Question: Hello, I need help understanding the solution and showing the work? Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and

Hello, I need help understanding the solution and showing the work?

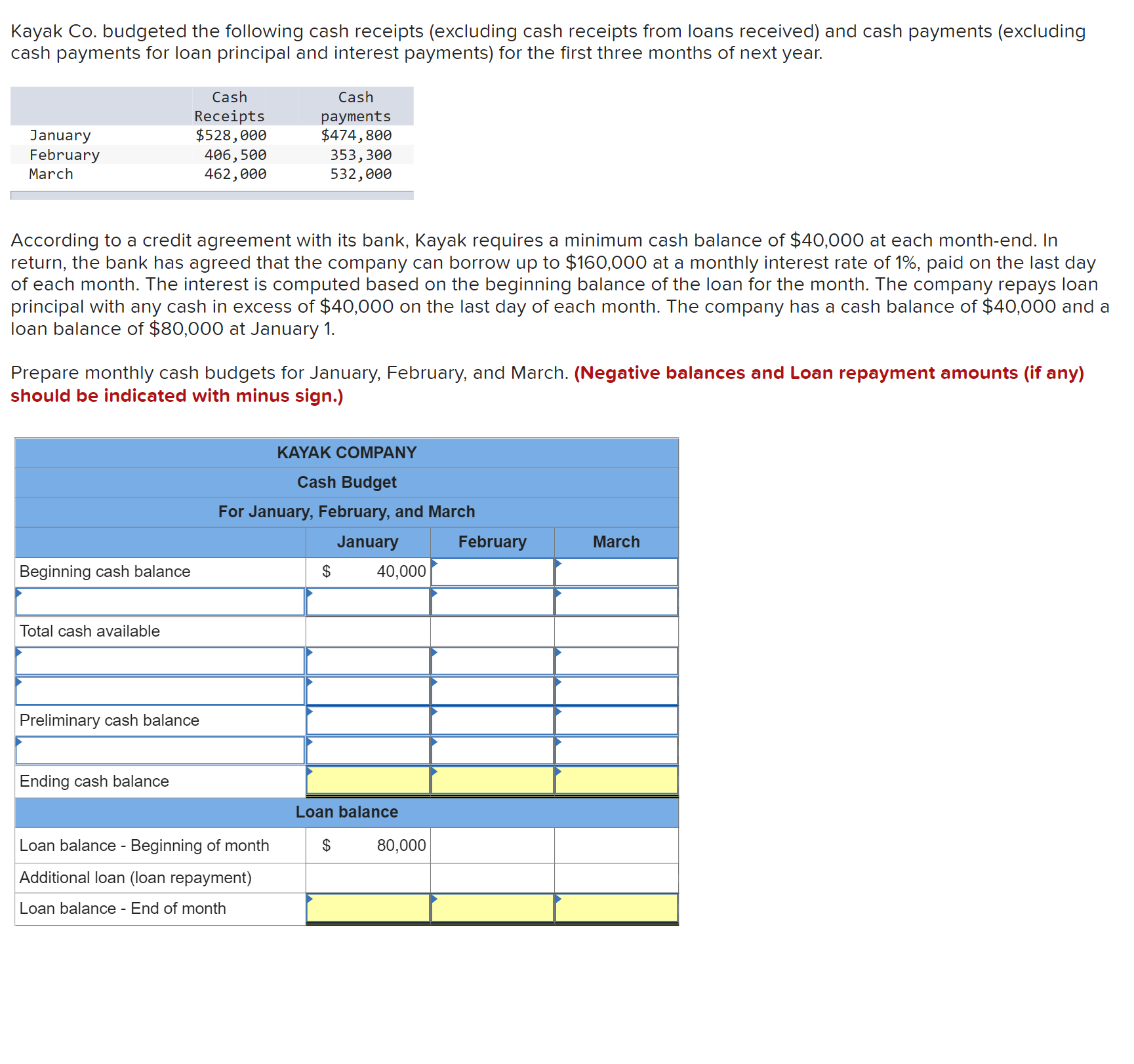

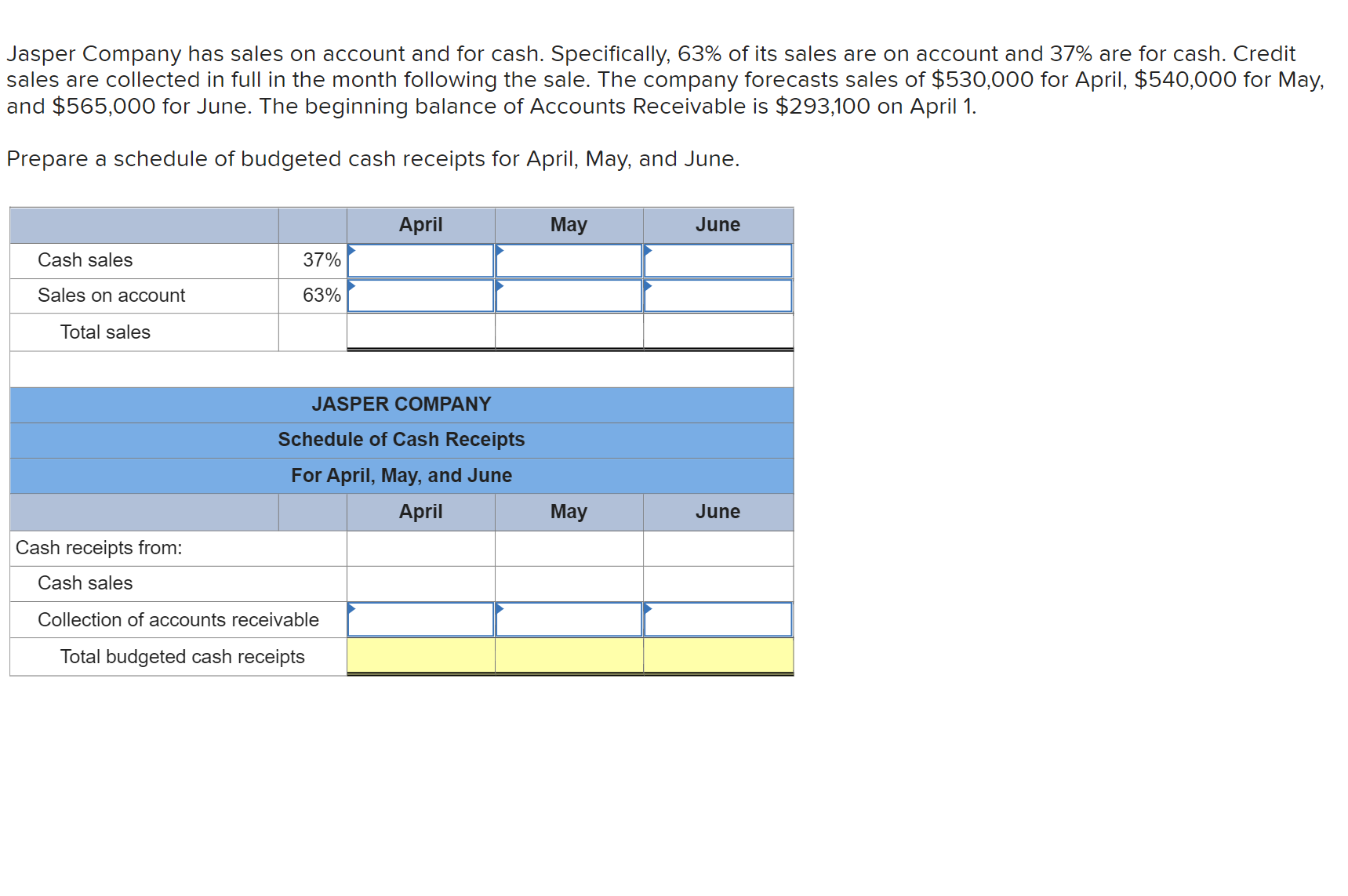

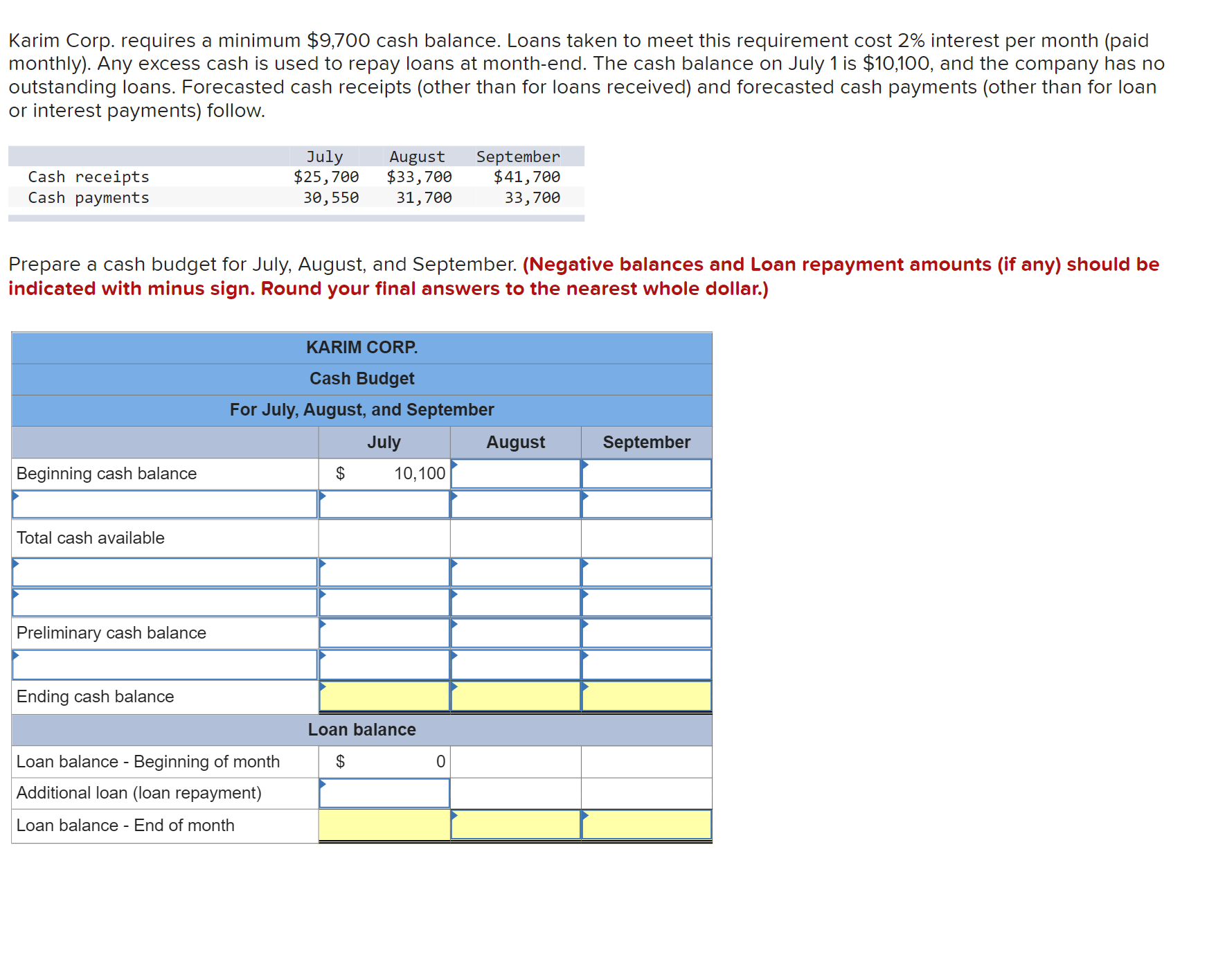

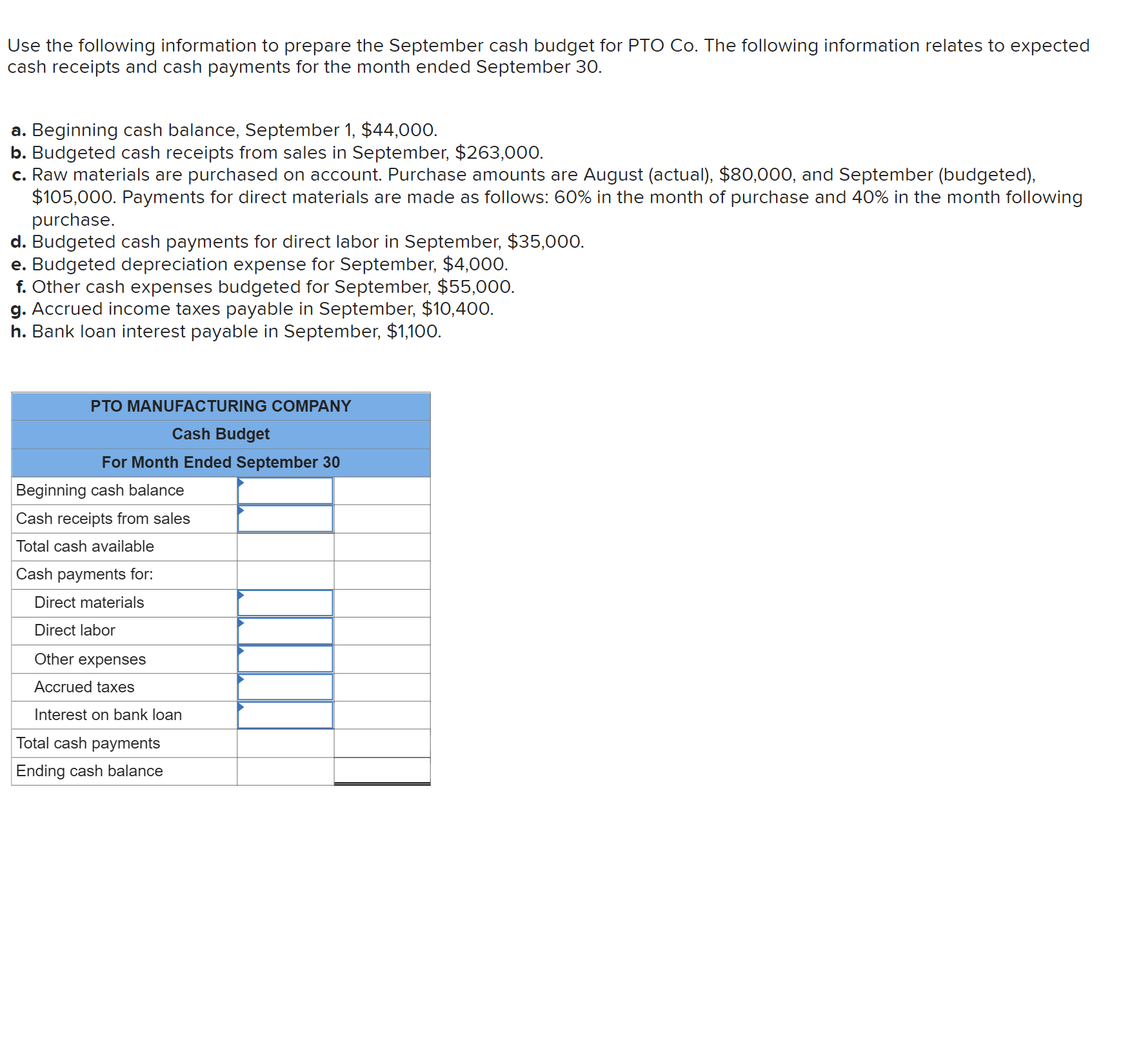

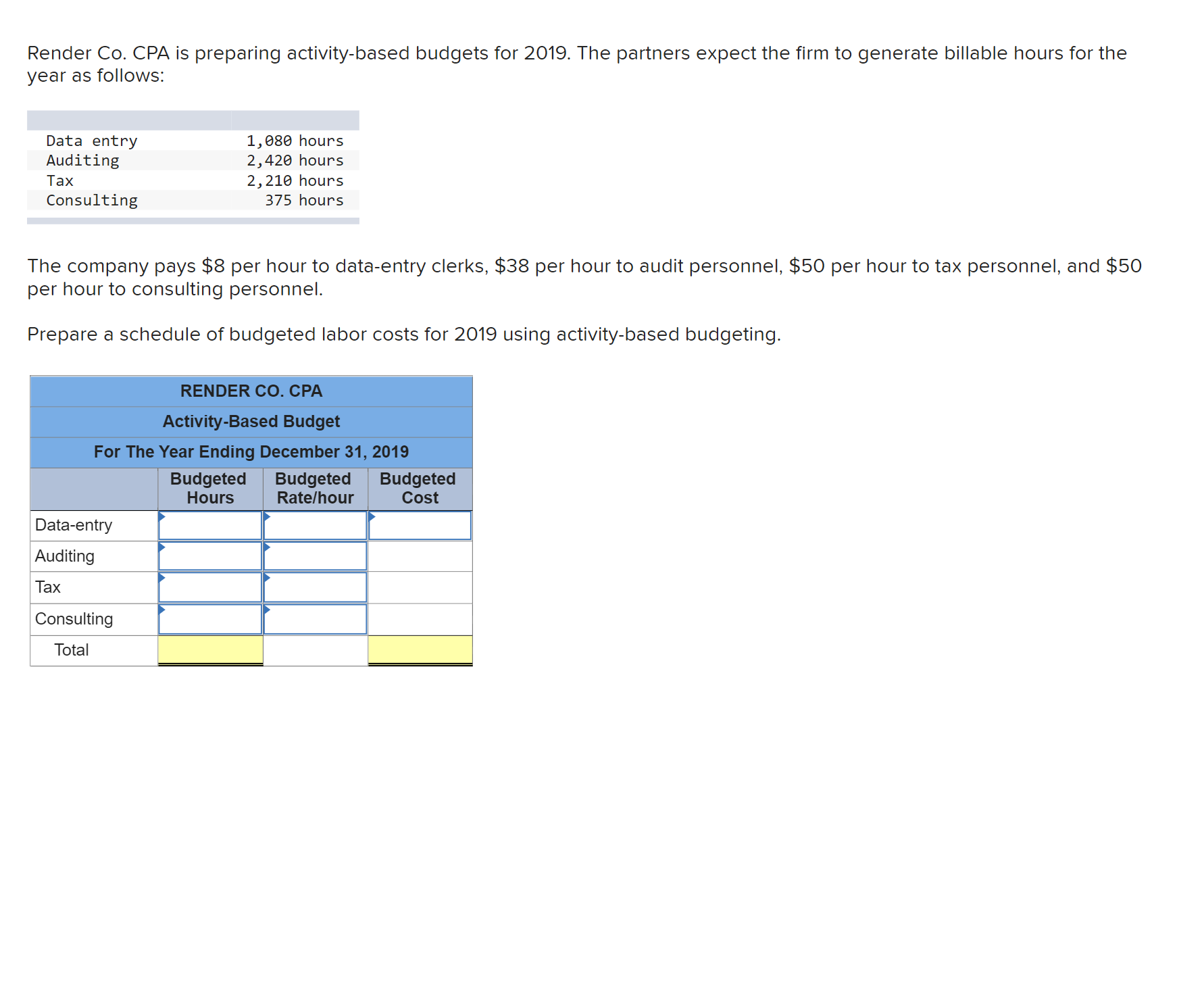

Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. Cash Cash Receipts payments January $528, 666 $474,866 February 466, 566 353,366 March 462,666 532,666 According to a credit agreement with its bank, Kayak requires a minimum cash balance of $40,000 at each monthend. In return, the bank has agreed that the company can borrow up to $160,000 at a monthly interest rate of1%, paid on the last day of each month. The interest is computed based on the beginning balance of the loan for the month. The company repays loan principal with any cash in excess of $40,000 on the last day of each month. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Beginning cash balance $ 40,000 __ Preliminary cash balance Ending cash balance Loan balance - Beginning of month $ 80,000 Additional loan (loan repayment) Loan balance End of month Jasper Company has sales on account and for cash, Specifically, 63% of its sales are on account and 37% are for cash. Credit sales are collected in full in the month following the sale. The company forecasts sales of $530,000 for April, $540,000 for May, and $565,000 for June. The beginning balance of Accounts Receivable is $293,100 on April 1. Prepare a schedule of budgeted cash receipts for April, May, and June. Cash sales Sales on account Total sales Cash receipts from: Cash sales Collection of accounts receivable Total budgeted cash receipts Karim Corp. requires a minimum $9,700 cash balance. Loans taken to meet this requirement cost 2% interest per month (paid monthly). Any excess cash is used to repay loans at month-end. The cash balance on July 1 is $10,100, and the company has no outstanding loans. Forecasted cash receipts (other than for loans received) and forecasted cash payments (other than for loan or interest payments) follow. July August September Cash receipts $25,766 $33,766 $41,766 Cash payments 36, 556 31, 766 33, 766 Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) Beginning cash balance Ending cash balance Loan balance - Beginning of month Additional loan (loan repayment) Loan balance - End of month Use the following information to prepare the September cash budget for PTO C0. The following information relates to expected cash receipts and cash payments for the month ended September 30. 3. Beginning cash balance, September 1, $44,000. b. Budgeted cash receipts from sales in September, $263,000. c. Raw materials are purchased on account. Purchase amounts are August (actual), $80,000, and September (budgeted), $105,000. Payments for direct materials are made as follows: 60% in the month of purchase and 40% in the month following purchase. cl. Budgeted cash payments for direct labor in September, $35,000. e. Budgeted depreciation expense for September, $4,000. f. Other cash expenses budgeted for September, $55,000. 9. Accrued income taxes payable in September, $10,400. h. Bank loan interest payable in September, $1,100. Beginning cash balance Cash receipts from sales Total cash available Cash payments for: Direct materials Direct labor Other expenses Accrued taxes Interest on bank loan Total cash payments Ending cash balance Render Co. CPA is preparing activity-based budgets for 2019. The partners expect the firm to generate billable hours for the year as follows: Data entry 1,686 hours Auditing 2,426 hours Tax 2, 216 hours Consulting 375 hours The company pays $8 per hour to data-entry clerks, $38 per hour to audit personnel, $50 per hour to tax personnel, and $50 per hour to consulting personnel. Prepare a schedule of budgeted labor costs for 2019 using activity-based budgeting. Data-entry Auditing Tax Consulting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts