Question: Hello, I need help learning how to solve these kinds of problems. thanks for the help Swap Agreement Swap Type The Bank of Detroit has

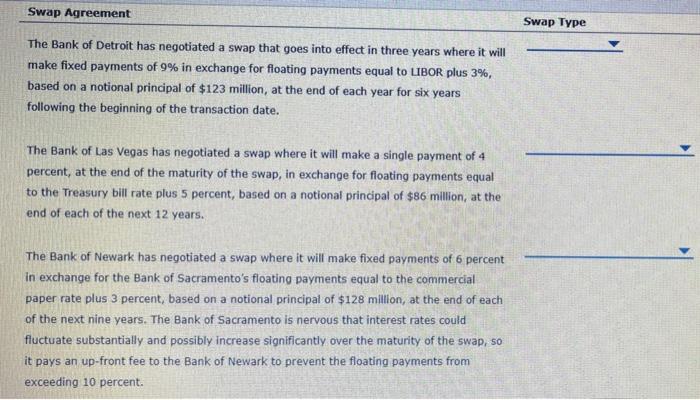

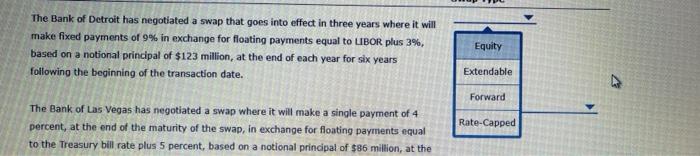

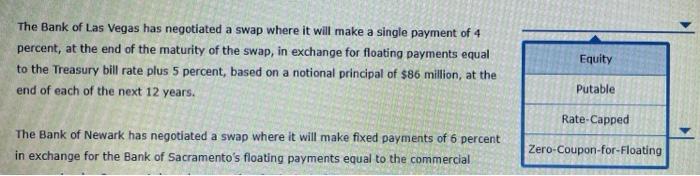

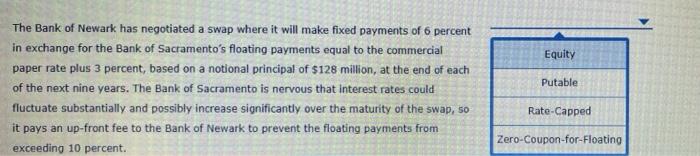

Swap Agreement Swap Type The Bank of Detroit has negotiated a swap that goes into effect in three years where it will make fixed payments of 9% in exchange for floating payments equal to LIBOR plus 3%, based on a notional principal of $123 million, at the end of each year for six years following the beginning of the transaction date. The Bank of Las Vegas has negotiated a swap where it will make a single payment of 4 percent, at the end of the maturity of the swap, in exchange for floating payments equal to the Treasury bill rate plus 5 percent, based on a notional principal of $86 million, at the end of each of the next 12 years. The Bank of Newark has negotiated a swap where it will make fixed payments of 6 percent in exchange for the Bank of Sacramento's floating payments equal to the commercial paper rate plus 3 percent, based on a notional principal of $128 million, at the end of each of the next nine years. The Bank of Sacramento is nervous that interest rates could fluctuate substantially and possibly increase significantly over the maturity of the swap, so it pays an up-front fee to the Bank of Newark to prevent the floating payments from exceeding 10 percent. The Bank of Detroit has negotiated a swap that goes into effect in three years where it will make fixed payments of 9% in exchange for floating payments equal to LIBOR plus 3%, based on a notional principal of $123 million at the end of each year for six years following the beginning of the transaction date. Equity Extendable Forward The Bank of Las Vegas has negotiated a swap where it will make a single payment of 4 percent, at the end of the maturity of the swap, in exchange for floating payments equal to the Treasury bil rate plus 5 percent, based on a notional principal of $86 million, at the Rate-Capped The Bank of Las Vegas has negotiated a swap where it will make a single payment of 4 percent, at the end of the maturity of the swap, in exchange for floating payments equal to the Treasury bill rate plus 5 percent, based on a notional principal of $86 million, at the end of each of the next 12 years. Equity Putable Rate-Capped The Bank of Newark has negotiated a swap where it will make fixed payments of 6 percent in exchange for the Bank of Sacramento's floating payments equal to the commercial Zero-Coupon-for-Floating Equity Putable The Bank of Newark has negotiated a swap where it will make fixed payments of 6 percent in exchange for the Bank of Sacramento's floating payments equal to the commercial paper rate plus 3 percent, based on a notional principal of $128 million, at the end of each of the next nine years. The Bank of Sacramento is nervous that interest rates could fluctuate substantially and possibly increase significantly over the maturity of the swap, 50 it pays an up-front fee to the Bank of Newark to prevent the floating payments from exceeding 10 percent. Rate-Capped Zero-Coupon-for-Floating Swap Agreement Swap Type The Bank of Detroit has negotiated a swap that goes into effect in three years where it will make fixed payments of 9% in exchange for floating payments equal to LIBOR plus 3%, based on a notional principal of $123 million, at the end of each year for six years following the beginning of the transaction date. The Bank of Las Vegas has negotiated a swap where it will make a single payment of 4 percent, at the end of the maturity of the swap, in exchange for floating payments equal to the Treasury bill rate plus 5 percent, based on a notional principal of $86 million, at the end of each of the next 12 years. The Bank of Newark has negotiated a swap where it will make fixed payments of 6 percent in exchange for the Bank of Sacramento's floating payments equal to the commercial paper rate plus 3 percent, based on a notional principal of $128 million, at the end of each of the next nine years. The Bank of Sacramento is nervous that interest rates could fluctuate substantially and possibly increase significantly over the maturity of the swap, so it pays an up-front fee to the Bank of Newark to prevent the floating payments from exceeding 10 percent. The Bank of Detroit has negotiated a swap that goes into effect in three years where it will make fixed payments of 9% in exchange for floating payments equal to LIBOR plus 3%, based on a notional principal of $123 million at the end of each year for six years following the beginning of the transaction date. Equity Extendable Forward The Bank of Las Vegas has negotiated a swap where it will make a single payment of 4 percent, at the end of the maturity of the swap, in exchange for floating payments equal to the Treasury bil rate plus 5 percent, based on a notional principal of $86 million, at the Rate-Capped The Bank of Las Vegas has negotiated a swap where it will make a single payment of 4 percent, at the end of the maturity of the swap, in exchange for floating payments equal to the Treasury bill rate plus 5 percent, based on a notional principal of $86 million, at the end of each of the next 12 years. Equity Putable Rate-Capped The Bank of Newark has negotiated a swap where it will make fixed payments of 6 percent in exchange for the Bank of Sacramento's floating payments equal to the commercial Zero-Coupon-for-Floating Equity Putable The Bank of Newark has negotiated a swap where it will make fixed payments of 6 percent in exchange for the Bank of Sacramento's floating payments equal to the commercial paper rate plus 3 percent, based on a notional principal of $128 million, at the end of each of the next nine years. The Bank of Sacramento is nervous that interest rates could fluctuate substantially and possibly increase significantly over the maturity of the swap, 50 it pays an up-front fee to the Bank of Newark to prevent the floating payments from exceeding 10 percent. Rate-Capped Zero-Coupon-for-Floating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts