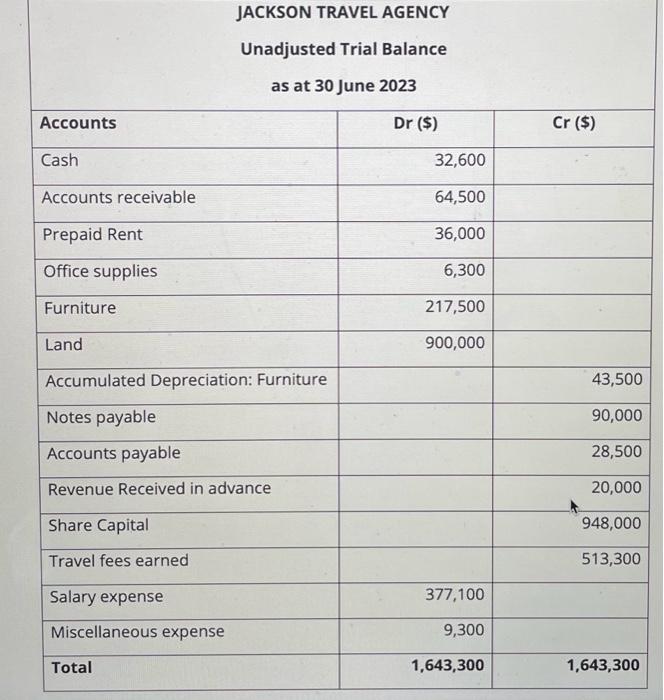

Question: hello, i need help witb these trial balances please JACKSON TRAVEL AGENCY Unadjusted Trial Balance as at 30 June 2023 begin{tabular}{|c|c|c|} hline Accounts & Dr($)

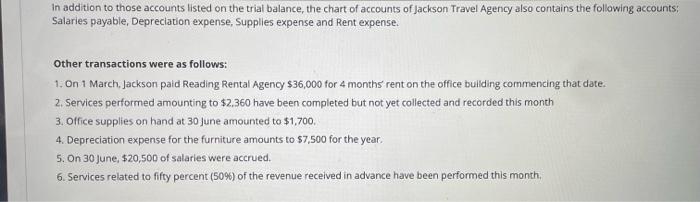

JACKSON TRAVEL AGENCY Unadjusted Trial Balance as at 30 June 2023 \begin{tabular}{|c|c|c|} \hline Accounts & Dr($) & Cr($) \\ \hline Cash & 32,600 & . \\ \hline Accounts receivable & 64,500 & \\ \hline Prepaid Rent & 36,000 & \\ \hline Office supplies & 6,300 & \\ \hline Furniture & 217,500 & . \\ \hline Land & 900,000 & \\ \hline Accumulated Depreciation: Furniture & % & 43,500 \\ \hline Notes payable & ? & 90,000 \\ \hline Accounts payable & & 28,500 \\ \hline Revenue Received in advance & & 20,000 \\ \hline Share Capital & & 948,000 \\ \hline Travel fees earned & & 513,300 \\ \hline Salary expense & 377,100 & \\ \hline Miscellaneous expense & 9,300 & \\ \hline Total & 1,643,300 & 1,643,300 \\ \hline \end{tabular} JACKSON TRAVEL AGENCY Adjusted Trial Balance as at 30 June 2023 In addition to those accounts listed on the trial balance, the chart of accounts of Jackson Travel Agency also contains the following accounts: Salaries payable, Depreciation expense, Supplies expense and Rent expense. Other transactions were as follows: 1. On 1 March, Jackson paid Reading Rental Agency $36,000 for 4 months rent on the office buliding commencing that date. 2. Services performed amounting to $2,360 have been completed but not yet collected and recorded this month 3. Office supplies on hand at 30 June amounted to $1,700. 4. Depreciation expense for the furniture amounts to $7,500 for the year. 5. On 30 June, $20,500 of salaries were accrued. 6. Services related to fifty percent ( 50% ) of the revenue received in advance have been performed this month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts