Question: Hello, i need help for this question Thanks Accueil Insertion Dessin Conception Mise en page Rfrences Publipostage Rvision Affichage Cration de tableau Mise en page

Hello, i need help for this question

Thanks

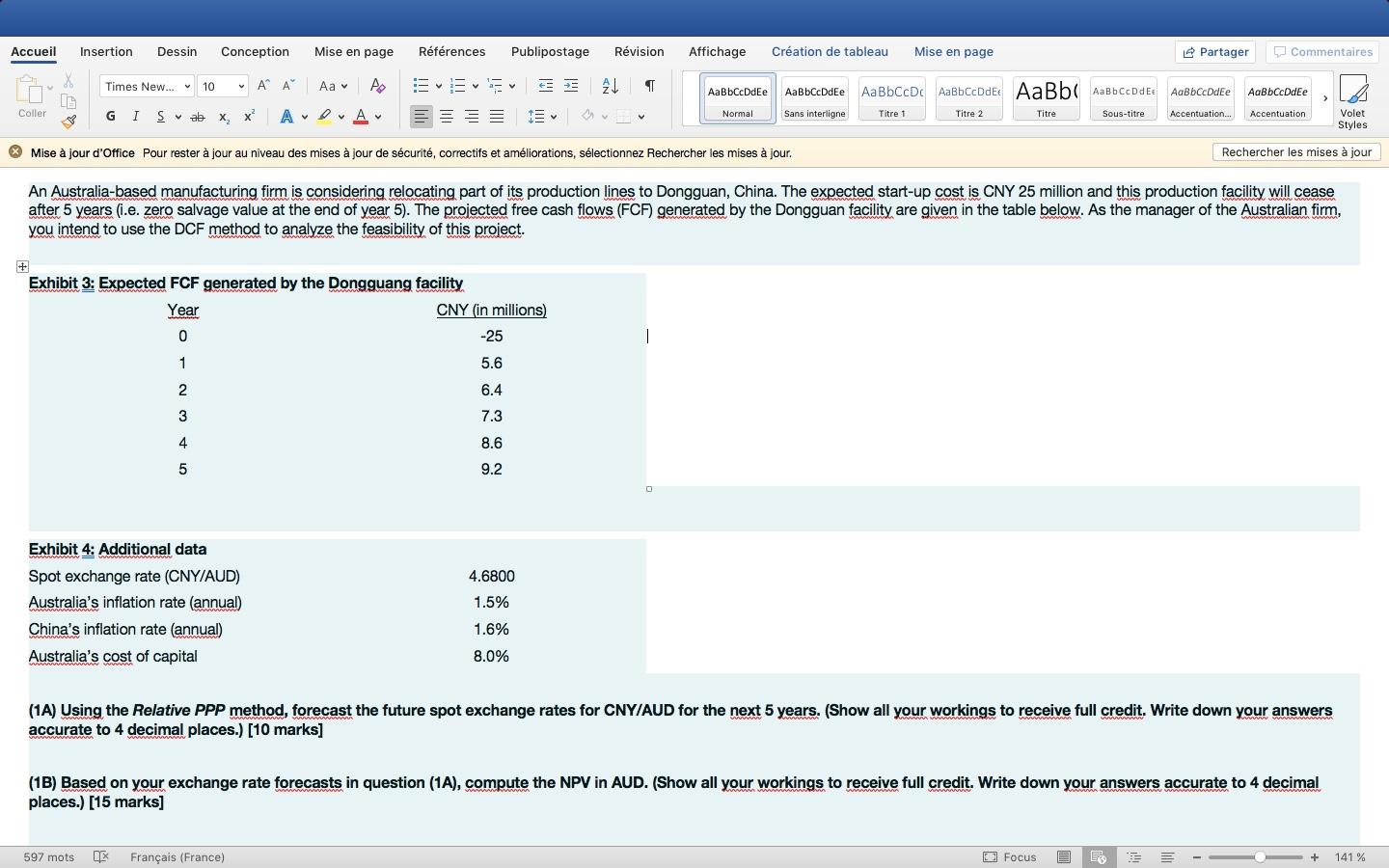

Accueil Insertion Dessin Conception Mise en page Rfrences Publipostage Rvision Affichage Cration de tableau Mise en page Partager Commentaires Times New... 10 A A T AaBbCcDdEe AaBbCcDdEe AaBbCcDc AaBb CcDdEt AaBb AaBb CcDd Ee AgBb CcDdEe AaBbCcDdEe Coller G I S + ab x Normal ADA x Titre 1 Sans interligne Titre 2 Titre Sous-titre Accentuation... Accentuation Volet Styles Mise jour d'Office Pour rester jour au niveau des mises jour de scurit, correctifs et amliorations, slectionnez Rechercher les mises jour. Rechercher les mises jour An Australia-based manufacturing firm is considering relocating part of its production lines to Dongguan, China. The expected start-up cost is CNY 25 million and this production facility will cease after 5 years (.e. zero salvage value at the end of year 5). The projected free cash flows (FCF) generated by the Dongguan facility are given in the table below. As the manager of the Australian firm, you intend to use the DCF method to analyze the feasibility of this project. Exhibit 3: Expected FCF generated by the Dongguang facility Year CNY (in millions) 0 -25 1 1 5.6 2 6.4 7.3 3 4 8.6 5 9.2 4.6800 Exhibit 4: Additional data Spot exchange rate (CNY/AUD) Australia's inflation rate (annual) China's inflation rate (annual) Australia's cost of capital 1.5% 1.6% 8.0% (1A) Using the Relative PPP method, forecast the future spot exchange rates for CNY/AUD for the next 5 years. (Show all your workings to receive full credit. Write down your answers accurate to 4 decimal places.) [10 marks] (13) Based on your exchange rate forecasts in question (1A), compute the NPV in AUD. (Show all your workings to receive full credit. Write down your answers accurate to 4 decimal places.) [15 marks] 597 mots LE Franais (France) D Focus 3 + 141%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts