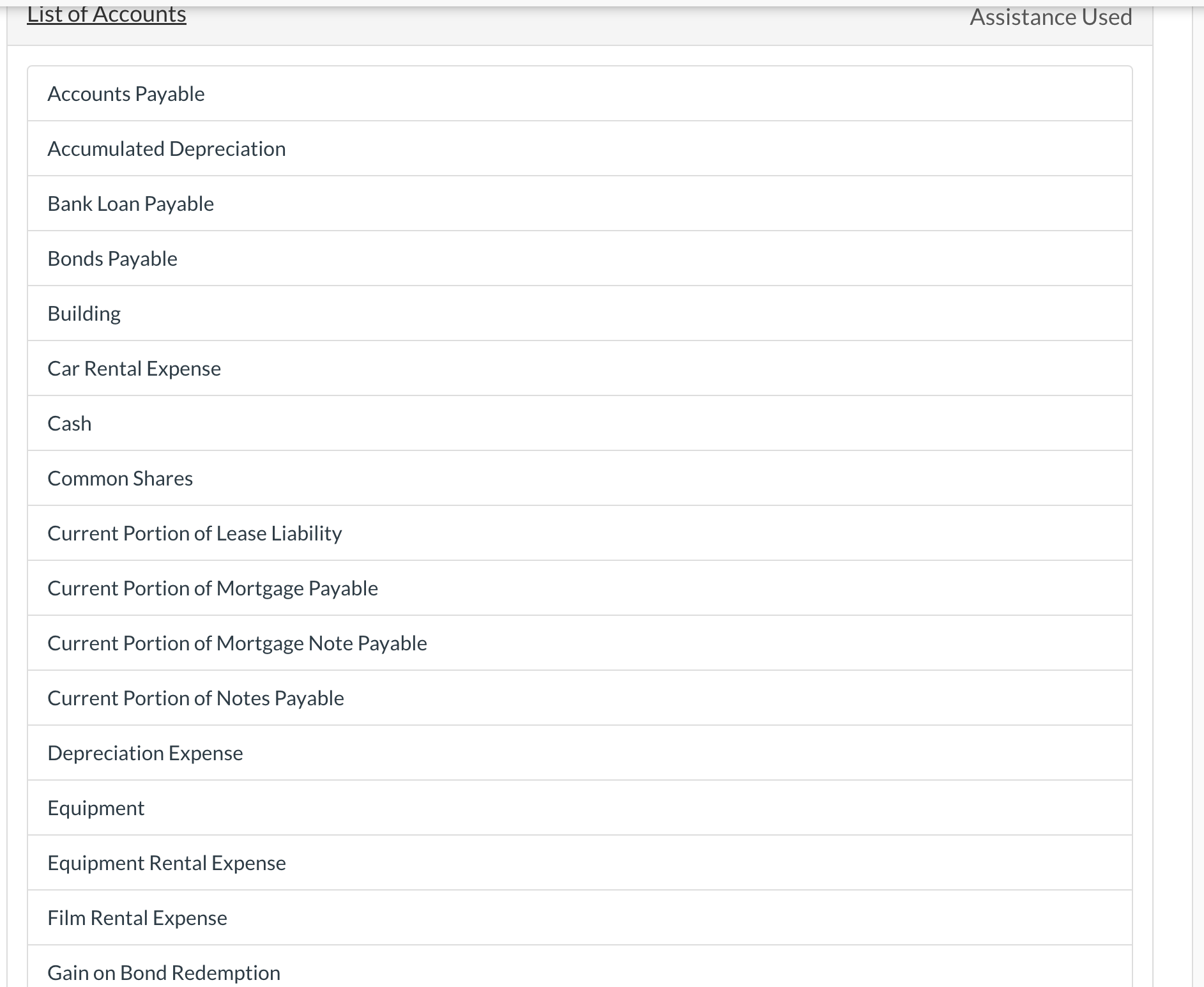

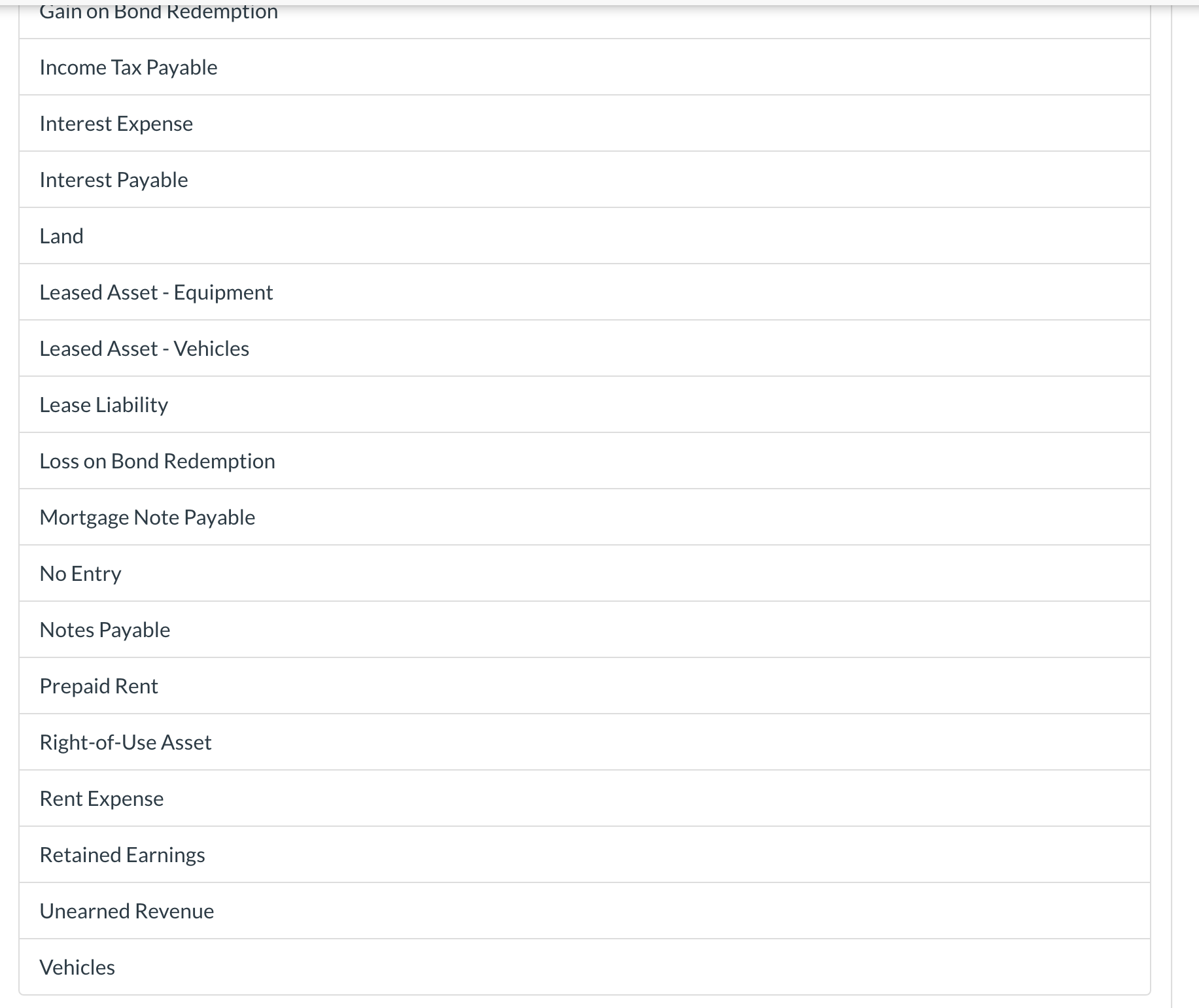

Question: hello i need help on part b and in the last 2 pictures it shows the list of accounts that should be put on that

hello i need help on part b and in the last 2 pictures it shows the list of accounts that should be put on that one blank spot

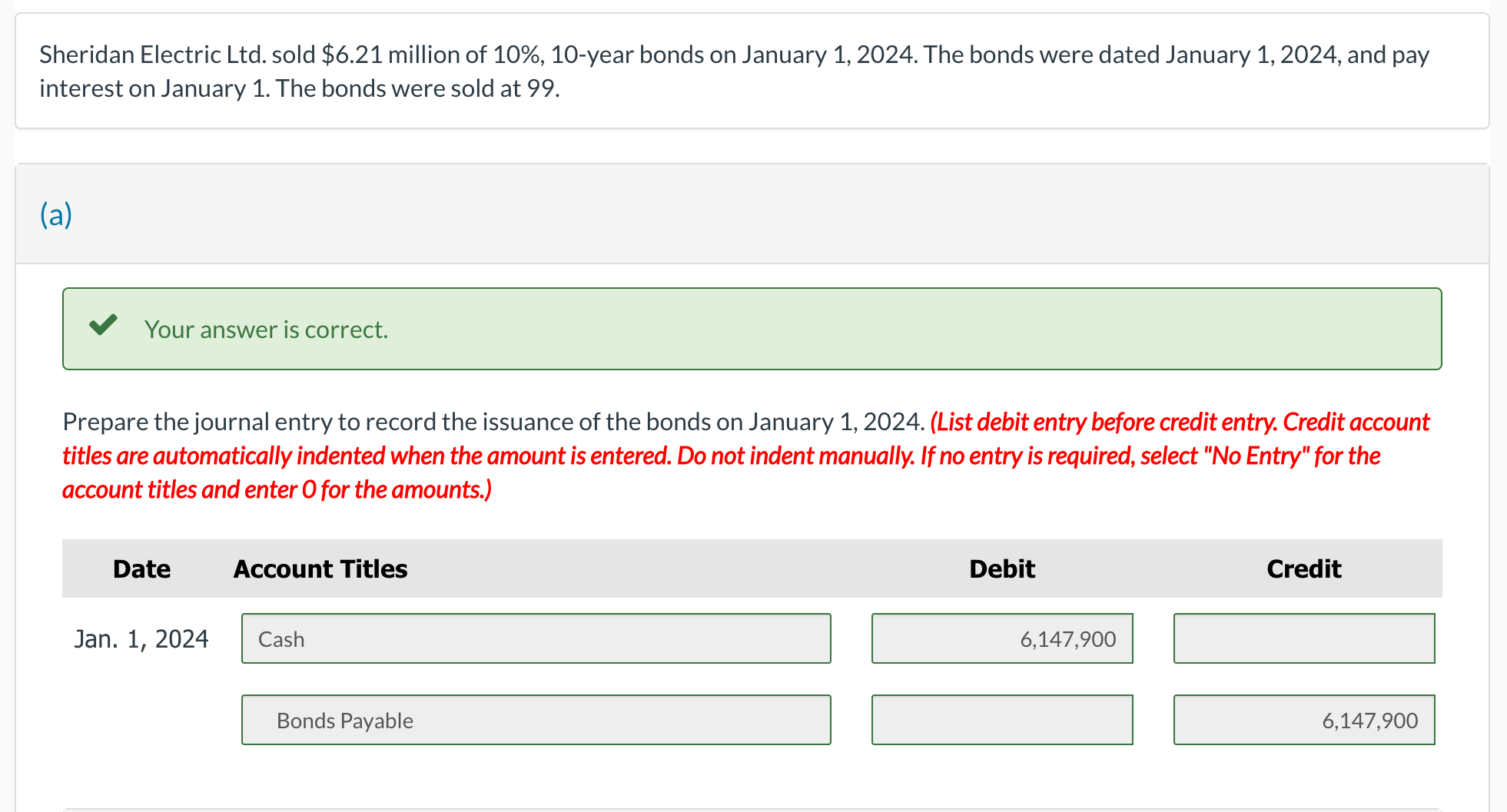

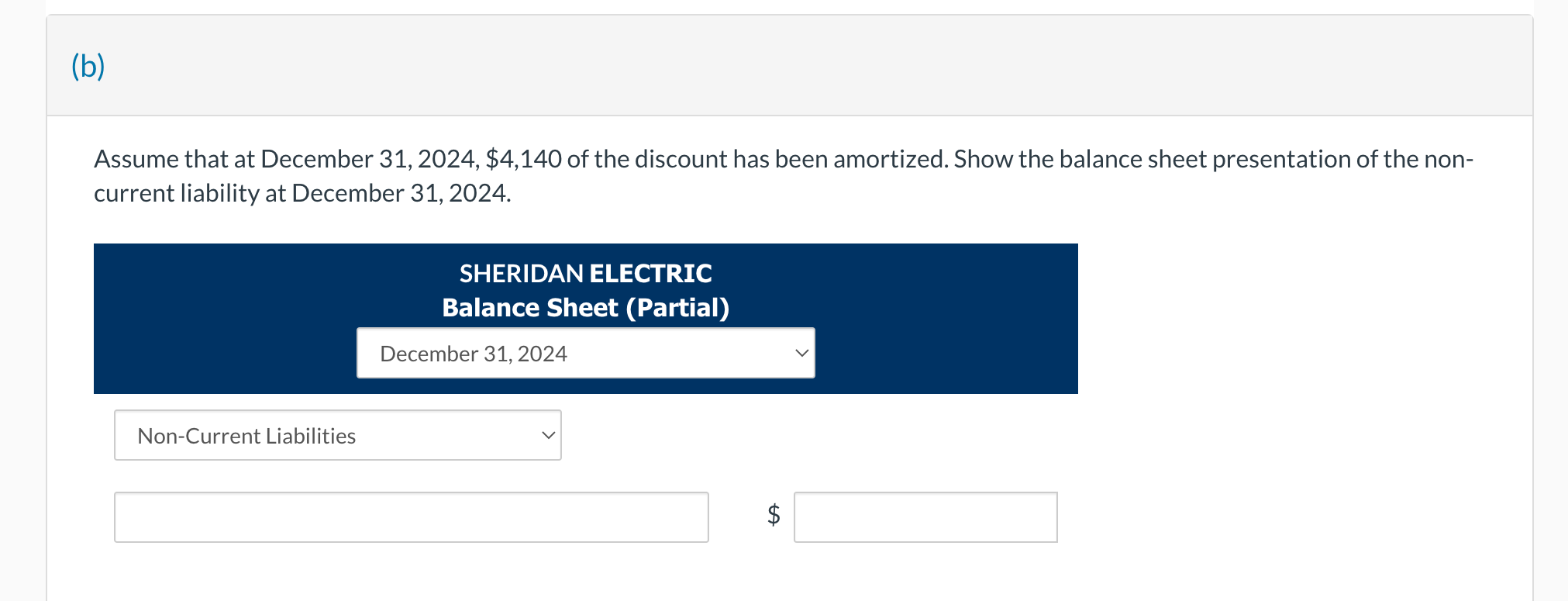

List of Accounts Assistance Used Accounts Payable Accumulated Depreciation Bank Loan Payable Bonds Payable Building Car Rental Expense Cash Common Shares Current Portion of Lease Liability Current Portion of Mortgage Payable Current Portion of Mortgage Note Payable Current Portion of Notes Payable Depreciation Expense Equipment Equipment Rental Expense Film Rental Expense Gain on Bond Redemption Gain on Bond Redemption Income Tax Payable Interest Expense Interest Payable Land Leased Asset - Equipment Leased Asset - Vehicles Lease Liability Loss on Bond Redemption Mortgage Note Payable No Entry Notes Payable Prepaid Rent Right-of-Use Asset Rent Expense Retained Earnings Unearned Revenue Vehicles Sheridan Electric Ltd. sold \$6.21 million of 10\%, 10-year bonds on January 1, 2024. The bonds were dated January 1, 2024, and pay interest on January 1. The bonds were sold at 99. (a) Your answer is correct. Prepare the journal entry to record the issuance of the bonds on January 1, 2024. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Assume that at December 31, 2024, $4,140 of the discount has been amortized. Show the balance sheet presentation of the noncurrent liability at December 31, 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts