Question: Hello, I need help solving this accounting problem. S eCampus: Home Content Connect X f (1) Facebook X G Grammarly C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware%252Fmhep.. G ili Apps

Hello, I need help solving this accounting problem.

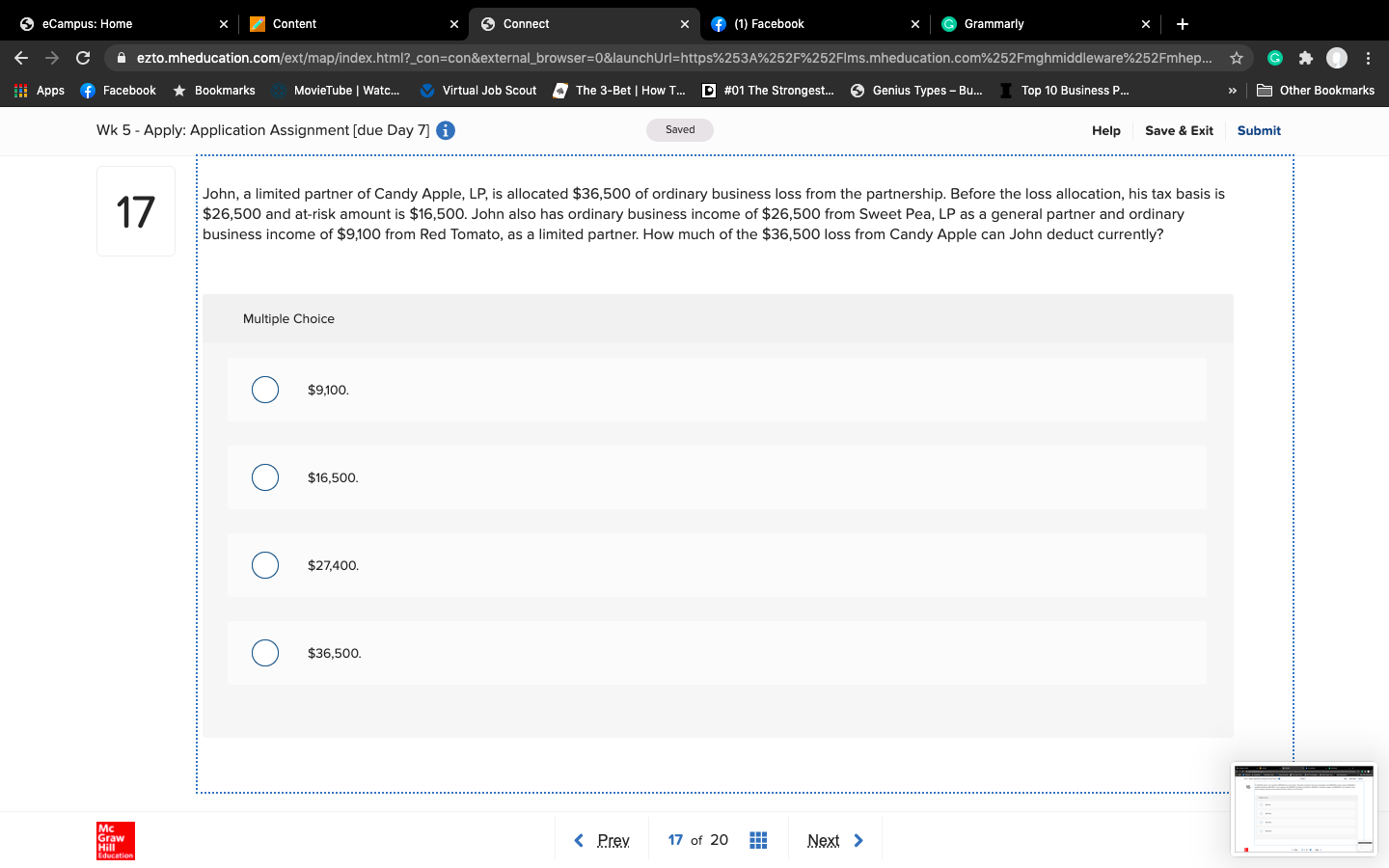

S eCampus: Home Content Connect X f (1) Facebook X G Grammarly C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware%252Fmhep.. G ili Apps Facebook * Bookmarks MovieTube | Watc.. Virtual Job Scout The 3-Bet | How T... D #01 The Strongest. Genius Types - Bu.. I Top 10 Business P. Other Bookmarks Wk 5 - Apply: Application Assignment [due Day 7] @ Saved Help Save & Exit Submit 17 John, a limited partner of Candy Apple, LP, is allocated $36,500 of ordinary business loss from the partnership. Before the loss allocation, his tax basis is $26,500 and at-risk amount is $16,500. John also has ordinary business income of $26,500 from Sweet Pea, LP as a general partner and ordinary business income of $9,100 from Red Tomato, as a limited partner. How much of the $36,500 loss from Candy Apple can John deduct currently? Multiple Choice O $9,100. O $16,500. O $27,400. O $36,500. Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts