Question: Hello, i need help can you please do part 1 2 3 4 please, Iv done part 1 but calculation but seems to be wrong

Hello, i need help can you please do part 1 2 3 4 please, Iv done part 1 but calculation but seems to be wrong thank you.

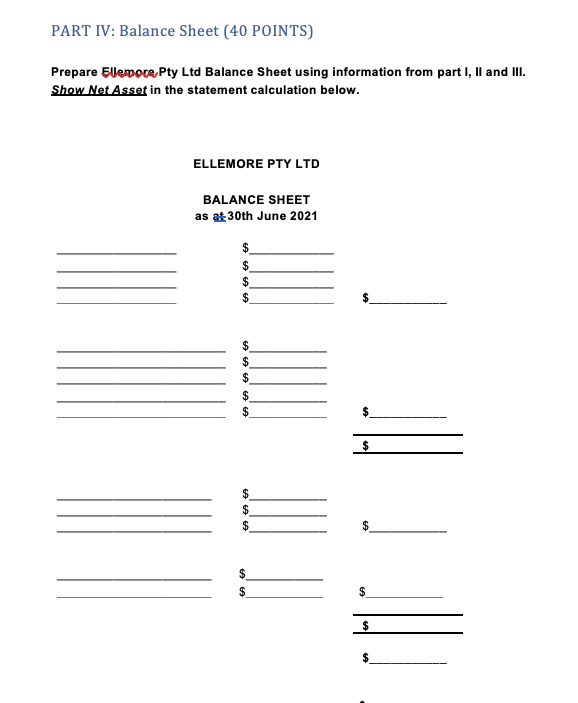

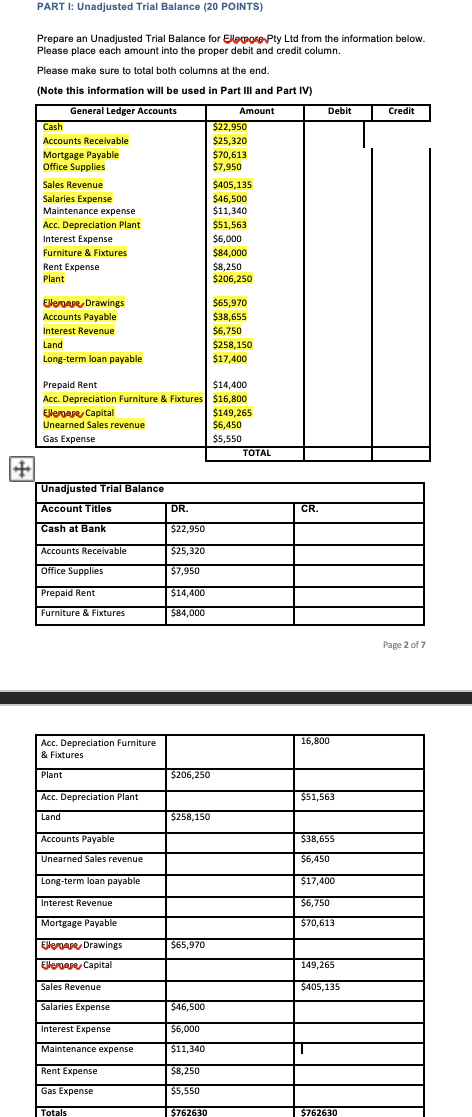

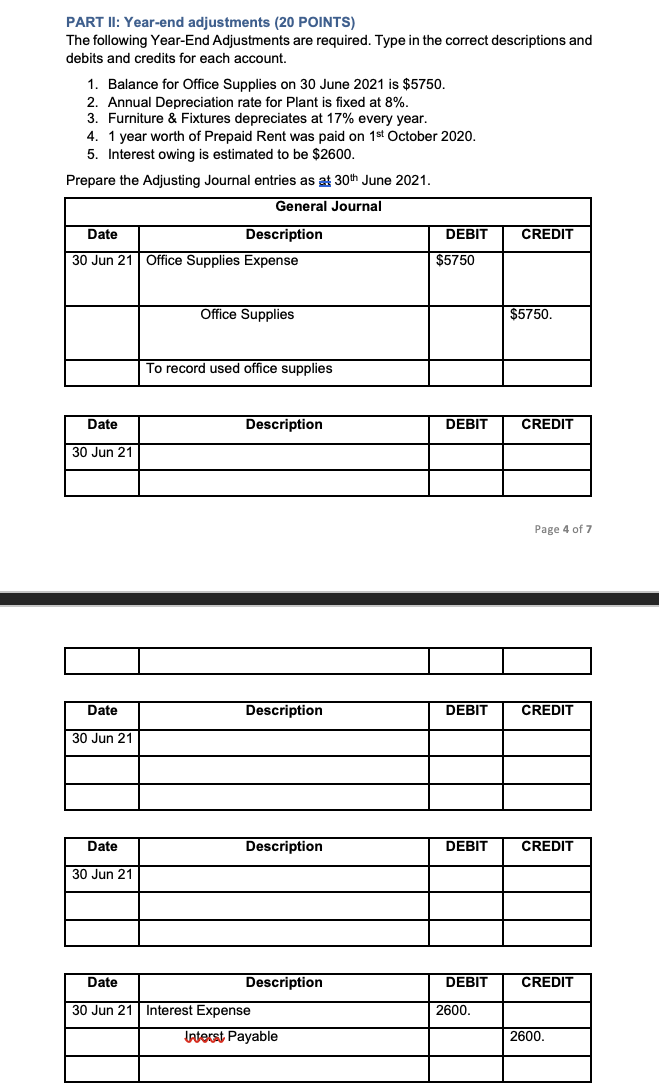

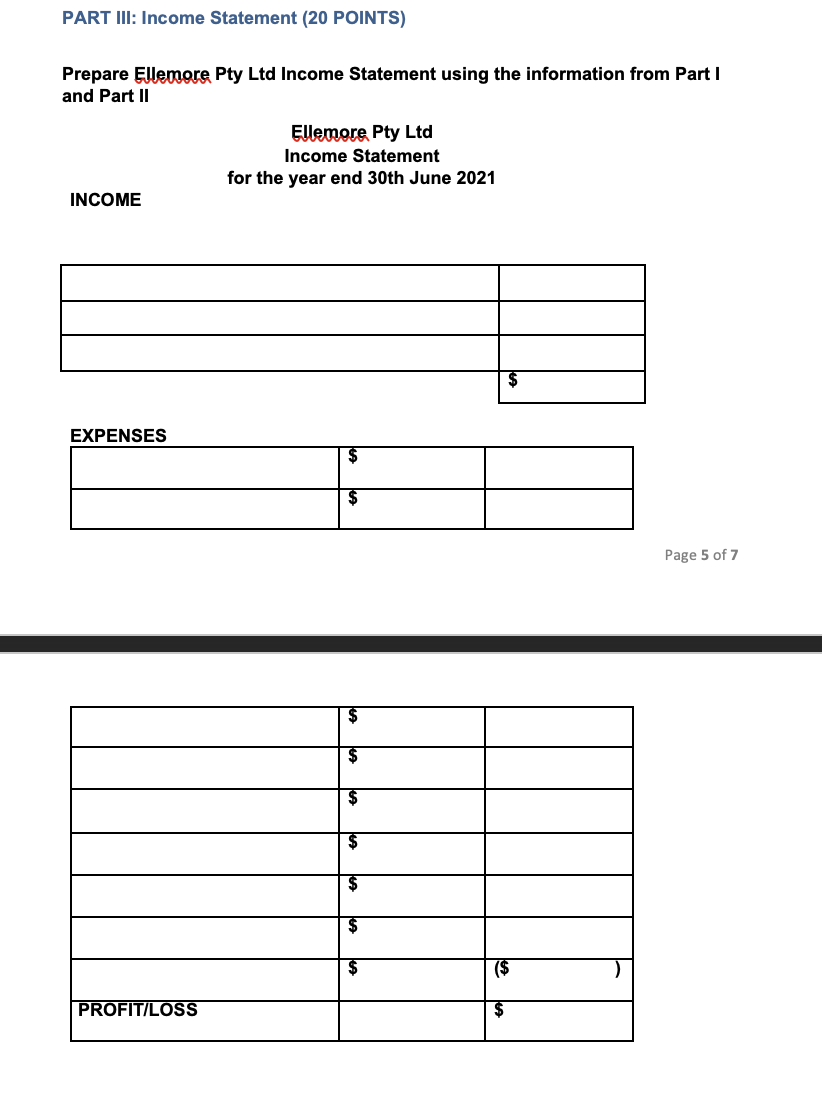

PART IV: Balance Sheet (40 POINTS) Prepare EVerone Pty Ltd Balance Sheet using information from part I, II and III. Show Net Asset in the statement calculation below. ELLEMORE PTY LTD BALANCE SHEET as at30th June 2021 $ th $ $PART I: Unadjusted Trial Balance (20 POINTS) Prepare an Unadjusted Trial Balance for Ellegions Pty Ltd from the information below. Please place each amount into the proper debit and credit column. Please make sure to total both columns at the end. (Note this information will be used in Part Ill and Part IV) General Ledger Accounts Amount Debit Credit Cash $22,950 Accounts Receivable $25,320 Mortgage Payable $70,613 Office Supplies $7,950 Sales Revenue $405,135 Salaries Expense $46,500 Maintenance expense $11,340 Acc. Depreciation Plant $51,563 Interest Expense $6,000 Furniture & Fixtures $84,000 Rent Expense $8,250 Plant $206,250 Ellergare Drawings $65,970 Accounts Payable $38,655 Interest Revenue $6,750 Land $258,150 Long-term loan payable $17,400 Prepaid Rent $14,400 Acc. Depreciation Furniture & Fixtures $16,800 Ellergave Capital $149,265 Unearned Sales revenue $6,450 Gas Expense $5,550 TOTAL Unadjusted Trial Balance Account Titles DR. CR. Cash at Bank $22,950 Accounts Receivable 525,320 Office Supplies $7,950 Prepaid Rent $14,400 Furniture & Fixtures $84,000 Page 2 of 7 Acc. Depreciation Furniture & Fixtures Plant Acc. Depreciation Plant Land Accounts Payable Unearned Sales revenue Long-term loan payable Interest Revenue $6,750 Mortgage Payable $70,613 Jean Drawings $65,970 JeanCapital 149,265 Sales Revenue $405,135 Salaries Expen $46,500 Interest Expense $6,000 Maintenance expense $11,340 Rent Expense $8,250 Gas Expense $5,550 5762630 1630PART II: Year-end adjustments (20 POINTS) The following Year-End Adjustments are required. Type in the correct descriptions and debits and credits for each account. 1. Balance for Office Supplies on 30 June 2021 is $5750. 2. Annual Depreciation rate for Plant is fixed at 8%. 3. Furniture & Fixtures depreciates at 17% every year. 4. 1 year worth of Prepaid Rent was paid on 1st October 2020. 5. Interest owing is estimated to be $2600. Prepare the Adjusting Journal entries as at 30th June 2021. General Journal Date Description DEBIT CREDIT 30 Jun 21 | Office Supplies Expense $5750 Office Supplies $5750. To record used office supplies Date Description DEBIT CREDIT 30 Jun 21 Page 4 of 7 Date Description DEBIT CREDIT 30 Jun 21 Date Description DEBIT CREDIT 30 Jun 21 Date Description DEBIT CREDIT 30 Jun 21 | Interest Expense 2600. Intoost Payable 2600.PART III: Income Statement (20 POINTS) Prepare Ellemore Pty Ltd Income Statement using the information from Part I and Part II Ellemore Pty Ltd Income Statement for the year end 30th June 2021 INCOME EXPENSES Page 5 of 7 $ $ ($ PROFIT/LOSS