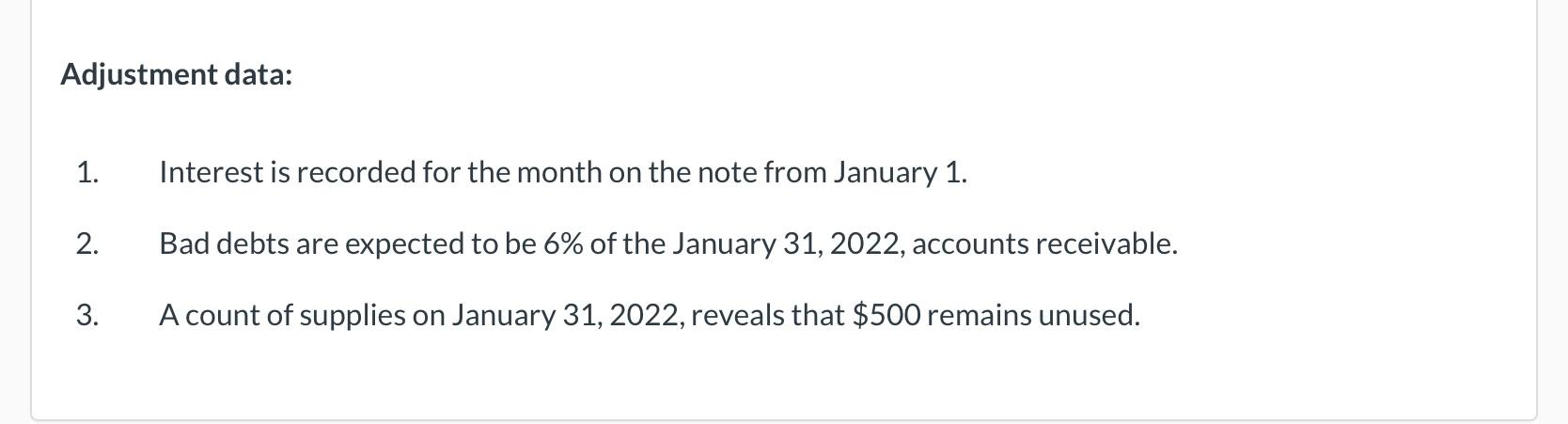

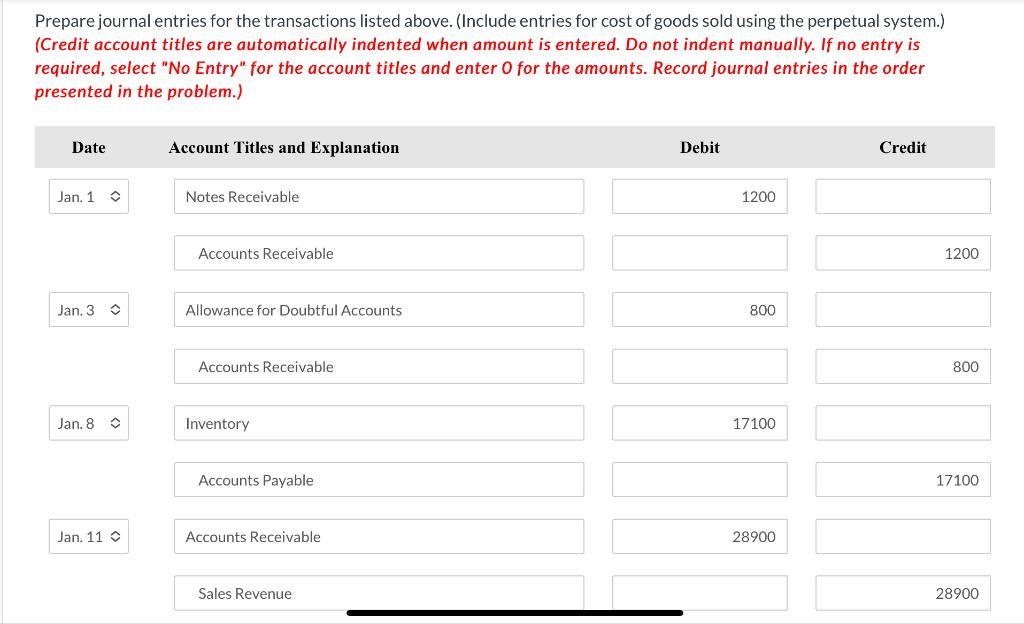

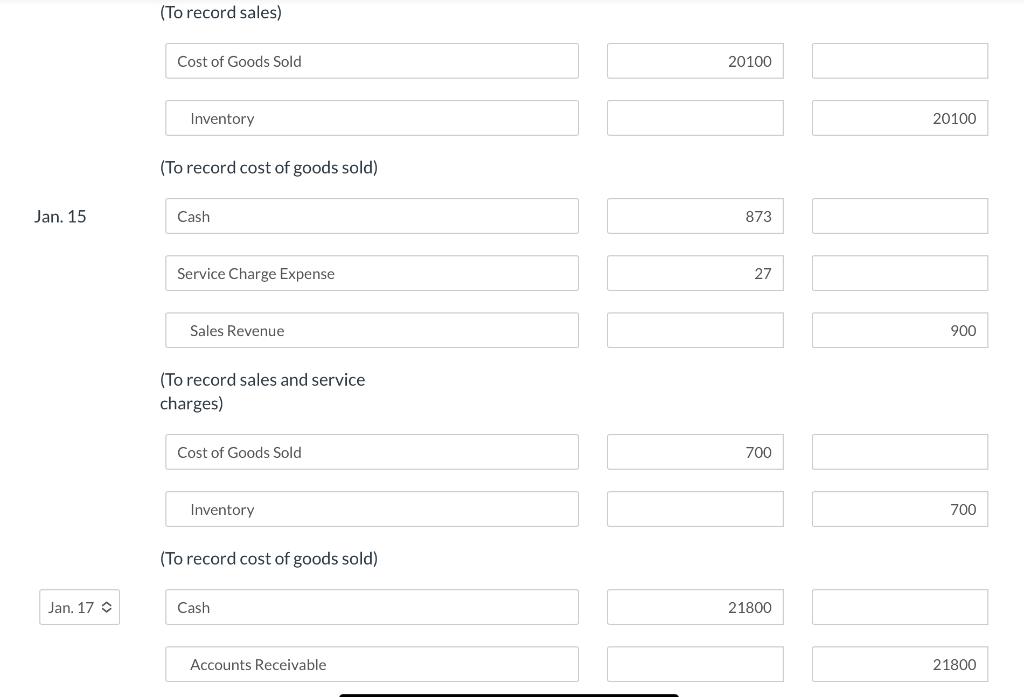

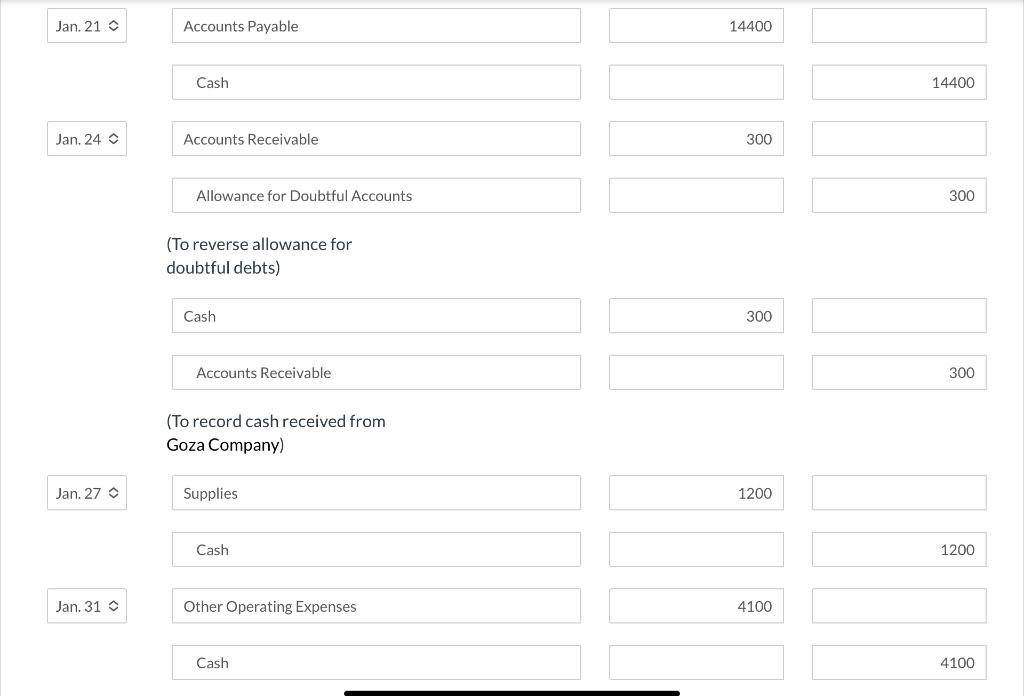

Adjustment data: 1. Interest is recorded for the month on the note from January 1. 2. Bad debts are expected to be 6% of the January 31,2022 , accounts receivable. 3. A count of supplies on January 31,2022 , reveals that $500 remains unused. Prepare journal entries for the transactions listed above. (Include entries for cost of goods sold using the perpetual system.) required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) (To record sales) \begin{tabular}{l} Cost of Goods Sold \\ Inventory \\ \hline \end{tabular} (To record cost of goods sold) Jan. 15 Cash 873 Service Charge Expense Sales Revenue (To record sales and service charges) Cost of Goods Sold Inventory (To record cost of goods sold) Accounts Receivable \begin{tabular}{|r|} \hline 14400 \\ \hline \end{tabular} Allowance for Doubtful Accounts (To reverse allowance for doubtful debts) \begin{tabular}{l} Cash \\ Accounts Receivable \\ \hline \end{tabular} (To record cash received from Goza Company) Cash Cash 4100 Prepare adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts