Question: Hello, I need help on the Balance Sheet please. Specifically, the red boxes. Thank you! Carla Vista Corporation's trial balance at December 31, 2020, is

Hello, I need help on the Balance Sheet please. Specifically, the red boxes. Thank you!

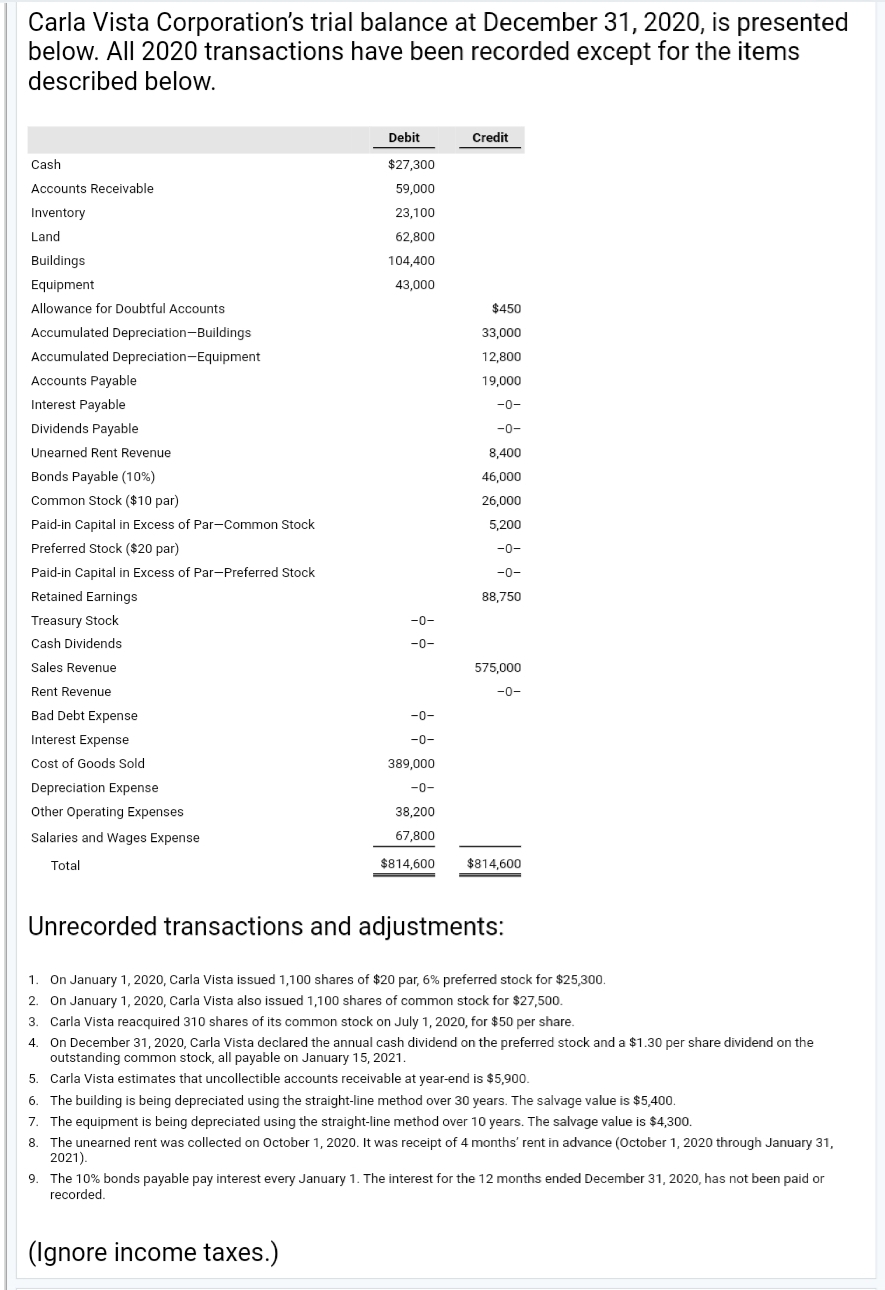

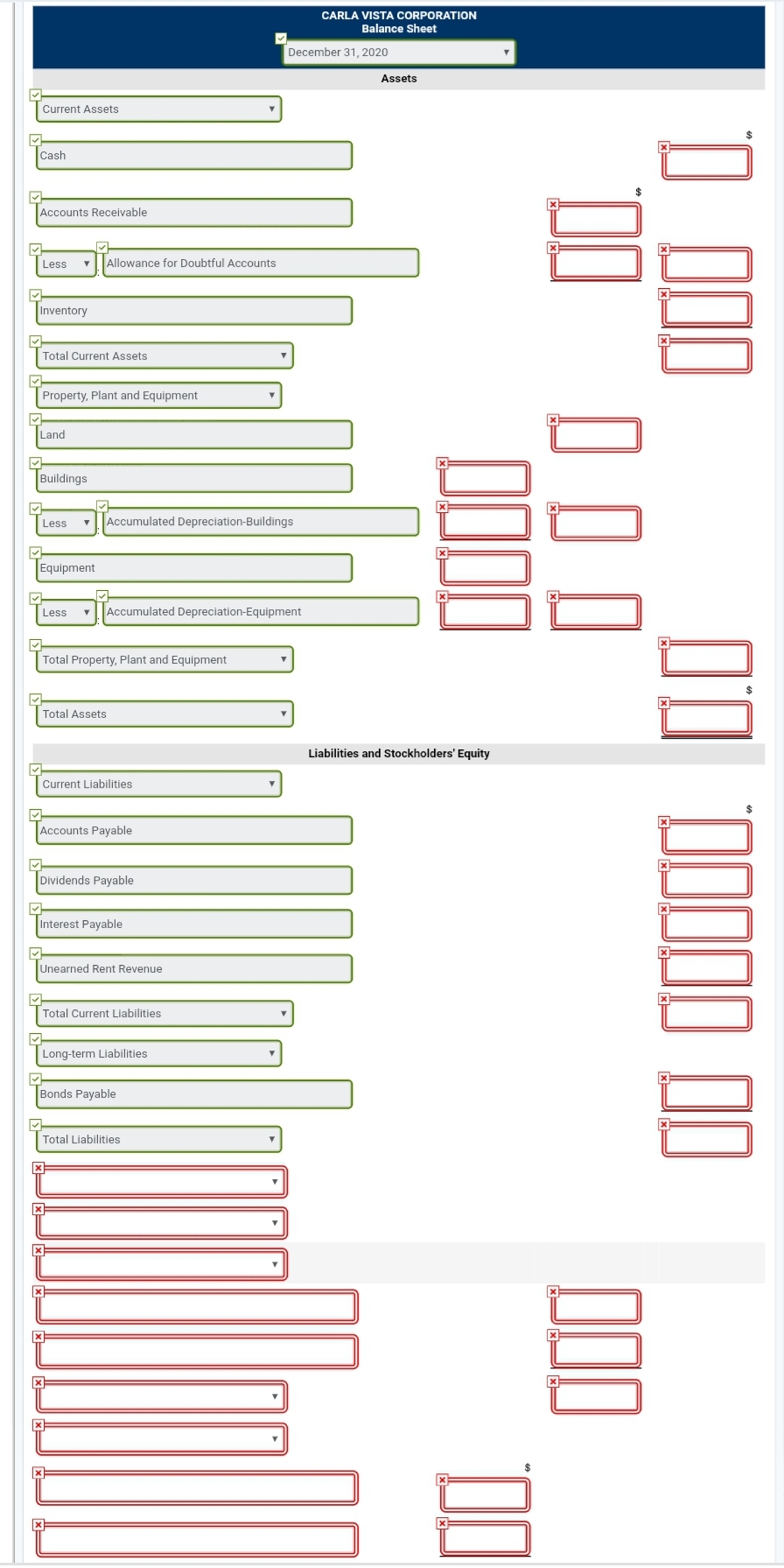

Carla Vista Corporation's trial balance at December 31, 2020, is presented below. All 2020 transactions have been recorded except for the items described below. Debit Credit Cash $27,300 Accounts Receivable 59,000 Inventory 23,100 Land 62,800 Buildings 104,400 Equipment 43,000 Allowance for Doubtful Accounts $450 Accumulated Depreciation-Buildings 33,000 Accumulated Depreciation-Equipment 12,800 Accounts Payable 19,000 Interest Payable -0- Dividends Payable -0- Unearned Rent Revenue 8,400 Bonds Payable (10%) 46,000 Common Stock ($10 par) 26,000 Paid-in Capital in Excess of Par-Common Stock 5,200 Preferred Stock ($20 par) -0- Paid-in Capital in Excess of Par-Preferred Stock -0- Retained Earnings 88,750 Treasury Stock -0- Cash Dividends -0- Sales Revenue 575,000 Rent Revenue -0- Bad Debt Expense -0- Interest Expense -0- Cost of Goods Sold 389,000 Depreciation Expense -0- Other Operating Expenses 38,200 Salaries and Wages Expense 67,800 Total $814,600 $814,600 Unrecorded transactions and adjustments: 1. On January 1, 2020, Carla Vista issued 1,100 shares of $20 par, 6% preferred stock for $25,300. 2. On January 1, 2020, Carla Vista also issued 1,100 shares of common stock for $27,500. 3. Carla Vista reacquired 310 shares of its common stock on July 1, 2020, for $50 per share. 4. On December 31, 2020, Carla Vista declared the annual cash dividend on the preferred stock and a $1.30 per share dividend on the outstanding common stock, all payable on January 15, 2021. 5. Carla Vista estimates that uncollectible accounts receivable at year-end is $5,900. 6. The building is being depreciated using the straight-line method over 30 years. The salvage value is $5,400. 7. The equipment is being depreciated using the straight-line method over 10 years. The salvage value is $4,300. 8. The unearned rent was collected on October 1, 2020. It was receipt of 4 months' rent in advance (October 1, 2020 through January 31, 2021). The 10% bonds payable pay interest every January 1. The interest for the 12 months ended December 31, 2020, has not been paid or recorded. (Ignore income taxes.)\fCARLA VISTA CORPORATION V Balance Sheet December 31, 2020 Assets Current Assets Cash V Accounts Receivable Less Allowance for Doubtful Accounts Inventory Total Current Assets Property, Plant and Equipment V Land V Buildings Less Accumulated Depreciation-Buildings Equipment Less Accumulated Depreciation-Equipment 00OO Total Property, Plant and Equipment Total Assets Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Dividends Payable V Interest Payable V Unearned Rent Revenue Total Current Liabilities Long-term Liabilities Bonds Payable Total Liabilities OO OOOOO