Question: Hello, I need help with parts C, D, and E. As you can see, I have completed the first two parts (but feel free to

Hello,

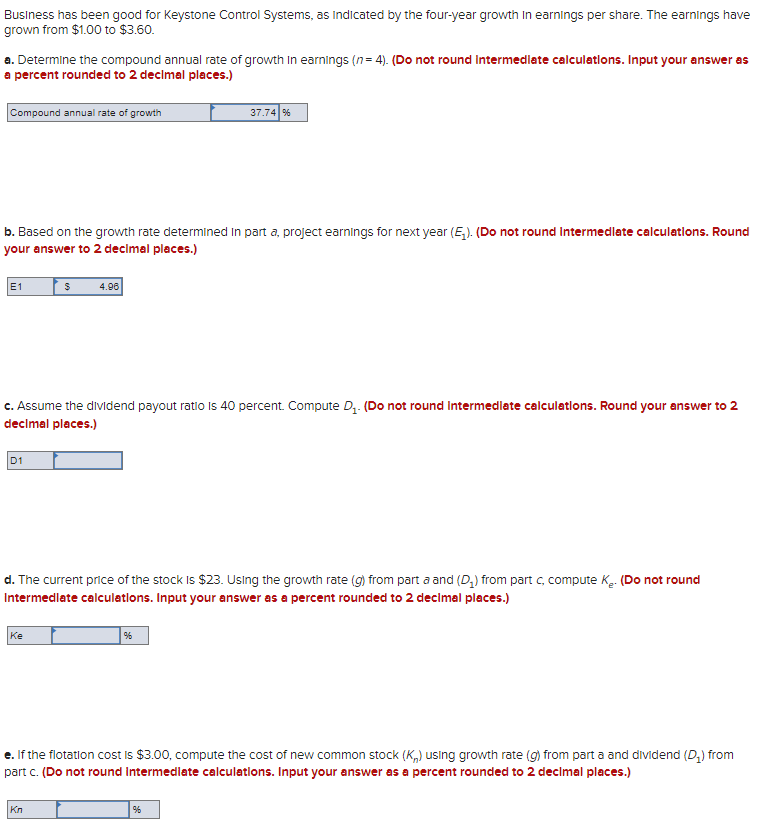

I need help with parts C, D, and E. As you can see, I have completed the first two parts (but feel free to double check me and advise if I made a mistake, please). This is for a Finance course.

Business has been good for Keystone Control Systems, as indicated by the four-year growth In earnings per share. The earnings have grown from $1.00 to $3.60. a. Determine the compound annual rate of growth In earnings (n=4). (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Compound annual rate of growth 37.74% b. Based on the growth rate determined in part a project earnings for next year (E_) (Do not round Intermediate calculations. Round your answer to 2 decimal places.) E1 $ 4.96 C. Assume the dividend payout ratio is 40 percent. Compute D- (Do not round Intermediate calculations. Round your answer to 2 decimal places.) D1 d. The current price of the stock is $23. Using the growth rate (g) from part a and (D) from part c, compute K. (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Ke 96 e. If the flotation cost is $3.00, compute the cost of new common stock (Km) using growth rate (g) from part a and dividend (D) from part C. (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Kn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts