Question: Hello! I need help calculating the Total Contribution margin on lost sales below. Please provide and explination for your answer. Thank you! Exercise 11A-1 Transfer

Hello! I need help calculating the Total Contribution margin on lost sales below. Please provide and explination for your answer. Thank you!

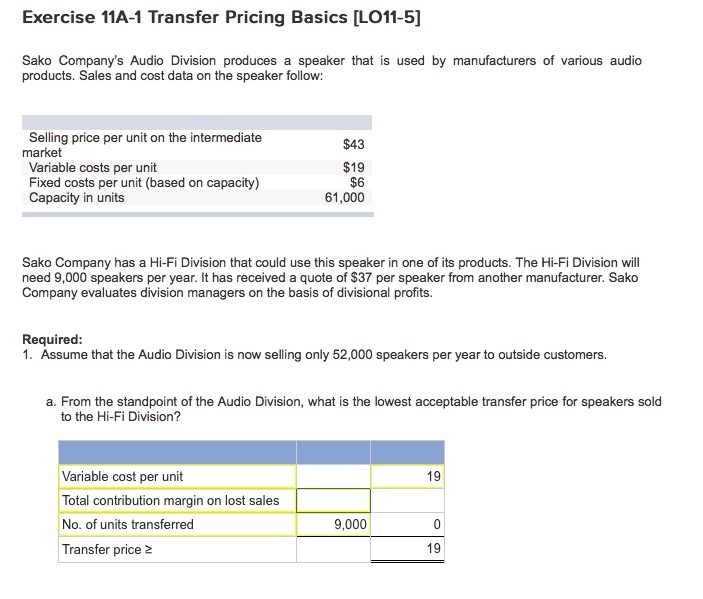

Exercise 11A-1 Transfer Pricing Basics [L011-5] Sako Company's Audio Division produces a speaker that is used by manufacturers of various audio products. Sales and cost data on the speaker follow: Selling price per unit on the intermediate $43 market Variable costs per unit Fixed costs per unit (based on capacity) Capacity in units $19 $6 61,000 Sako Company has a Hi-Fi Division that could use this speaker in one of its products. The Hi-Fi Division will need 9,000 speakers per year. It has received a quote of $37 per speaker from another manufacturer. Sako Company evaluates division managers on the basis of divisional profits. Required 1. Assume that the Audio Division is now selling only 52,000 speakers per year to outside customers. a. From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division? Variable cost per unit Total contribution margin on lost sales No. of units transferred Transfer price 2 19 9,000 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts