Question: Hello I need help with a formula for excel regarding federal withholding taxes. My answer from DQ 1 was this and it was correct 10,288Or

Hello I need help with a formula for excel regarding federal withholding taxes. My answer from DQ 1 was this and it was correct

10,288"Or my taxable wages"-350.00= 9,938.00 you would then resort to chart and go to the "over/but not over section between 7,754 and 15,967 which states 1540.00 plus 28%

then take the wage of 9938.00 and subtract it from the "but not over" number listed

9938-7754=2184 then take that and multiply it by the listed percent

2184*28%=611.52

then add the totals 2184+611.52=$2,795.52

9938-7754=2,184+611.52+1540.00=$4,335 tax with held

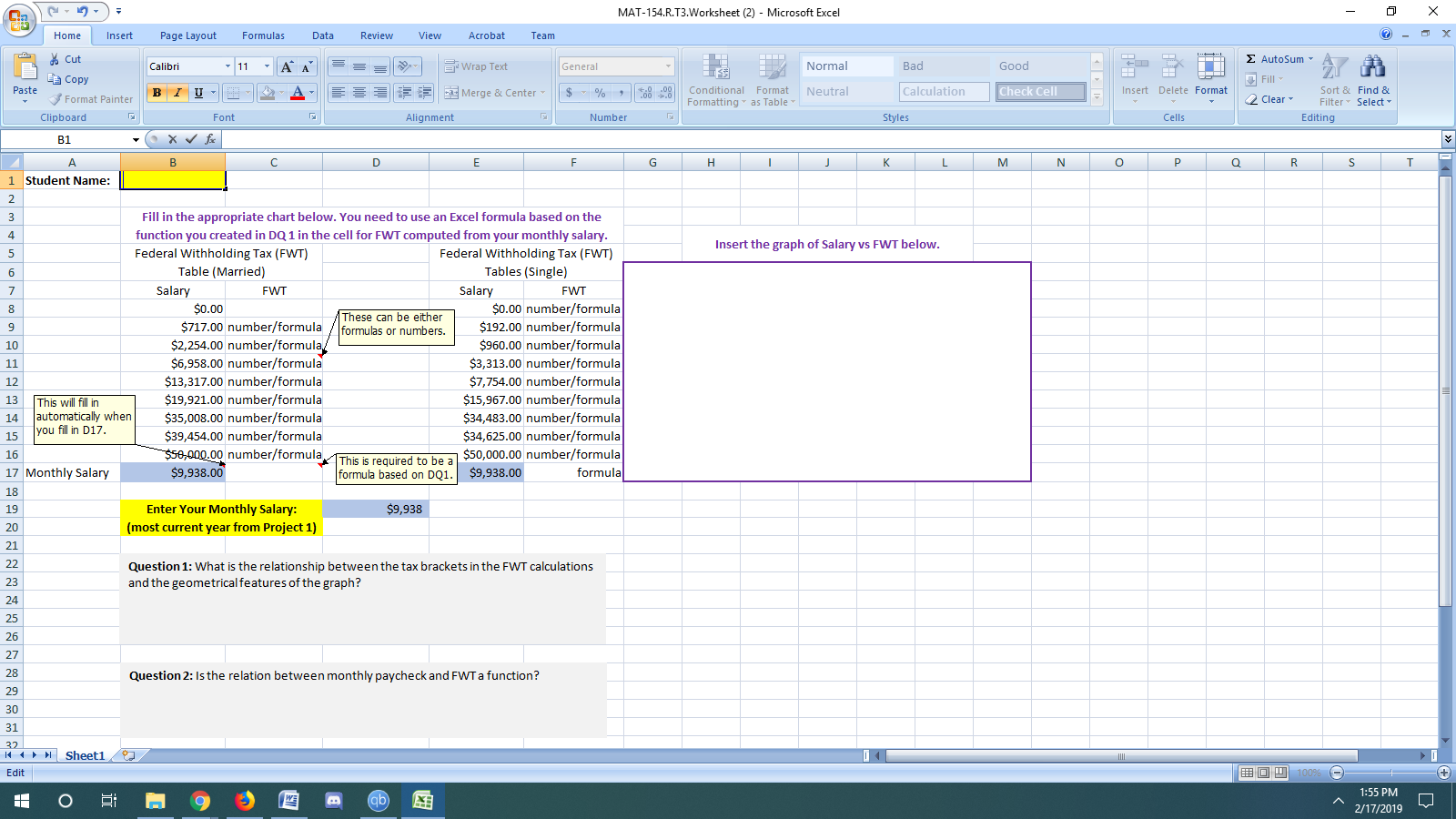

I need to make a formula from my previous calculations to find the federal with holding wage in this chart below.

MAT-154.R. T3.Worksheet (2) - Microsoft Excel X Home Insert Page Layout Formulas Data Review View Acrobat Team do Cut Calibri Copy 11 - A A Wrap Text General Normal Bad Good Ex 2 AutoSum 41 4 Fill Past Format Painter BIU-2 A- Merge & Center % , 68 08 Conditional Format Neutral Calculation Check Cell Insert Delete Format Formatting ~ as Table 2 Clear Sort & Find & Filter > Select Clipboard Font Alignment Number Styles Cells Editing B1 X Vfx B C D H M N P Q O E F G K R S 1 Student Name: Fill in the appropriate chart below. You need to use an Excel formula based on the function you created in DQ 1 in the cell for FWT computed from your monthly salary. Federal Withholding Tax (FWT) Federal Withholding Tax (FWT) Insert the graph of Salary vs FWT below. Table (Married) Tables (Single) Salary FWT Salary FWT Nmtn 0M $0.00 $0.00 number/formula $717.00 number/formula These can be either formulas or num $192.00 number/formula $2,254.00 number/formula $960.00 number/formula $6,958.00 number/formula $3,313.00 number/formula $13,317.00 number/formula $7,754.00 number/formula This will fill in $19,921.00 number/formula $15,967.00 number/formula 14 automatically when $35,008.00 number/formula $34,483.00 number/formula 15 you fill in D17. $39,454.00 number/formula $34,625.00 number/formula 16 $50,000.00 number/formula) 17 Monthly Salary This is required to be a $50,000.00 number/formula $9,938.00 formula based on DQ1. $9,938.00 formula Enter Your Monthly Salary $9,938 (most current year from Project 1) Question 1: What is the relationship between the tax brackets in the FWT calculations and the geometrical features of the graph? Question 2: Is the relation between monthly paycheck and FWT a function? 30 31 32 1 1 Sheet1 Edit 100% O Ei m9 1 qb 1:55 PM 2/17/2019 LI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts