Question: Hello, i need assistance with this question. I guarantee a thumbs up/ up vote for the gorewvt answer. You are contemplating the purchase of a

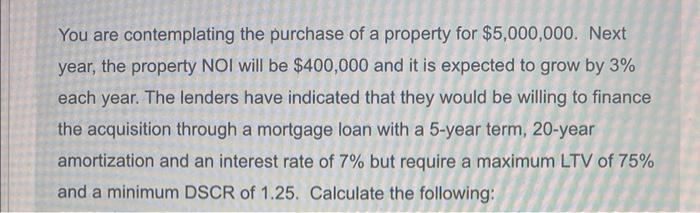

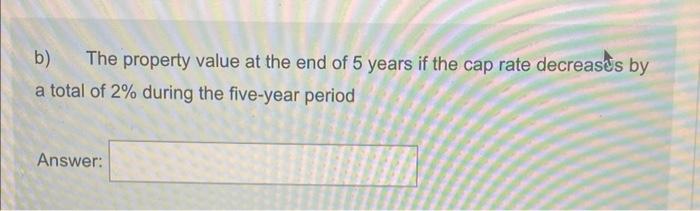

You are contemplating the purchase of a property for $5,000,000. Next year, the property NOI will be $400,000 and it is expected to grow by 3% each year. The lenders have indicated that they would be willing to finance the acquisition through a mortgage loan with a 5-year term, 20-year amortization and an interest rate of 7% but require a maximum LTV of 75% and a minimum DSCR of 1.25. Calculate the following: b) The property value at the end of 5 years if the cap rate decreases by a total of 2% during the five-year period Answer: You are contemplating the purchase of a property for $5,000,000. Next year, the property NOI will be $400,000 and it is expected to grow by 3% each year. The lenders have indicated that they would be willing to finance the acquisition through a mortgage loan with a 5-year term, 20-year amortization and an interest rate of 7% but require a maximum LTV of 75% and a minimum DSCR of 1.25. Calculate the following: b) The property value at the end of 5 years if the cap rate decreases by a total of 2% during the five-year period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts