Question: Hello i need help about this exercise especially for question a, b, c and d for the board Subject : Investment Thanks The following table

Hello i need help about this exercise especially for question a, b, c and d for the board

Subject : Investment

Thanks

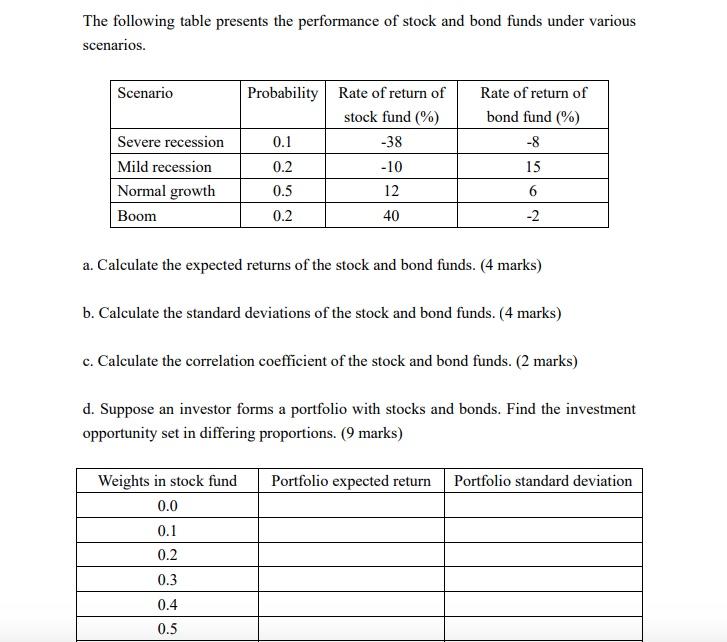

The following table presents the performance of stock and bond funds under various scenarios. Scenario Severe recession Mild recession Normal growth Boom Probability Rate of return of stock fund (%) 0.1 -38 0.2 -10 0.5 12 0.2 40 Rate of return of bond fund (%) -8 15 6 -2 a. Calculate the expected returns of the stock and bond funds. (4 marks) b. Calculate the standard deviations of the stock and bond funds. (4 marks) c. Calculate the correlation coefficient of the stock and bond funds. (2 marks) d. Suppose an investor forms a portfolio with stocks and bonds. Find the investment opportunity set in differing proportions. (9 marks) Portfolio expected return Portfolio standard deviation Weights in stock fund 0.0 0.1 0.2 0.3 0.4 0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts