Question: Hello, I need help with my discussion for this week. I am in Accounting 220. I am requesting a tutor who is proficient in accounting

Hello,

I need help with my discussion for this week. I am in Accounting 220. I am requesting a tutor who is proficient in accounting due to the knowledge required. I need help pinpointing this information for the discussion. My SEC 10K is on Walt Disney Co. The link to the SEC 10K is here:

file:///C:/Users/Christy/Desktop/ACCT%20220/SEC.10K.WALT%20DISNEY.html

Please see below for the Discussion topic. Thank you!!!

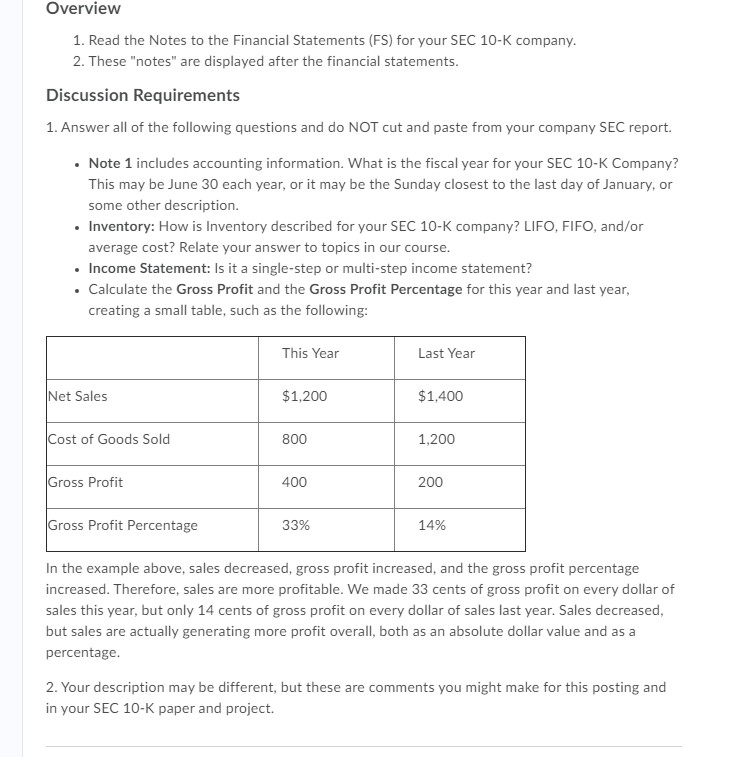

Ove rview 1. Read the Notes to the Financial Statements {F5} for your SEC 10-K company. 2. These \"notes" are displayed after the financial statements. Discussion Requirements 1. Answer all of the following questions and do NOT cut and paste from your company SEC report. . Note 1 includes accounting information. What is the fiscal year for your SEC 10-K Company? This may be June 30 each year, or it may be the Sunday closest to the last day ofJanuary, or some other description. . Inventory: How is Inventory described for your SEC 10-K company? LIFO. FIFO, andfor average cost? Relate your answer to topics in our course. . income Statement: Is it a singlestep or multi-step income statement? . Calculate the Gross Profit and the Gross Profit Percentage for this year and last year, creating a small table. such as the following: This Year Last Year Net Sales $1.200 $1.400 Cost of Goods Sold 300 1,2 00 Gross Profit 400 200 Gross Profit Percentage 33% 14% In the example above, sales decreased, gross profit increased, and the gross profit percentage increased. Therefore, sales are more protable. We made 33 cents of gross profit on every dollar of sales this year, but only 14 cents of gross profit on every dollar of sales last year. Sales decreased, but sales are actually generating more profit overall, both as an absolute dollar value and as a percentage. 2. Your description may be different, but these are comments you might make for this posting ant;i in your SEC 10-K paper and project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts