Question: Hello i need help with payroll please. please write clean and step by step. Also please give me correct answers no wrong answers thank you.

Hello i need help with payroll please. please write clean and step by step. Also please give me correct answers no wrong answers thank you.

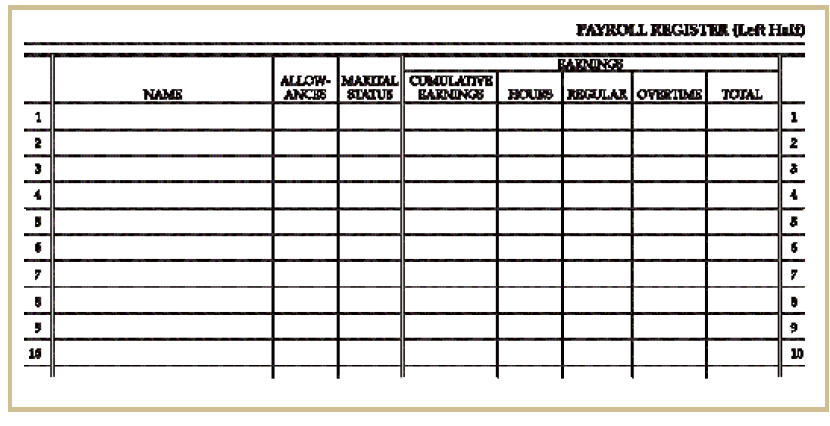

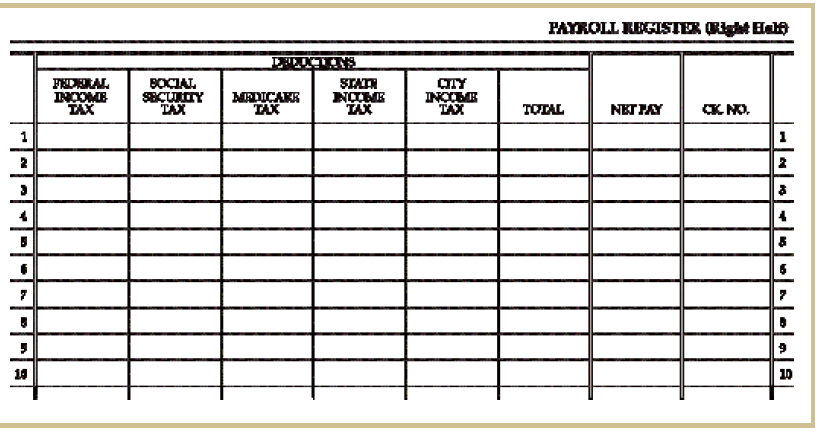

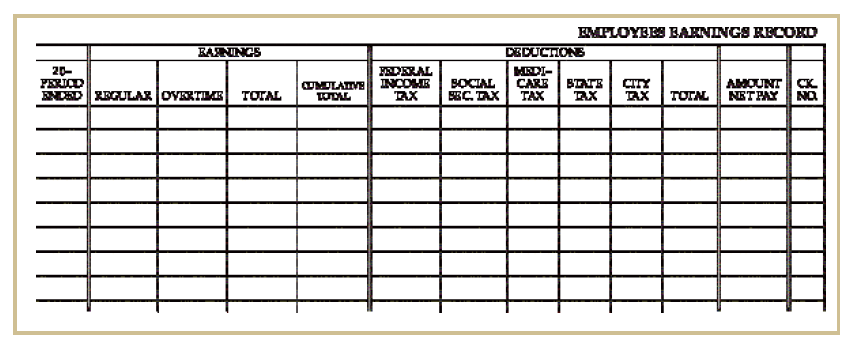

Complete an Employee Earnings Record for each employee and the Payroll Register for the payroll period using the payroll information.

since the next pay date is December 23 and the business will be closed for the holiday, checks will be distributed on Monday, December 26 instead of December 23.

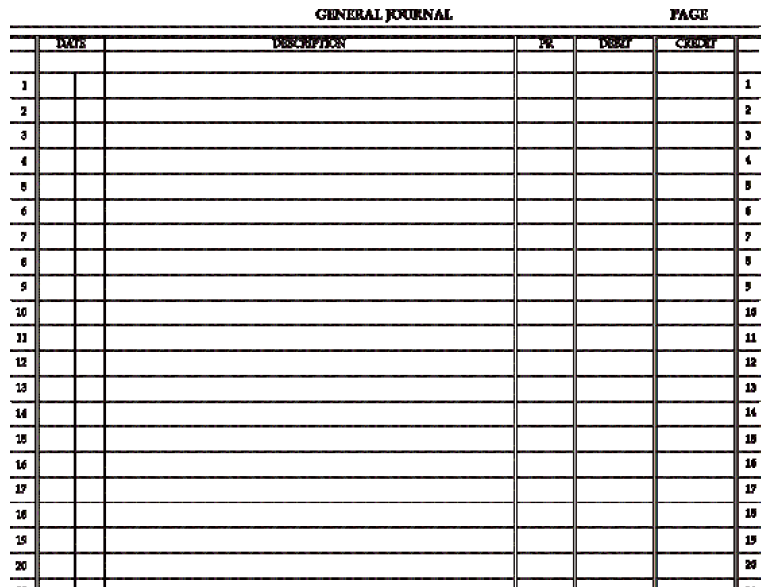

Make and post the journal entry for the employees payroll.

Make and post the journal entry to record the additional payroll expense to the employer for the employers portion of Social Security, Medicare, FUTA, and SUTA using the tax expense account.

I need help on journals as well please.

Thank you

PAYROLL INFORMATION As of November 30, 20XX

Employee:

Ian Smith 234 Pinewood Rd. Hemlock, PA 18951

Status: Married

Number of Allowances Claiming: 4

Additional Amount Withheld: $ 0.00

Wage/Salary: $2,500.00 (Salary)

YTD Earnings: $60,000.00

Employee:

Betty Gable 465 Pinewood Rd. Hemlock, PA 18951

Status: Single

Number of Allowances Claiming: 0

Additional Amount Withheld: $ 0.00

Wage/Salary: $12.50/hr

YTD Earnings: $16,500.00

Employee:

Billie Redmond 67 Oak St. Hemlock, PA 18951

Status: Married

Number of Allowances Claiming: 3

Additional Amount Withheld: $ 0.00

Wage/Salary: $17.00/hr

YTD Earnings: $29,920.00

Employee:

Janet Adams 83 Empire St. Hemlock, PA 18951

Status: Married

Number of Allowances Claiming: 2

Additional Amount Withheld: $ 0.00

Wage/Salary: $15.00/hr

YTD Earnings: $24,900.00

Additional Payroll Information:

Hourly employees are paid time-and-one-half for overtime hours. Any hours worked over 40 hours for the week qualify for overtime pay.

Hourly employees are paid double time for any hours worked over 60 hours for the week and for working on holidays.

Currently, employees are responsible for their own insurance.

| Payroll Information: Basswood Furniture |

| SWT: Pennsylvania Income State Tax Percentage: 3.07% LWT: Hemlock Local Withholding Tax Percentage: 1.00% FICA: Social Security Tax Percentage: Employee: 6.02% on all earnings Employer: 6.02% on all earnings Note: The 6.02% is not the same as the 6.2% that was used in the Payroll lesson. Be sure to use the 6.02% in your calculations instead. (The government does change tax percentages and will notify the business when they do. This is an example of a tax percentage change. Use the correct percentage in your calculations.) Medicare Tax Percentage: Employee: 1.45% up to $106,800 in earnings Employer: 1.45% up to $106,800 in earnings FUTA: The FUTA tax percentage is 0.8% of the first $7,000 of wages per year SUTA: The SUTA tax percentage is 5.4% of the first $7,000 of wages per year

Payroll register left half if you are unable to see whats written on it i will write it here. Name, Allowances, Marital Status, Cumulative Earnings, hours, Regular, overtime, Total

Payroll register right half

if you are unable to see whats written on it i will write it here. Federal income tax, Social security tax, Medicare tax, State income tax, City income tax, total, net pay, and check number.

Period ending, regular, overtime, total, Cumulative total, Federal income tax, Social security tax, Medicare tax, State tax, City tax, Total, Amount net pay, and check number

|

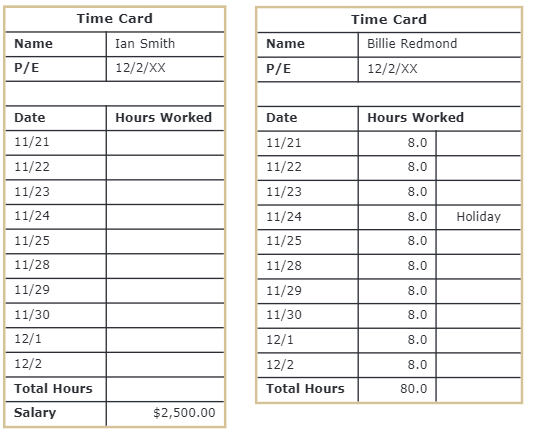

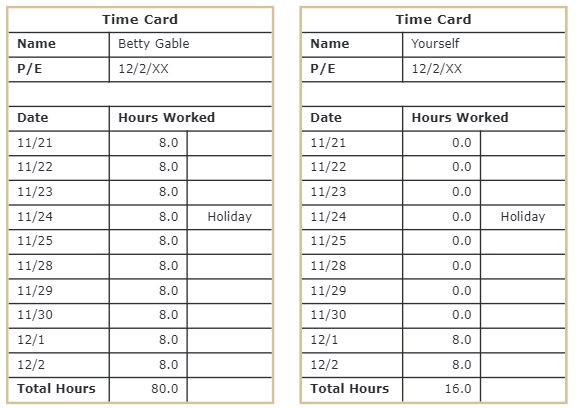

Name Time Card Ian Smith 12/2/XX Name P/E Time Card Billie Redmond 12/2/XX P/E Hours Worked Hours Worked 8.0 8.0 8.0 8.0 Holiday 8.0 Date 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours Salary Date 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours 8.0 8.0 8.0 8.0 8.0 80.0 $2,500.00 Name Time Card Betty Gable 12/2/XX Name Time Card Yourself 12/2/XX P/E P/E Hours Worked Date Hours Worked 8.0 0.0 8.0 0.0 8.0 0.0 8.0 Holiday 0.0 Holiday 8.0 0.0 Date 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours 8.0 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours 0.0 8.0 0.0 8.0 0.0 8.0 8.0 8.0 8.0 80.0 16.0 FAYROLL KEGISTRE Left Halt PR3 ALLOW-MARITAL COOLANTE ANA STATUS BARNUNGE Hows XPULA. OTEC TOTAL NAMC 10 10 PAYROLL REGISTER RI Hal FEDERAL INCOME TX BOCIAL SECURITY TAX MALICAKE TUX STATN NUWE TX CITY THER TAX TOTAL NET WAY No. 10 10 KUNINCS 20- PRID NORD ZEGULAR DYRTLE TOTAL ADRAL UVOLATIVE INOOKIE WOUL TX EMPLOYEES EARNINGS RECORD DECOCHONS HADI- BOCIAL CARE BENTE AHOUNT CK BEC TX TAX TX 2x TOTAL NRT PAY NO GENERAL JOURNAL FAGE MUS 7 20 10 2 13 13 14 10 1. 10 16 17 10 1. 19 1 29 Name Time Card Ian Smith 12/2/XX Name P/E Time Card Billie Redmond 12/2/XX P/E Hours Worked Hours Worked 8.0 8.0 8.0 8.0 Holiday 8.0 Date 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours Salary Date 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours 8.0 8.0 8.0 8.0 8.0 80.0 $2,500.00 Name Time Card Betty Gable 12/2/XX Name Time Card Yourself 12/2/XX P/E P/E Hours Worked Date Hours Worked 8.0 0.0 8.0 0.0 8.0 0.0 8.0 Holiday 0.0 Holiday 8.0 0.0 Date 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours 8.0 11/21 11/22 11/23 11/24 11/25 11/28 11/29 11/30 12/1 12/2 Total Hours 0.0 8.0 0.0 8.0 0.0 8.0 8.0 8.0 8.0 80.0 16.0 FAYROLL KEGISTRE Left Halt PR3 ALLOW-MARITAL COOLANTE ANA STATUS BARNUNGE Hows XPULA. OTEC TOTAL NAMC 10 10 PAYROLL REGISTER RI Hal FEDERAL INCOME TX BOCIAL SECURITY TAX MALICAKE TUX STATN NUWE TX CITY THER TAX TOTAL NET WAY No. 10 10 KUNINCS 20- PRID NORD ZEGULAR DYRTLE TOTAL ADRAL UVOLATIVE INOOKIE WOUL TX EMPLOYEES EARNINGS RECORD DECOCHONS HADI- BOCIAL CARE BENTE AHOUNT CK BEC TX TAX TX 2x TOTAL NRT PAY NO GENERAL JOURNAL FAGE MUS 7 20 10 2 13 13 14 10 1. 10 16 17 10 1. 19 1 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts