Question: Hello I need help with BE 9 . 9 - BE 9 . 1 7 BE 9 . 9 ( L O 3 ) Fielder

Hello I need help with BE BE

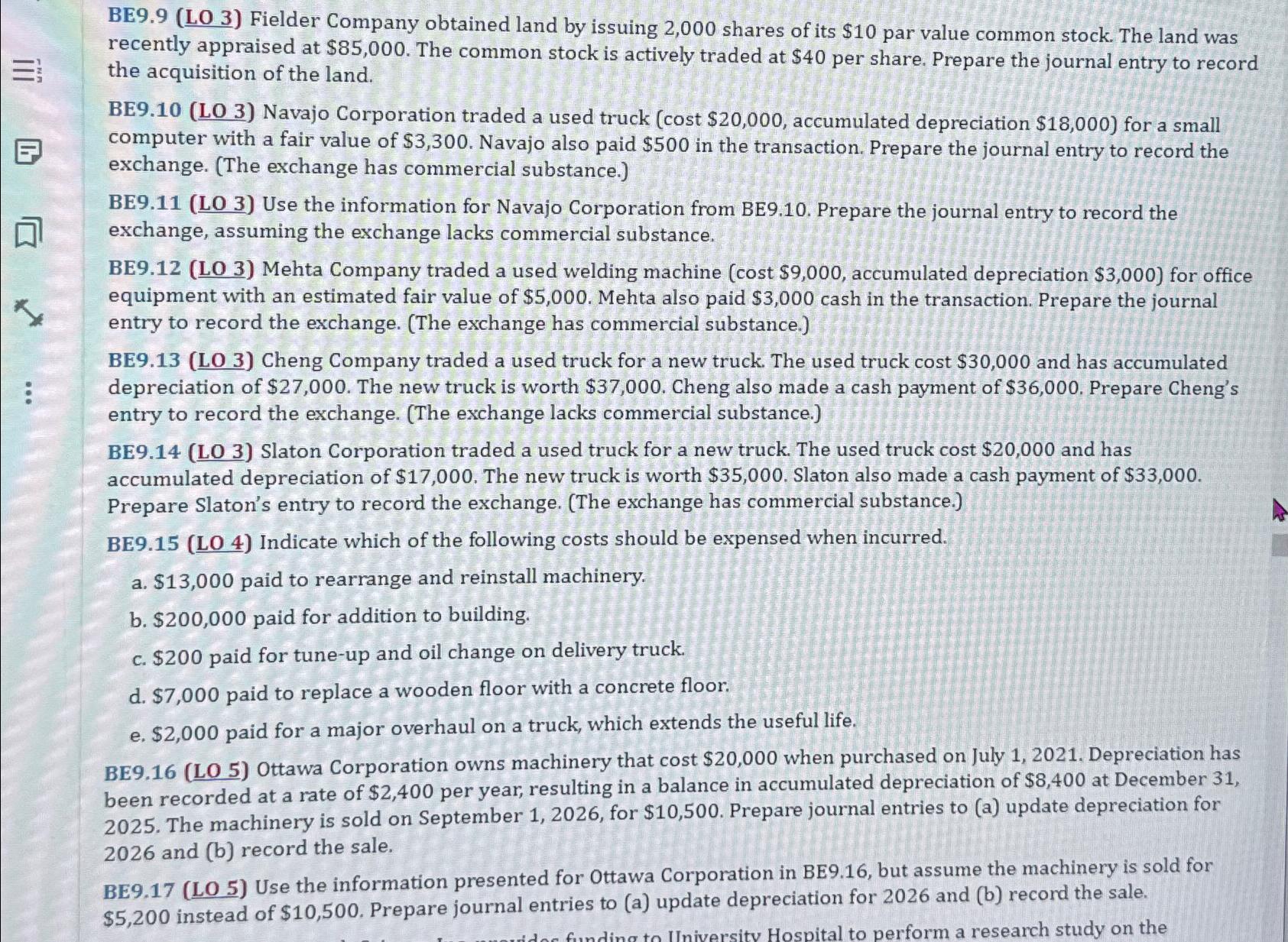

BE Fielder Company obtained land by issuing shares of its $ par value common stock. The land was recently appraised at $ The common stock is actively traded at $ per share. Prepare the journal entry to record the acquisition of the land.

BELO Navajo Corporation traded a used truck cost $ accumulated depreciation $ for a small computer with a fair value of $ Navajo also paid $ in the transaction. Prepare the journal entry to record the exchange. The exchange has commercial substance.

BE Use the information for Navajo Corporation from BE Prepare the journal entry to record the exchange, assuming the exchange lacks commercial substance.

BE Mehta Company traded a used welding machine cost $ accumulated depreciation $ for office equipment with an estimated fair value of $ Mehta also paid $ cash in the transaction. Prepare the journal entry to record the exchange. The exchange has commercial substance.

BELO Cheng Company traded a used truck for a new truck. The used truck cost $ and has accumulated depreciation of $ The new truck is worth $ Cheng also made a cash payment of $ Prepare Cheng's entry to record the exchange. The exchange lacks commercial substance.

BELO Slaton Corporation traded a used truck for a new truck. The used truck cost $ and has accumulated depreciation of $ The new truck is worth $ Slaton also made a cash payment of $ Prepare Slaton's entry to record the exchange. The exchange has commercial substance.

BE Indicate which of the following costs should be expensed when incurred.

a $ paid to rearrange and reinstall machinery.

b $ paid for addition to building.

c $ paid for tuneup and oil change on delivery truck.

d $ paid to replace a wooden floor with a concrete floor.

e $ paid for a major overhaul on a truck, which extends the useful life.

BELO Ottawa Corporation owns machinery that cost $ when purchased on July Depreciation has been recorded at a rate of $ per year, resulting in a balance in accumulated depreciation of $ at December The machinery is sold on September for $ Prepare journal entries to a update depreciation for and b record the sale.

BELO Use the information presented for Ottawa Corporation in BE but assume the machinery is sold for $ instead of $ Prepare journal entries to a update depreciation for and b record the sale.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock